Most mineral and metal prices to edge higher in 2026, BMI forecasts

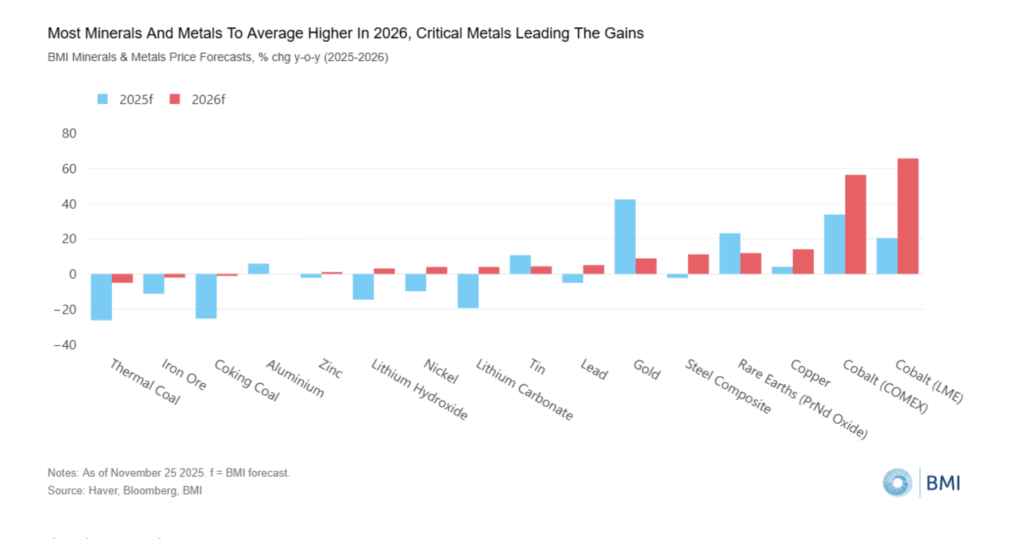

BMI, a unit of Fitch Solutions, holds a cautiously optimistic outlook for 2026, with analysts expecting most mineral and metal prices to edge higher, supported by declining tariff uncertainties, robust demand from sectors linked to the transition to net zero and tighter supply.

“In 2026, we forecast that most minerals and metals will average higher than in 2025, as the global economy stabilizes with easing trade frictions,” analysts said in BMI’s year-end report.

Tariff uncertainty peaked in August 2025, and while the firm said it could see flare-ups between the US and individual economies over the coming quarters, its country risk team expects broad tariff uncertainty to continue to decline over 2026.

This will support demand for commodities in general, the firm noted, adding that it does not rule out bouts of volatility, especially as certain metals might face renewed US tariff pressures in the attempt to protect critical domestic industries.

“In particular, we see copper on the cards for further tariffs, with the US Secretary of Commerce required to provide an update on the domestic copper market by June 30 2026, to determine whether to implement a universal duty on refined copper of 15% from 2027 and 30% from 2028,” analysts said.

While China’s domestic housing market remains under pressure, weighing on industrial metals consumption, BMI analysts expect this is likely to be partially offset by robust growth in green energy transition sectors, which is particularly supportive of critical minerals, including copper, aluminum, lithium and nickel.

“That said, Mainland China’s property market weakness is set to remain a drag on industrial metals price growth,” the firm noted.

Precious metals promising

In regards to precious metals, while gold prices will average higher in 2026 compared to 2025, prices will ease later in the year as monetary easing loses momentum, in particular as the US Fed eventually stops cutting rates, analysts said.

“Prices are likely to moderate later in 2026, falling below $4,000/oz as the monetary easing cycle that began in 2024 starts to lose momentum, and in particular as the US Fed eventually pauses rate cutting.”

With the global economy set to stabilize further in 2026, tariff uncertainty receding and most of the downside to the US dollar behind us, gold’s historic rally is likely to lose its shine by Q3 2026, BMI noted.

“Our country risk team believes the US dollar index (DXY) is unlikely to experience the same amount of volatility in 2026 as it did in early 2025, inherently capping both industrial and precious metal price growth.

“While we still expect the DXY to trade within a wide range of around 95-100 over the coming quarters, we do not rule out a move to slightly stronger levels, particularly if the US economy outperforms. This will cap the extent of rise in gold prices.”

BMI also noted that the balance of risks to its 2026 metals price outlook remains tilted to the downside, given challenging external demand dynamics and risks of weaker-than-expected global growth, particularly in China, the world’s largest consumer of industrial metals, with its domestic property sector being a major source of demand across a broad spectrum of the metals market.

“We expect Western investment to ramp up across the value chain both at home and in resource‐rich markets in 2026, alongside new strategic partnerships to secure future supply. Industrial policy has become the primary mechanism through which countries are achieving resource security as the race for critical minerals intensifies.”

M&A momentum

Analysts expect robust M&A momentum in the metals and mining sector to continue into 2026, fueled by the accelerated race for critical minerals, with industry players prioritizing opportunities that strengthen their exposure to minerals essential for the energy transition, including but not limited to copper, lithium and rare earths.

Large-scale capex projects still remain in focus, yet risk-averse developments are coming to the forefront, the report said.

“We expect continued investment in mining projects across frontier markets in 2026. While resource nationalism has been a key concern for a while, we believe governments and local populations in regions including Africa now have more awareness and bargaining power over their mineral resources.

“This will enable more progress to be made on mineral beneficiation compared to previous years, with global mining investors having little choice but to comply with mineral policy changes in these jurisdictions.”

The firm forecasted metals and mining projects will benefit from partnerships with tech, autos and aerospace companies in 2026, including through offtake agreements, as supply bottlenecks threaten to derail key growth sectors like AI, robotics and defense.

{{ commodity.name }}

{{ post.title }}

{{ post.date }}

Comments