Silver price falls from record as US holds off on critical minerals tariff

Silver pulled back from a record after the US held off on new import levies on critical minerals, prompting investors to take profits on a metal that has already soared 15% this year.

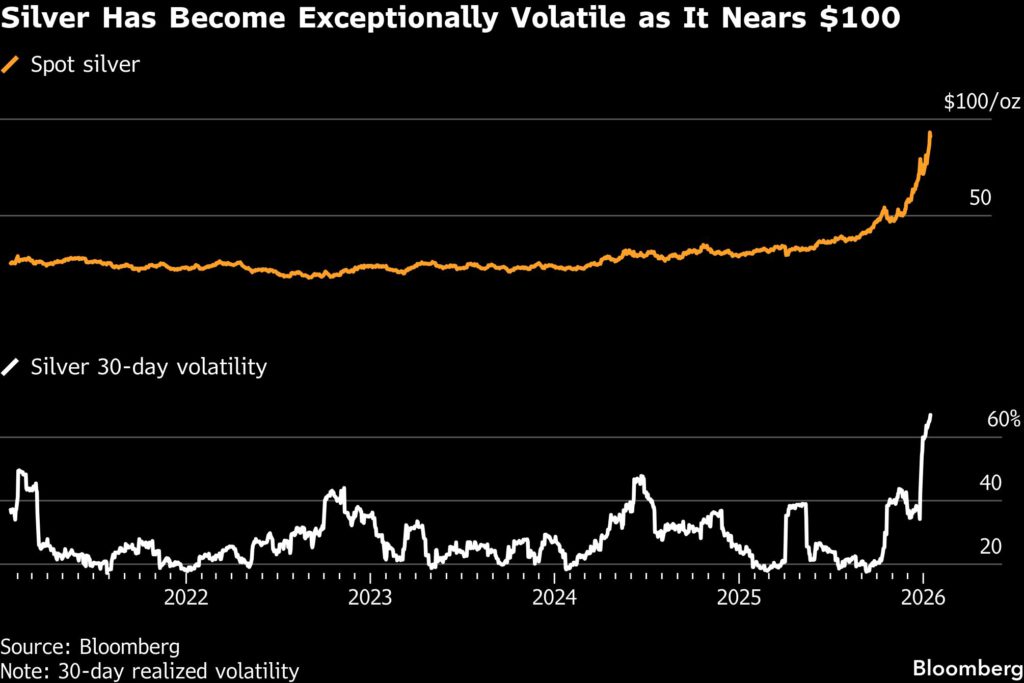

Spot price of the metal fell as much as 7% on Thursday morning from its all-time high of $93.75 per ounce set a day earlier. By midday, it had recouped half of the losses, settling at around $90 an ounce.

The move came after US President Donald Trump stopped short of imposing sweeping tariffs on critical minerals such as silver, saying he would instead pursue bilateral negotiations and floated the idea of price floors. The decision followed a months-long review into whether foreign shipments of these minerals posed a threat to US national security.

Fears that tariffs would be imposed on these minerals have kept some supplies in US warehouses. For silver, that contributed to a global short squeeze in October, igniting an end-of-year rally that sent prices to successive record highs.

About 434 million ounces of silver are held in warehouses linked to the Comex futures exchange in New York, roughly 100 million more than a year ago, when tariff-related trade disruptions intensified, according to Bloomberg.

While those inventories could help ease tightness in other markets, “there is likely to be some sclerosis in any silver movement out of the US,” said Rhona O’Connell, an analyst at StoneX Group. She noted that the white metal remains on the list of critical minerals that could be targeted by future trade measures.

Thin liquidity and a surge in investor demand have left silver prone to sharp swings in recent weeks, putting pressure on traders’ risk limits. That volatility can become self-sustaining, as rapid price moves trigger forced selling or short covering.

Trump’s decision to hold off tariffs “suggests the administration will take a more surgical approach in making future decisions,” Daniel Ghali, a senior commodity strategist at TD Securities, said in a note. That “significantly alleviates the fear of a broad-based approach that could have inadvertently impacted the underlying bars that underscore benchmark metals prices.”

Meanwhile, gold was largely unaffected by Trump’s tariff decision on critical minerals, trading close to its own all-time high.

Buying momentum

Both metals benefited from a broad rush into commodities this week that also saw copper and tin hit records. The Trump administration’s renewed pressure on the Federal Reserve has buoyed prices and revived the debasement trade. Rising geopolitical tensions have also added to haven demand.

Silver also benefited from strong industrial demand — particularly from the solar sector — while a speculative buying frenzy in China has added to upward momentum in recent weeks.

The medium-term outlook for silver remains “firmly constructive, underpinned by supply shortfalls, industrial consumption and spillover demand from gold,” said Christopher Wong, a strategist at Oversea-Chinese Banking Group.

However, “the velocity of recent moves warrants some near-term caution,” he added.

(With files from Bloomberg)

More News

{{ commodity.name }}

{{ post.title }}

{{ post.date }}

Comments

Mark Kenyon-Slade

Comex has 11% of the silver of customers in metal the rest is “non existent” A huge shortage is happening which is obviously hushed by “Legacy” controlled Mainstream Media.