Gold price soars past $4,700 for new record

Gold roared past $4,700 for the first time Tuesday, while silver also set a new milestone, as investors continue to pile into safe havens amid tensions between the US and Europe over Greenland.

Spot gold rose as much as 1.4% to an all-time best $4,749.84 an ounce, taking its gains in 2026 to nearly 8%. Silver notched a new record of $95.89 an ounce, rising almost a quarter this year.

The latest rally in precious metals ignited on Monday after US President Donald Trump threatened to impose tariffs on eight European nations that oppose his plans to take control of Greenland. Investors will now monitor developments from Davos, where Trump will meet with several parties to discuss this issue.

“The Greenland episode has poured fresh fuel on a rally that has been building for months, driven by a macro and geopolitical backdrop that has become increasingly uncomfortable for investors reliant on financial assets alone,” Ole Hansen, a strategist at Saxo Bank, said in a note to Bloomberg.

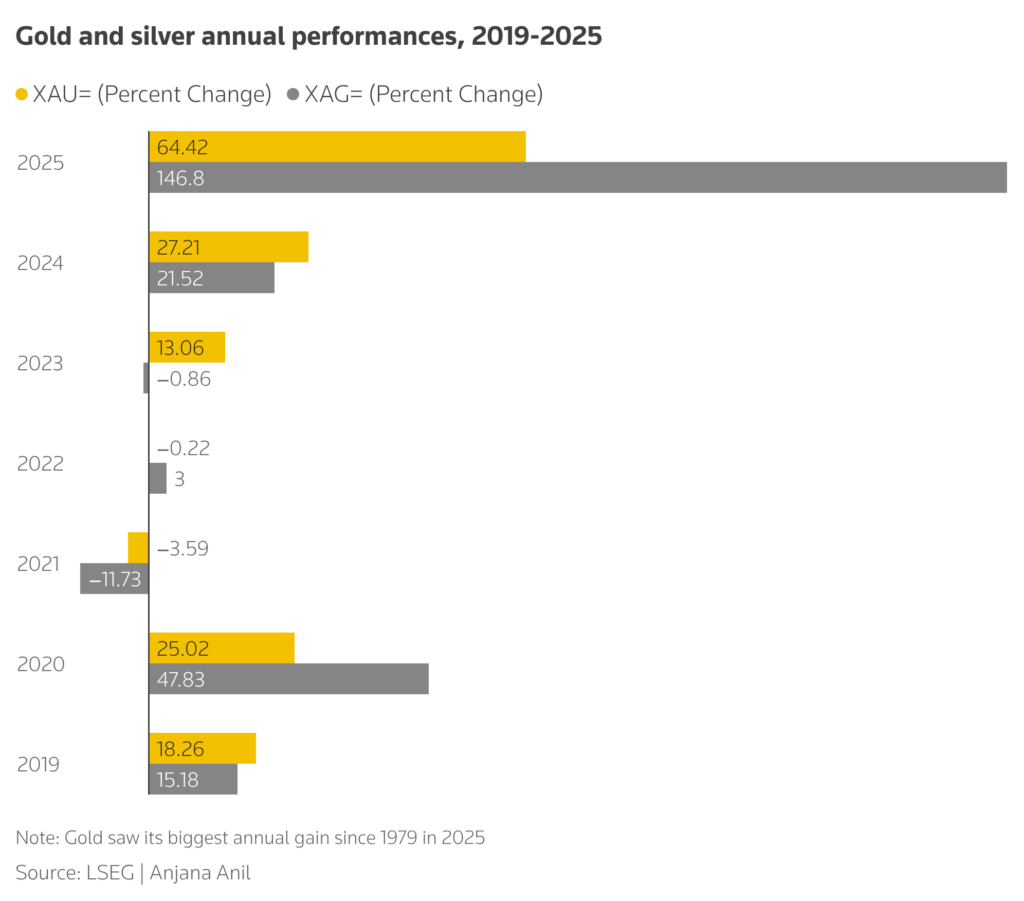

Gold is coming off its best annual performance since 1979 last year, supported by falling US interest rates, continued central bank buying and ructions to the geopolitical landscape brought about by Washington. Silver’s rally has been even greater, with prices tripling over the past year.

Even before the US-Europe tensions, gold and silver had already been rising and setting new highs on expectations of Federal Reserve interest rate cuts this year. Markets are currently pricing in two rate cuts of 25-basis-points from mid-2026, according to Reuters.

While major banks expect the metals to rise even higher as the year goes on, with some setting gold price targets of $4,800-$5,000 by mid-year, market participants are starting to proceed with caution. A Bank of America survey recently showed that a majority of fund managers thought gold was the “most crowded trade.”

(With files from Bloomberg and Reuters)

{{ commodity.name }}

{{ post.title }}

{{ post.date }}

Comments