Gold price extends record run with $4,900 in sight

Gold extended its record rally to almost $4,900 per ounce on Wednesday, as geopolitical tensions surrounding Greenland and a meltdown in Japanese government debt kept safe-haven demand elevated.

Spot gold spiked as much as 2% to a record $4,887.19 per ounce before paring some gains. This marks the first time ever that gold has crossed the $4,800 threshold, and it comes a day after prices first broke past the $4,700-an-ounce level.

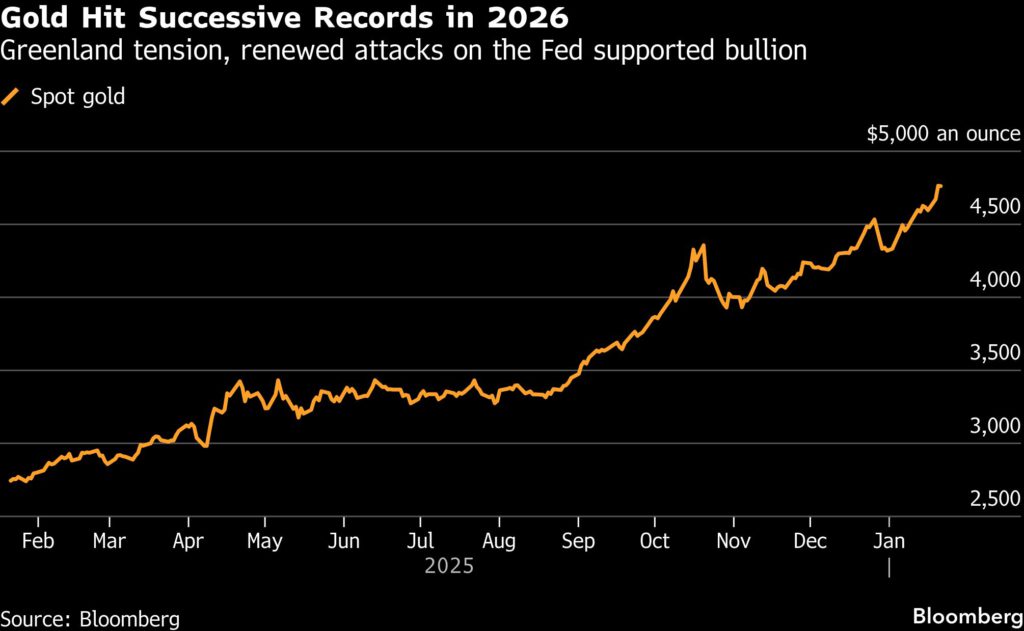

Gold is coming off its best annual performance since 1979, as mounting geopolitical risks and a global shift away from fiat currencies lifted the metal’s appeal, driving prices to record highs on more than 50 occasions through 2025 and into the new year.

This record-breaking rally in gold, which has risen by 75% over the past 12 months, reignited in recent days amid growing tensions between the US and its NATO allies. On Saturday, US President Donald Trump threatened tariffs on eight European nations that opposed his plan to take over Greenland, raising the specter of a damaging trade war.

Meanwhile, a meltdown in Japanese sovereign debt spilt over into bond markets worldwide earlier this week, with long-dated Treasuries and the dollar both tumbling. As well as sparking fears of the repatriation of capital to the East Asian nation as yields rise, the ructions highlighted worries about the fiscal situations of major economies that fueled the so-called “debasement trade”, where investors avoid currencies and government bonds.

The situation in Japan is spurring “fear of market-led debasement in the rest of the world,” Daniel Ghali, a senior commodity strategist at TD Securities, wrote in a note. “Gold’s rally is about trust. For now, trust has bent, but hasn’t broken. If it breaks, momentum will persist for longer.”

Gold is poised for more support from the world’s biggest reported buyer, the National Bank of Poland. The central bank approved plans to purchase another 150 tons, while Bolivia’s central bank has resumed purchases for its foreign reserves under new regulations enacted in December 2025.

“Gold remains our highest conviction,” Daan Struyven, co-head of commodities research at Goldman Sachs Group, said at a media briefing on Wednesday, citing continued purchases by central banks. He reiterated the bank’s base case scenario is for gold to climb to $4,900 an ounce, with risks to the upside.

Silver down

Meanwhile, silver retreated by over 1% after notching its all-time best $95.89 per ounce during the Tuesday session. The metal has benefitted from the gold trade and performed even better during 2025, recording a gain of 140% for the year.

As with gold, analysts remain bullish on the white metal in 2026. “Silver’s rise to a three-digit number is looking quite possible given the price momentum we are seeing, but it will not be a one-way move. There could be some correction in prices and volatility can be higher,” ANZ commodity strategist Soni Kumari said on Wednesday.

(With files from Bloomberg and Reuters)

{{ commodity.name }}

{{ post.title }}

{{ post.date }}

Comments