CHARTS: Mining M&A surges as Canada deal values hit post-2009 high

Mining companies are rushing into mergers and acquisitions (M&A) as a core growth strategy, a shift that is helping drive Canada’s deal market to its highest level in more than a decade, a Bain & Company report shows.

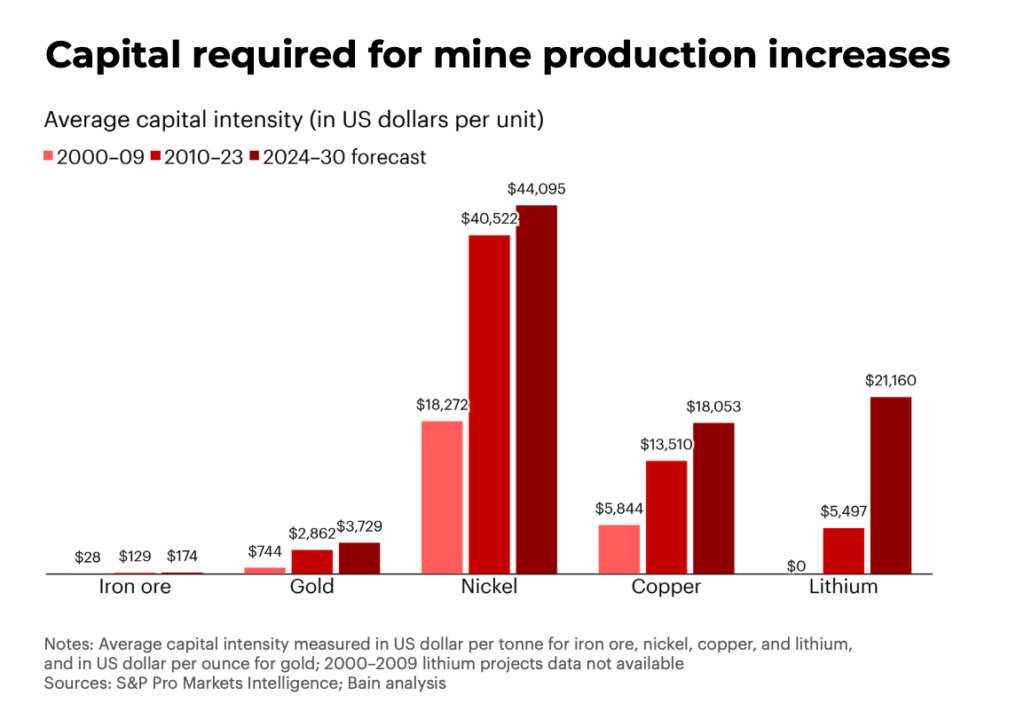

The shift reflects mounting pressure from rising capital costs, longer development timelines and intensifying competition for high-quality assets, which are the main forces reshaping how miners pursue growth and efficiency.

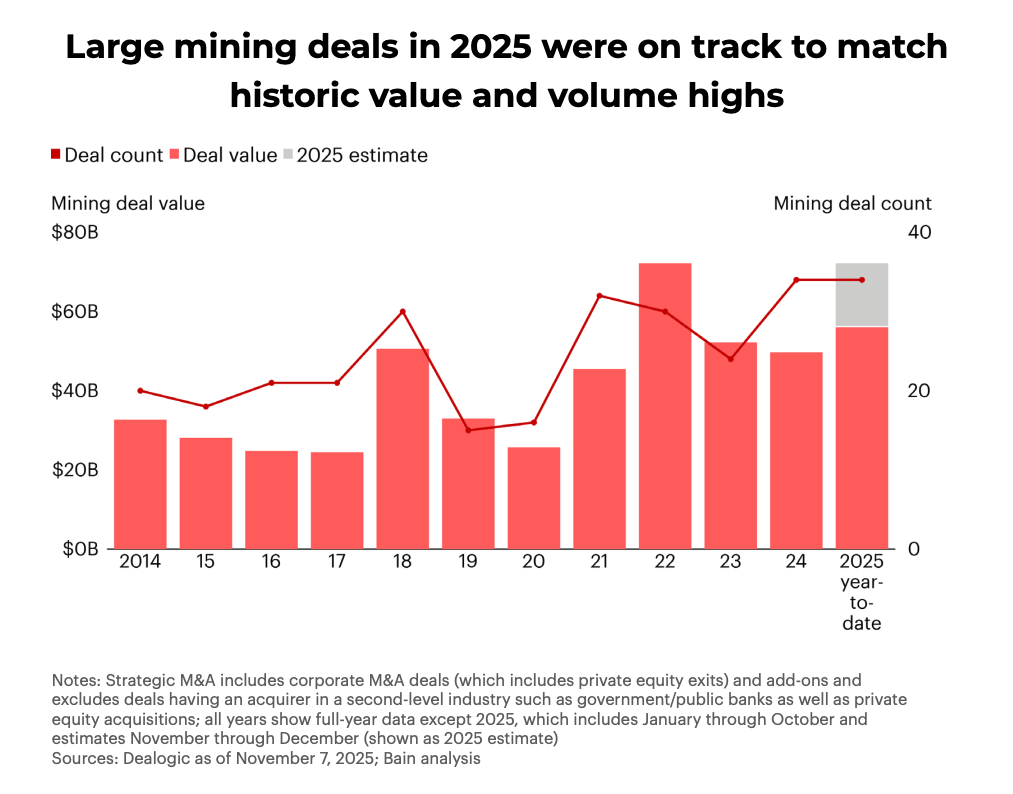

Bain estimates that global mining transactions valued above $500 million rose about 45% in 2025 compared with 2024, as companies looked to secure scale and resilience through acquisitions rather than greenfield development.

Recent large moves underscore the trend. Anglo American’s (LON: AAL) proposed merger with Teck (TSX: TECK.A TECK.B, NYSE: TECK), which values the Canadian miner at nearly $24 billion including debt, would create a combined entity with a market value of roughly $53 billion.

Bain says such transactions highlight how strategic M&A is becoming a critical tool for competitiveness and capital efficiency as the sector positions for a new commodity supercycle.

The next wave of mining dealmaking is expected to be larger, more complex and more decisive in determining long-term winners, the report finds.

Execution matters

While most large mining deals over the past decade have delivered neutral or positive shareholder outcomes, few have reached their full potential. Bain points to timing risk, peak-cycle valuations and execution challenges as the main constraints on value creation.

Successful examples show what is possible when execution is strong. Agnico Eagle’s $10.7 billion merger with Kirkland Lake Gold created the world’s second-largest gold producer, anchored in the Abitibi gold belt. The deal targeted between $800 million and $2 billion in synergies over five to 10 years, with only 15% to 20% tied to general and administrative costs and the bulk expected from operational and strategic integration.

By the second quarter of 2022, Agnico reported early “quick-win” synergies and signalled it could exceed the $2 billion target. Subsequent milestones—including commissioning the Macassa mine’s No. 4 shaft in 2023 and record gold production and free cash flow in 2024—point to growing momentum, though Bain notes it is still early to fully assess outcomes.

Canada focus

Canada’s total M&A deal value rose 30% to $178 billion last year, outperforming the US on strategic transactions even as it lagged the 40% increase globally. Strategic M&A value jumped 57% year over year in Canada, compared with 54% growth south of the border.

Energy and natural resources led Canadian strategic dealmaking, with deal value rising 133% in 2025, while advanced manufacturing and services declined 21%. Strategic buyers accounted for $149 billion in total deal value, though the number of Canadian deals larger than $30 million increased just 8% from the prior year.

Beyond Canada, Bain highlights Evolution Mining (ASX: EVN) as an example of repeatable, strategic M&A done well. The company focuses on building regional, long-life operating hubs where adjacent assets and shared expertise compound value. Rather than relying on top-down cost cutting, Evolution emphasizes operating leverage —shared infrastructure, transferable mining methods and portfolio mix— to strengthen margins across cycles.

Looking ahead, dealmakers remain optimistic about 2026 but warn that macroeconomic and geopolitical uncertainty could still temper market momentum, particularly for capital-intensive sectors such as mining.

{{ commodity.name }}

{{ post.title }}

{{ post.date }}

Comments