Anglo American, Teck strike $53B merger in decade’s top deal

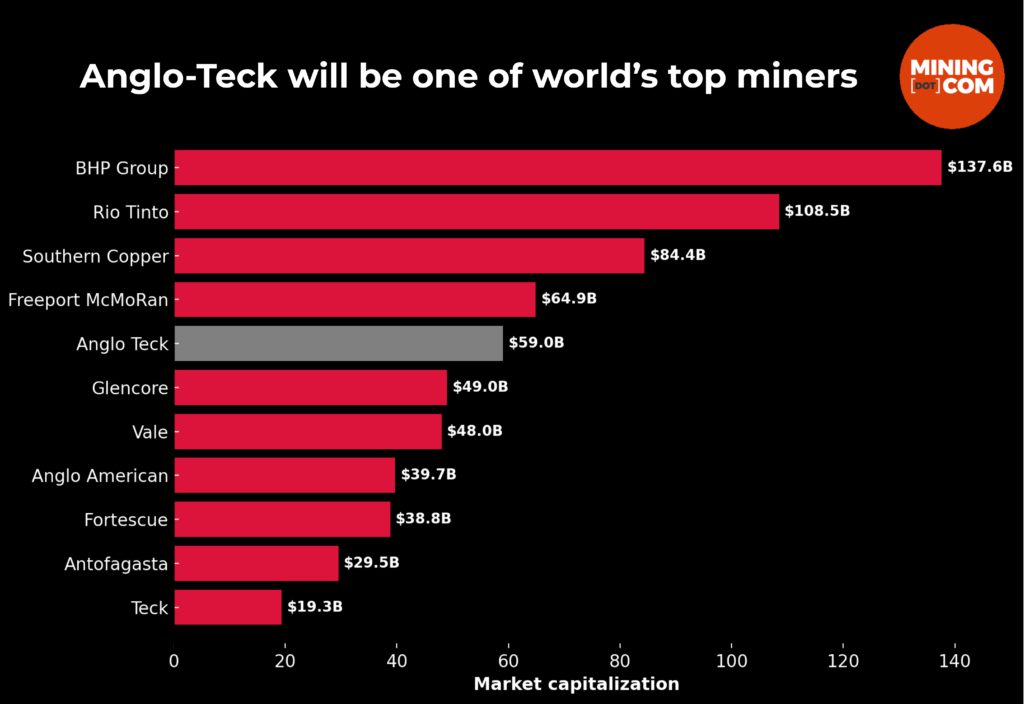

Anglo American (LON: AAL) is acquiring Teck Resources (TSX: TECK.A TECK.B, NYSE: TECK), Canada’s largest diversified miner, in a $53-billion all-share merger that would create the world’s fifth-largest copper producer — if regulators in Canada, the United States and China sign off.

Anglo will exchange 1.3301 shares for each Teck share, a structure it called a “zero-premium” merger. The math tells a different story: the exchange ratio represents a 17% premium on Teck’s closing price Monday, though Anglo will offset it with a $4.5-billion special dividend to its investors, leaving the effective premium at just 1%.

If completed, Anglo shareholders will own 62.4% of the new company, to be named Anglo Teck, while Teck shareholders will hold 37.6%.

Anglo American’s chief executive officer Duncan Wanblad will lead the combined miner, with Teck CEO Jonathan Price as deputy CEO. The headquarters will be in Vancouver, with Anglo’s London office to be “streamlined”.

Secondary listings are planned for Toronto and Johannesburg, along with a New York float via American Depository Receipts.

It’s all about copper

The deal cements Anglo’s access to Teck’s prized copper assets at a time of surging demand for the metal, crucial to electrification and renewable energy. Central to the strategy is Teck’s Quebrada Blanca mine in Chile, an operation that has been plagued by cost overruns and operational challenges.

Both miners have been reshaping portfolios to focus on critical minerals. Teck sold most of its coal unit to Glencore (LON: GLEN), while Anglo has been shedding coal, platinum and diamonds.

Teck also recently launched a sweeping operational review, due in October, aimed at boosting performance, with QB singled out as a top priority.

“We have a positive outlook on this merger, as it is expected to deliver significant value and growth,” Gimme Credit’s senior bond analyst, Franck Bekaert, said in a note. “The new company will emerge as one of the world’s leading copper producers, boasting a diversified portfolio of six copper production sites, along with iron ore and zinc operations.”

The deal is backed by Teck’s controlling shareholder, Norm Keevil, who holds a majority of the company’s supervoting shares. The proposed deal now awaits crucial approval from two-thirds of Teck’s Class A and Class B shareholders, along with 50% of Anglo shareholders.

QB-Collahuasi power play

Teck had already been exploring potential synergies between QB and Collahuasi, a nearby copper mine in northern Chile co-owned by Anglo and Glencore.

The companies estimate annual pretax synergies of $800 million, with up to $1.4 billion in earnings before interest, taxes, depreciation and amortization (EBITDA) gains through shared procurement and operational efficiencies.

“The industrial logic is pretty self-evident,” Wanblad said. “You can see the logic of moving some of the high-grade ore from Collahuassi to the QB plant.”

Glencore was not consulted on the merger but has long argued the two Chilean mines should be combined to cut costs.

A “significant coup”

Duncan Hay, mining analyst at Panmure Liberum, qualified the merger as a “significant coup” for Anglo American. “If they are successful it is a great move as they’re locking up high-quality copper assets that the industry has been coveting,” Hay wrote.

Canada’s Industry Minister Mélanie Joly confirmed the merger will be reviewed under the Investment Canada Act to ensure it delivers a “net benefit” to the country.

“Any new investments must support our core mission of building one economy in the best interests of Canadians,” she posted on X. The review could take up to 18 months.

“The Canada angle raises the bar for any potential gate-crashers,” Camilla Palladino, deputy head of Lex at FT.com wrote. “If they wanted to present a rival bid for Teck, they too would probably need to ship their management teams off to Canada — or provide some adequate alternative inducement. And that is on top of offering Teck shareholders better value.”

That puts pressure on potential and previous suitors such as Rio Tinto or BHP, Palladino said. For once, she added, it looks like the buyer’s shareholders have the stronger hand in a mining deal.

Berenger analyst Richard Hatch said Anglo put “a lot more consideration” on the softer elements of the deal to avoid a rejection by Canada’s authorities. “To me it feels there was a lot more of a nod to the history and to the country stakeholders of these businesses, particularly to Canada and to South Africa. (…) and that was very well thought out”.

Bidding war?

Other analysts believe Anglo’s friendly bid may signal the onset of a bidding war. National Bank Financial mining analyst Shane Nagle noted the deal may attract “several large-cap diversified mining companies looking to secure access to Teck’s large-scale copper portfolio within the Americas”.

Potential suitors include US copper giant Freeport McMoRan (NYSE: FCX) and gold miner Agnico Eagle Mines (TSX, NYSE: AEM). Both companies, particularly Agnico, are currently benefiting from strong stock prices that could facilitate an all-share deal. Brazil’s Vale (NYSE: VALE) could also be interested in the company, according to Desjardins Securities mining analyst Bryce Adams.

For those unable to secure Teck, alternative takeover targets may emerge as a strategy to ensure access to critical raw materials, especially copper, in a resource-hungry world.

“It has finally started,” George Cheveley, a portfolio manager at Ninety One UK Ltd., which holds shares in both companies told Bloomberg News. “Do people come in for one or the other, or wait for the two to combine? All of those things are possible. It might be a catalyst for others to pursue different deals and combine elsewhere.”

The existing $330 million break-up free included in the deal “is not a prohibitive figure to a potential interloper for either company given the size of the potential prize,” Scotia Capital mining analyst Orest Wowkodaw wrote.

“We find it difficult to see how Anglo competes for Teck if the larger miners with much stronger balance sheets get involved,” Wowkodaw said.

Teck’s Price said he cannot speculate on a potential bidding war. “That is not something we can control. We are focused on getting approval for bringing Anglo and Teck together,” he said.

The Anglo-Teck deal follows a wave of industry consolidation driven by the scramble to secure copper supply. Anglo fended off a $49-billion approach from BHP last year, while Glencore’s 2023 bid for Teck collapsed.

Shares in Anglo rose almost 10% in London to 2,498p, giving it a market cap of £29.4 billion (about $40 billion). Teck stock jumped 17% in New York pre-market trading, last at $40.95, valuing the company at $17.2 billion.

{{ commodity.name }}

{{ post.title }}

{{ post.date }}

Comments

BARNEY BIGGS

I would expect once this deal is approved that two years from now the HQ will be moved to the US. Business has no Nationality.