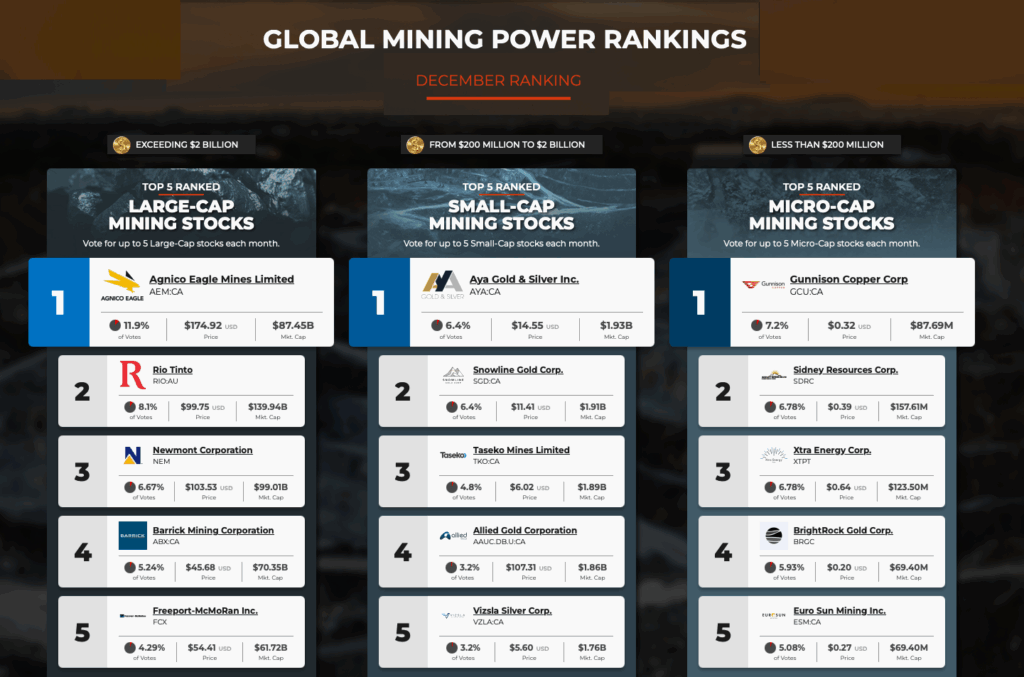

Agnico, Aya and Gunnison lead MDC December rankings

>>Before you read about our December winners, add your voice to January’s benchmark. Vote Now – It takes 60 seconds<<

Agnico Eagle Mines (TSX, NYSE: AEM), Aya Gold & Silver (TSX: AYA) and Gunnison Copper (TSX: GCU)

led the December Global Mining Power Rankings as investor sentiment, firmer commodity prices and clear 2025 execution separated winners from peers.

The December rankings highlight companies viewed by investors, analysts and industry insiders as delivering operational consistency, financial momentum and strategic progress across market capitalizations. Sentiment played a larger role this month, underpinned by improving balance sheets, steady project delivery and supportive metals prices, particularly for gold, silver and copper.

These rankings are not paid sponsorships or promotional placements. They are determined entirely by votes from the MINING.COM community, reflecting real-time market sentiment rather than advertising influence.

Below, we break down the top performers across all market caps and celebrate the leaders driving mining forward:

Large-cap winner: Agnico Eagle (11.9% of votes)

Canada’s Agnico Eagle (TSX, NYSE: AEM) once again topped the large-cap category, supported by steady production across Canada, Australia, Mexico and Finland, disciplined cost control and a strong third quarter that kept the stock ahead of global peers. Investors continued to favour the company’s predictable operating profile in a year marked by inflationary pressure across the mining sector.

Shares have gained 116% in Toronto and 125% in New York over the past year as Agnico reaffirmed its 2025 production outlook of 3.3 to 3.5 million oz of gold and advanced the Canadian Malartic underground expansion on schedule and within guidance. Balance sheet strength also remained a key draw.

Agnico broadened its strategic footprint in 2025 with the launch of Avenir Minerals Limited to pursue roughly $80 million in early-stage critical minerals investments, following its $180 million investment in Perpetua Resources (NASDAQ, TSX: PPTA) and the Stibnite gold-antimony project in Idaho. Through the first nine months of 2025, the company generated about $3.1 billion in free cash flow, putting it on an annualized run rate approaching $6.8 billion. That cash flow supported higher dividends, $1 billion in share buybacks for 2025 and full debt elimination by the fourth quarter.

“2025 has been an exceptional year for gold on many fronts,” president and CEO Ammar Al-Joundi said. “This renewed distinction from MINING.COM is a demonstration of Agnico Eagle’s focus on operational performance, cost control, and disciplined capital management. We look forward to continuing building on this performance in 2026.”

With gold prices strengthening further in the second half of 2025, analysts expect strong financial performance to extend into 2026, positioning Agnico for continued shareholder returns.

Notables:

2. Rio Tinto (8.1%): Firm iron ore prices and steady global steel demand underpinned sentiment.

3. Newmont (6.7%), with investors weighing portfolio optimization and integration progress following asset sales and strategic refocusing during 2025.

Small-cap winner: Aya Gold & Silver (6.4% of votes)

Aya Gold & Silver, a Morocco-focused silver producer, captured the small-cap title as soaring silver prices and operational milestones reshaped its investment case in 2025. The company benefited from silver’s roughly 160% price surge during the year, driven by industrial demand, safe-haven buying and supply constraints.

Aya moved past a short-seller report alleging that the company had overstated the resource and value of the Zgounder mine, its only producing asset. The asset achieved commercial production in early 2025 following a major expansion, positioning Aya as a low-cost producer.

The company also released a preliminary economic assessment for its Boumadine polymetallic project, showing rapid capital payback under current metals prices. Aya owns 85% of Boumadine and envisions a multi-pit, multi-underground operation over an 11-year mine life.

Notables:

2. Snowline Gold Corp (6.4%) (TSX: SGD; OTCQX: SNWGF) tied with Aya, but was placed second due to its slightly lower market capitalization. The company delivered a total return of about 209% in 2025, far outpacing gold’s gains. The Yukon-focused explorer advanced its Rogue project, where drilling at the Valley deposit extended mineralization beyond 1 km, and graduated to the TSX in November, a key corporate milestone.

3. Taseko Mines (4.8%). One of this Canadian miner’s biggest milestones in 2025 was continuing to advance the Florence Copper project in Arizona toward commercial production. After nearly two years of construction, Florence’s wells began pumping in 2025, with first copper cathode production expected in early 2026. The milestone marks Taseko’s shift from reliance on a single asset toward becoming a multi-asset copper producer alongside its Gibraltar Copper mine in British Columbia. The company also released an updated technical study for Yellowhead Copper and reached a landmark agreement with the Tŝilhqot’in Nation and the province of British Columbia on the New Prosperity project, helping clarify a potential development pathway.

“2025 was a great year for Taseko,” CEO Stuart McDonald said. “Major milestones achieved at Florence Copper in Arizona contributed significantly to Taseko’s share price appreciation over the past 12 months. First copper cathode production from Florence Copper is expected in early 2026, with ramp-up to full production over the following year. This new operation, together with strong production from Gibraltar, ideally positions Taseko to benefit from current copper price momentum.”

McDonald believes Taseko is quickly becoming “a major North American-based copper producer” with near- and long-term growth opportunities. “We appreciate the recognition from MINING.COM readers as being one of the top small-cap mining stocks.”

Micro-cap winner: Gunnison Copper (7.2% of votes)

Gunnison Copper topped the micro-cap category after achieving a defining milestone in 2025 by producing its first pure copper cathode at the Johnson Camp mine in Arizona. First sales followed in September, formally transitioning the company from developer to operating producer, with commercial output reached ahead of schedule.

With its made-in-America copper, Gunnison supports domestic supply at a time when US infrastructure and electrification demand is accelerating. Gunnison also received about $13.9 million in US Department of Energy Section 48C tax credits in 2025, strengthening its funding position for expanded domestic copper production.

“We’re honoured to be recognized with this achievement,” Melissa Mackie, director of investor relations and communications said. “It reflects a year of disciplined execution and meaningful progress, including first production of copper cathode at our Johnson Camp mine, continued advancements at our flagship open-pit Gunnison project, debt repayment deleveraging our balance sheet, and backing from the US Department of Energy and Rio Tinto’s Nuton LLC,” Mackie said. “Located in Arizona’s copper belt, we’re proud to be America’s newest copper producer providing domestic supply chains. This achievement is a testament to the dedication of our team and the momentum we’ve built as we continue to deliver on our strategy and create value for stakeholders.”

Notables:

2. Sidney Resources Corp. (6.78%) The Idaho-focused explorer expanded its footprint in the historic Warren Mining District through the acquisition of Unity GoldSilver Mines assets early in the year and staked roughly 7,600 acres of new claims in December. The company advanced gold, silver and critical minerals exploration while continuing development of its proprietary laser mining technology.

“We are deeply grateful to the MINING.COM community for this recognition,” CEO Sean-Rae Zalewski said. “It reflects growing confidence in our team’s steady progress, from recent claim expansions in the Warren District to encouraging rare earth and critical mineral results, alongside continued development of our laser mining technology.”

Zalewski noted that while this recognition was encouraging, the company remained focused on building long-term value through disciplined exploration and responsible development.

3. Xtra Energy (6.78%) The micro-cap explorer spent 2025 advancing early-stage critical mineral and energy-related assets, focusing on asset consolidation, permitting and positioning for drilling as investor interest in domestic resource supply chains increased.

“We appreciate the recognition,” the company said. “This acknowledgment highlights Xtra Energy’s progress in advancing US-based antimony resources at a time when secure domestic supply is increasingly important. We remain focused on steady execution and technical validation.”

{{ commodity.name }}

{{ post.title }}

{{ post.date }}

Comments