AI to boost copper demand 50% by 2040 — S&P

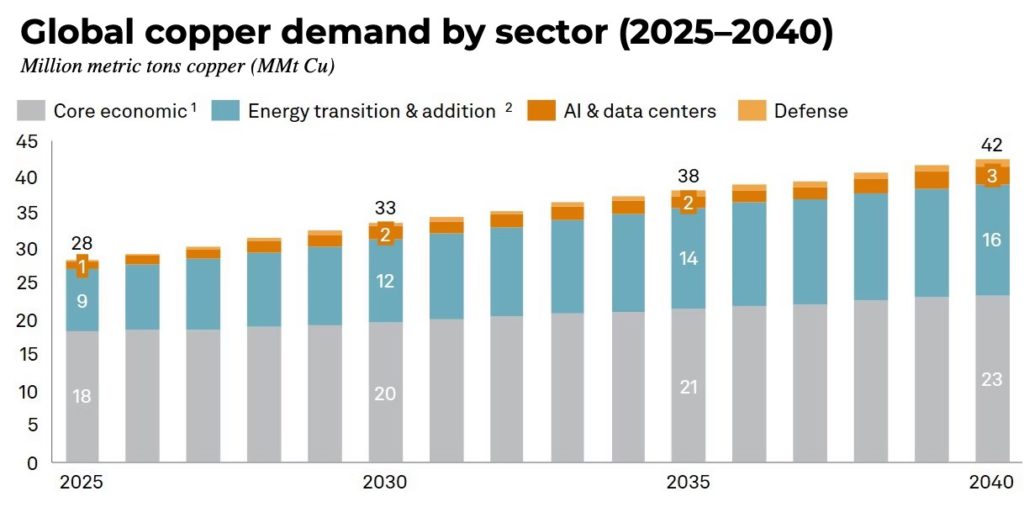

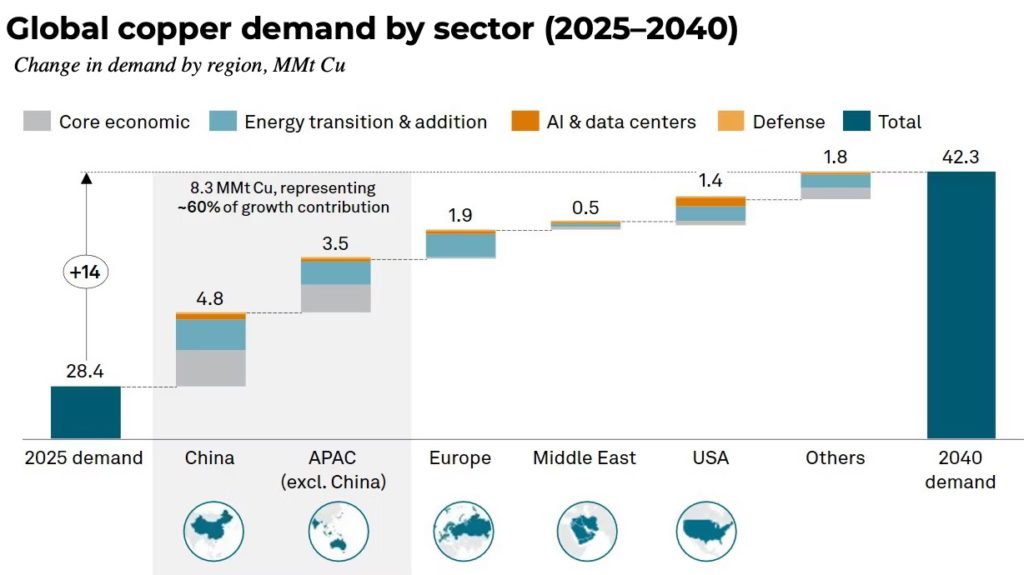

Rapid and exponential growth in artificial intelligence (AI), defence spending and robotics will lift global copper demand by 50% by 2040, leaving a supply shortfall of more than 10 million tonnes a year without major gains in mining and recycling, according to a new S&P Global study.

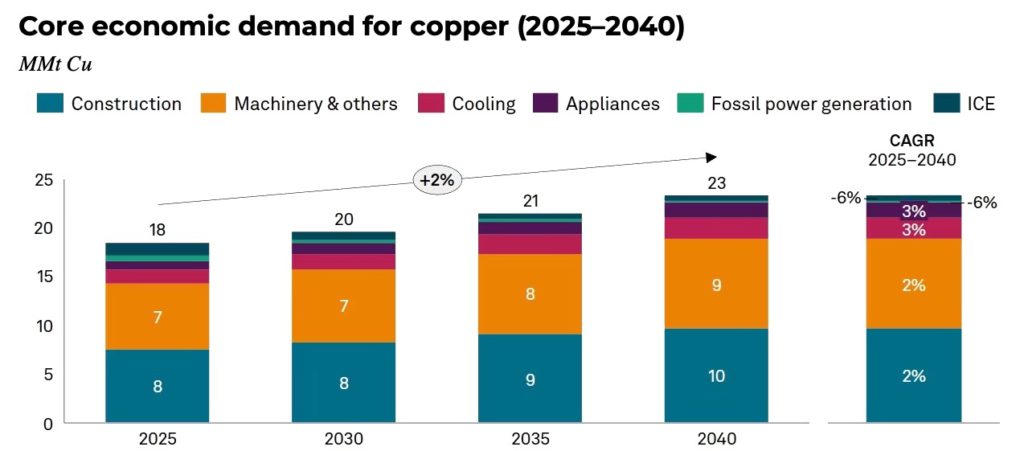

Copper demand is rising as these new sectors add to long-standing uses in construction, transportation, technology and electronics, where the metal is prized for its conductivity, corrosion resistance and malleability.

While electric vehicles drove much of the growth over the past decade, S&P said emerging technologies will become the dominant force over the next 14 years, alongside steady consumer demand for appliances, such as air conditioners.

“AI and data centres really weren’t even on the radar three years ago,” Aurian De La Noue, head of energy transition and critical metals consulting at S&P Global, said. “What this study shows is that the world is tracking toward a supply deficit even before you consider these new growth vectors.”

Prices are set to benefit even more than what they have in the past year. The metal has surged to record highs above $13,000 a tonne in London, fuelled by mine outages and stockpiling in the US ahead of potential Trump administration tariffs.

While those flows have pushed prices beyond levels suggested by current consumption, S&P said structural demand growth points to an even tighter market over the longer term.

Copper hungry humanoids

S&P Global sees global copper demand rising 50% from current levels to 42 million tonnes a year by 2040, with nearly a quarter of that demand likely to go unmet without new supply.

AI is a key driver, with more than 100 new data centre projects launched last year worth just under $61 billion, while combined demand from the emerging AI sector and global defence spending is expected to add about 4 million tonnes of annual consumption.

The study also flags another potential source of demand: humanoid robots. Although the technology is in the early stages, S&P says that if 1 billion humanoid robots are in operation by 2040, they would require about 1.6 million tonnes of copper a year, or roughly 6% of current global consumption.

The report does not include any potential supply from deep-sea mining.

“Hypothetical” problem

Global copper production is expected to peak at about 33 million tonnes in 2030 as ore grades decline and new projects face permitting, financing and construction challenges. Even after accounting for recycled copper, which S&P expects to more than double to 10 million tonnes, the market would still face a gap of about 10 million tonnes a year.

S&P cautions that such a deficit is largely hypothetical, as consumption ultimately adjusts to available supply. Higher prices could push manufacturers to substitute other materials, while tighter markets could make new supply projects more economically viable. Still, the firm said long development timelines, rising costs and a highly concentrated supply chain leave the copper market increasingly exposed to disruptions as demand accelerates.

The study was financed by major mining companies including BHP (ASX: BHP) and Rio Tinto (ASX: RIO), as well as traders Trafigura and Gunvor, and Google (NASDAQ: GOOG | GOOGL).

{{ commodity.name }}

{{ post.title }}

{{ post.date }}

Comments