Government policies to drive mining investment activity in 2026: survey

Geopolitical events steered the world’s attention to the mining sector in 2025, highlighting the persistent supply chain risks that the industry has largely overlooked for years. In 2026, all eyes are on how governments react to rising global tensions and mitigate those risks, says law firm White & Case LLP.

According to its Mining & Metals 2026 survey, policies surrounding critical minerals will likely be at the front and center. Nearly half of the respondents (47%) regard political variables — including government support — as the single biggest driver of activity.

In its report, White & Case said the shift to a policy-driven deal cycle has already shifted the investment landscape, exemplified by US government support that led to a wave of interest in critical minerals projects.

About a third of its respondents believe that will remain a key trend in 2026, and nearly 40% expect state-backed financing to be the most common policy prescription in developed markets.

Key geopolitical factors

The unprecedented degree of policy support for new mining projects — and volatility of trade policy — reflects the geopolitical urgency to secure critical minerals supplies, White & Case said.

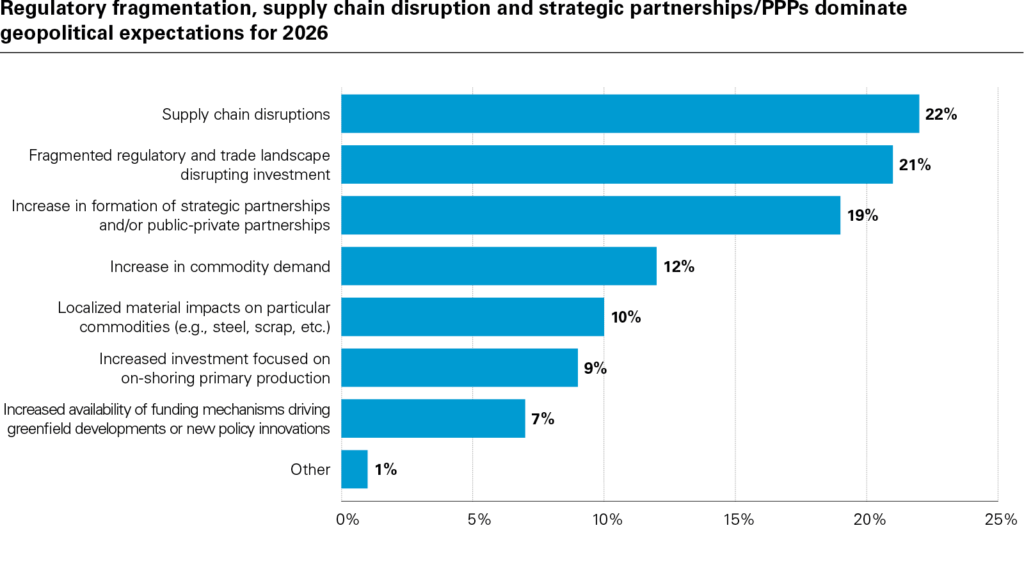

Supply chain disruptions, as seen during 2025, remain one of the biggest risks this year, as highlighted in its survey. Roughly an equal number of respondents consider the fragmentation of national policies as another key issue.

Still, a large number of investors see increased activity or potential upsides following a year of trade shocks, according to the survey results. Nearly three-quarters (73%) expect a greater divergence between the US and China on trade and critical minerals policy over the next 12 months.

Moreover, the massive gap in government-backed funding between the US and Europe would also create opportunities, the firm added.

“The next 12 months promise a consolidation of the sector’s ongoing politicization, providing opportunities and risks for miners and investors increasingly reliant on access to policy support across metals markets that are generally well supplied or over-supplied,” said Rebecca Campbell, partner at White & Case.

Potential ‘bubble’

While mining companies stand to benefit from policy support, White & Case’s report also warned that this trend would create “an over-expansion of supply”, leading to a potential investment bubble in the sector.

The law firm, quoting one respondent, said “this mining sector ‘gold rush’ will run for two to three years before ending in a downturn.” Importantly, demand is driven by markets, rather than policies, it pointed out.

Overall, smoothing out the traditional boom-bust cycle for key metals can stabilize prices and investment over time as policy frameworks evolve, it said.

Biggest winners

As such, the biggest winners of 2026 will likely be the “sure bets” — copper and gold — according to the firm’s survey. Two-thirds of the respondents predict these metals to be the year’s biggest risers, continuing their strong performance from 2025.

The survey results on other minerals are mixed, with many expecting a consolidation in base metals and a political bull market for rare earths. Most respondents expect coal to underperform, followed by lithium.

M&A trends

In 2026, volatile national policies, resource nationalism and the cost of capital could once again hinder mergers and acquisition (M&A) activity in the industry, though some see those as potential deal drivers as well.

The biggest obstacle to M&A deals, however, is the availability of assets, as highlighted by about 20% of the survey respondents.

The formation of strategic partnerships between industry participants is expected to be the most likely type of transactional activity this coming year, according to the survey, highlighting the ongoing attempted merger between Anglo American and Teck Resources.

In the year ahead, strategic partnerships between governments, government agencies and the private sector are likely to be the backbone of growth M&A in the sector, White & Case said.

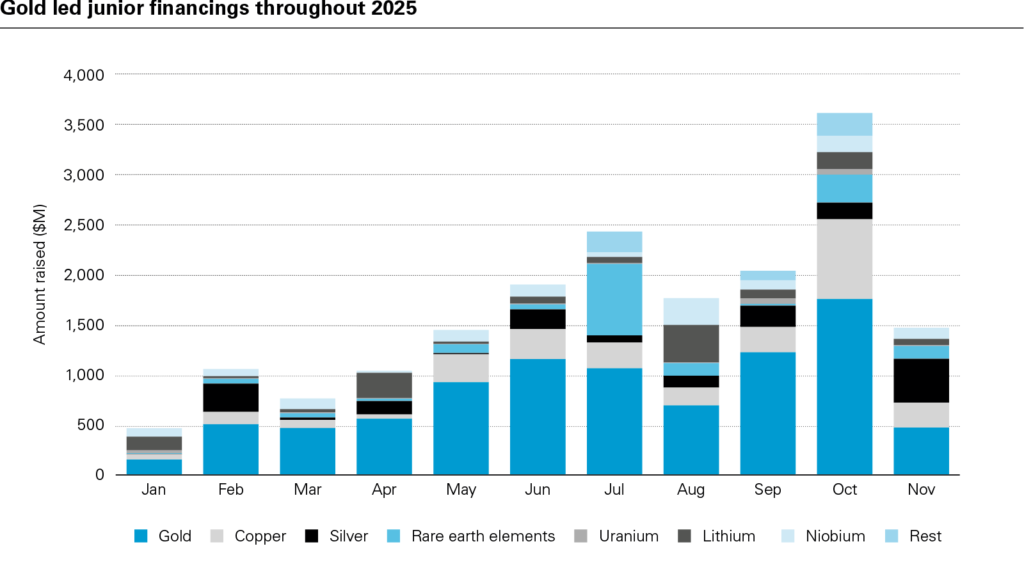

Most respondents (29%) predict that gold miners are the likeliest to experience consolidation, given these companies raised more capital than any other mineral in 2025.

{{ commodity.name }}

{{ post.title }}

{{ post.date }}

Comments