Almost 75% of mining M&As flow to Latin America: McKinsey

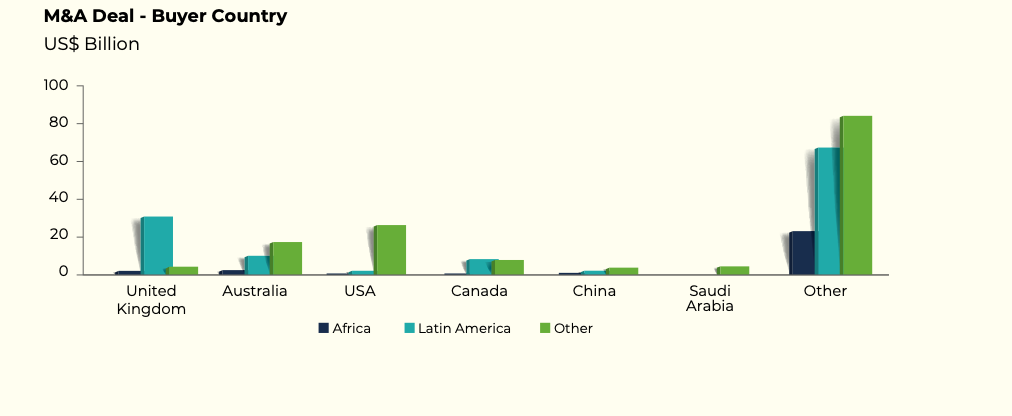

Global mining mergers and acquisitions hit about $30 billion in the first three quarters of 2025, with 74% of deal value flowing to Latin America as investors retreat from higher-risk jurisdictions, a report from McKinsey & Company and the Future Minerals Forum shows.

The figures are part of the Future Minerals Barometer Report 2025, which tracks supply-chain readiness across Africa, West Asia, Central Asia and Latin America.

Developed in partnership with McKinsey & Company and other sector experts S&P Global Market Intelligence, Global AI and GlobeScan, the barometer integrates stakeholder sentiment, data, market intelligence and project-level evidence into a single authoritative platform to guide global decision-making.

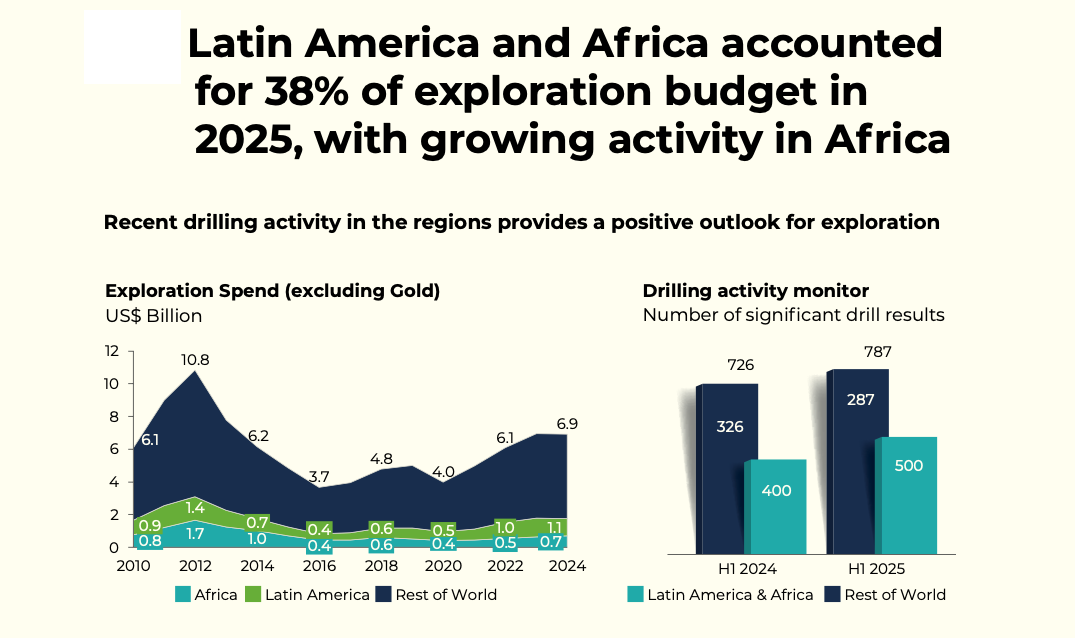

The report found there is a widening gap between mineral endowment and investment. More than 50% of global critical mineral reserves sit in the so-called Super Region — Africa, West Asia and central Asia — yet it attracts the lowest exploration spending worldwide, heightening long-term supply risks.

Deals value skyrockets

Since 2021, mining deal values in Latin America are up more than 200%, while Africa has seen an almost 80% decline as capital gravitates toward jurisdictions perceived as more stable.

The barometer builds on McKinsey’s Global Materials Perspective, released in October last year, which shows mining productivity has improved by just 1% a year since 2018, reinforcing why investors are increasingly focused on capital discipline and permitting certainty.

The report warns that global critical mineral supply chains are under growing strain just as demand accelerates, driven by the energy transition, digitalization and rising defence needs.

Demand for copper, lithium, nickel and rare earths is rising faster than new supply can be brought online, while long permitting timelines, infrastructure gaps, capital intensity and policy uncertainty continue to slow project development.

More than 45% of refined production for electric vehicle materials is concentrated in a single region, increasing exposure to geopolitical risk, trade disruptions and price volatility.

Anglo American (LON: AAL) CEO Duncan Wanblad said global copper demand is projected to rise 75% to 56 million tonnes a year by 2050, requiring about 60 new mines the size of Quellaveco in Peru to be developed over the next decade to offset declining output from aging assets.

Risk reset

Investment flows reflect a broader reset in risk perception. McKinsey partner Jeffrey Lorch said the barometer integrates market data and stakeholder sentiment to give companies a practical roadmap to navigate volatility. GlobeScan CEO Chris Coulter said the Super Region faces major challenges but also a significant opportunity if policy, financing and infrastructure gaps can be addressed.

The report estimates the world will need about $5 trillion in cumulative investment by 2035 to meet critical minerals demand, while exploration spending remains 40% to 50% below what is required. Compounding the shortfall is an average 16-year timeline from discovery to first production, meaning projects found today are unlikely to contribute meaningfully to 2030 or 2035 climate targets.

Industry leaders at the forum argued that faster development will depend on regulatory harmonization, new funding mechanisms and deeper collaboration between governments, miners and investors to unlock supply in Africa, Asia and Latin America.

{{ commodity.name }}

{{ post.title }}

{{ post.date }}

Comments