Copper’s tight supply and tariff risks set for a volatile 2026

Copper’s record-breaking 2025 has set up a tight but fragile market heading into 2026 as supply strains deepen, tariff fears distort trade flows and analysts flag long-term deficits.

With only a few trading days left in the year on the London Metal Exchange, copper is up nearly 40%, marking its largest annual gain since 2009. Prices surged past $11,800 a tonne this year, at one point sitting about 3% above any previous high as traders rushed metal into the US ahead of possible Trump administration tariffs as high as 15%.

Analyst Albert Mackenzie of Benchmark Minerals told MINING.COM the firm estimates that by October this year there were 730,000 to 830,000 tonnes of economically trapped material in the US, swelling CME stocks while tightening the rest of the world and driving premiums sharply higher.

“We use the term ‘economically trapped’ to refer to that copper as the current arbitrage and premium environment means there is no incentive for that material to be removed from the US,” Mackenzie said. “This trapped tonnage is almost certainly higher now as material continues to flow into the US.”

Mackenzie noted that while the copper price has had a chaotic year, the rally seemed to have drifted away from fundamentals. He added that the surge has been driven as much by tariff hedging and an “EV–AI–energy transition” investment narrative as by genuine supply scarcity.

The expert suggests mining companies have been so effective at promoting the idea of a looming deficit that investors and traders have priced in future shortages prematurely, contributing to higher prices today even though physical tightness is uneven or not yet severe.

“Mining companies are pushing a compelling long-term shortage narrative — and the market believes it,” Mackenzie said. “But belief and fundamentals aren’t the same thing.”

The analyst’s view is that the long-term is undeniably bullish. The present is more complicated. Much of the diverted metal is sitting in storage and leveraged against the CME forward curve rather than being consumed, Mackenzie noted.

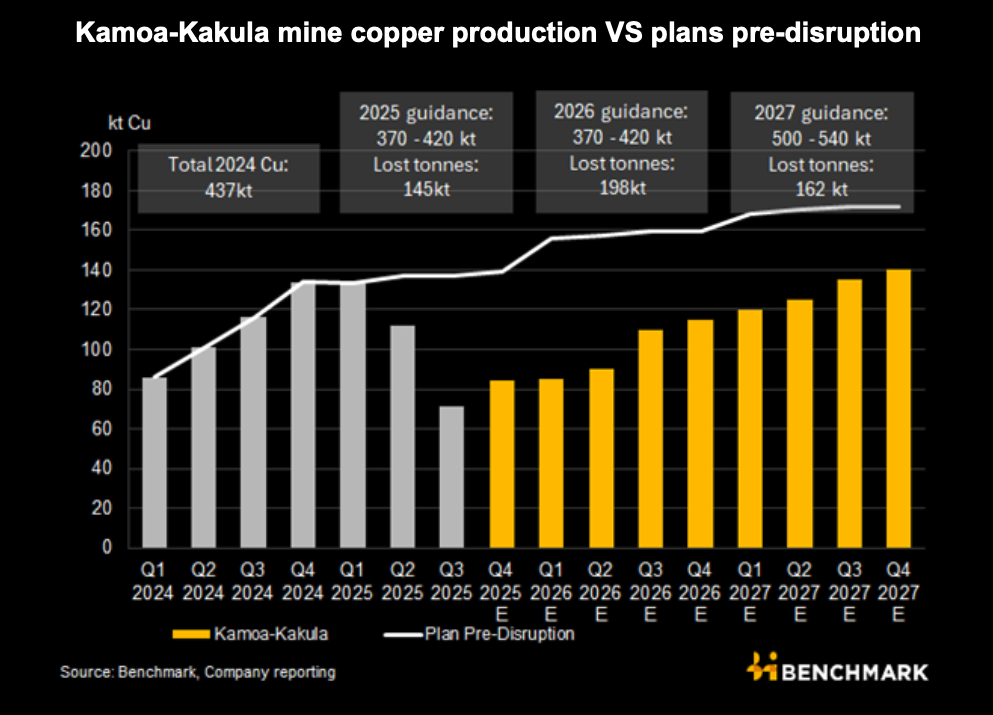

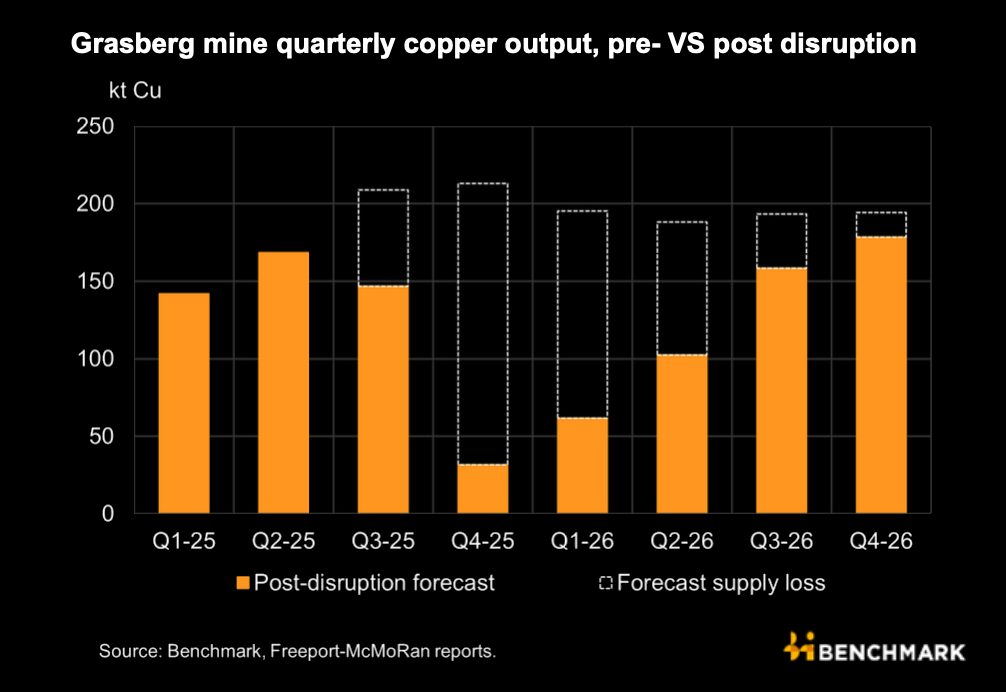

Underlying supply problems added pressure. Long disruptions at Grasberg in Indonesia, Kamoa-Kakula in the DRC and Chile’s El Teniente stretched through the year, with some mines not expected to recover 2024 output levels until 2027 or later.

Even operations free of formal stoppages struggled with declining ore grades, complex geology or slow ramp-ups, leaving smelters squeezed by tight concentrate availability.

Disruptions at Teck’s (TSX: TECK.A, TECK.B)(NYSE: TECK) QB2 project in Chile, and worse-than-recent production at mines including Collahuasi, Los Bronces and a handful of others added to the narrative of supply disruption, Mackenzie said.

Strong on paper, softer on the ground

Demand growth remained strong on paper, backed by expectations for electric vehicles, grid upgrades, data centres and broader electrification. But near-term consumption lagged the narrative, particularly in China, where construction and parts of manufacturing stayed soft. High premiums pushed some buyers toward cheaper alternatives, though analysts said the market was tight rather than broken.

Copper’s role as a macro barometer ensured policy and economic sentiment drove sharp swings. Prices broke higher when hopes for a China–US trade deal improved, and traders reacted quickly to shifts in stimulus expectations. Any new Trump-era tariffs on copper or copper-heavy appliances could jolt flows and demand, adding another layer of volatility across the LME–CME spread, analysts warn.

Substitution and scrap acted as safety valves. Engineers revisited aluminum in wiring applications when copper traded far above it, and high prices drew more scrap into circulation. While not frictionless, these pressures can cap rallies if demand starts to erode.

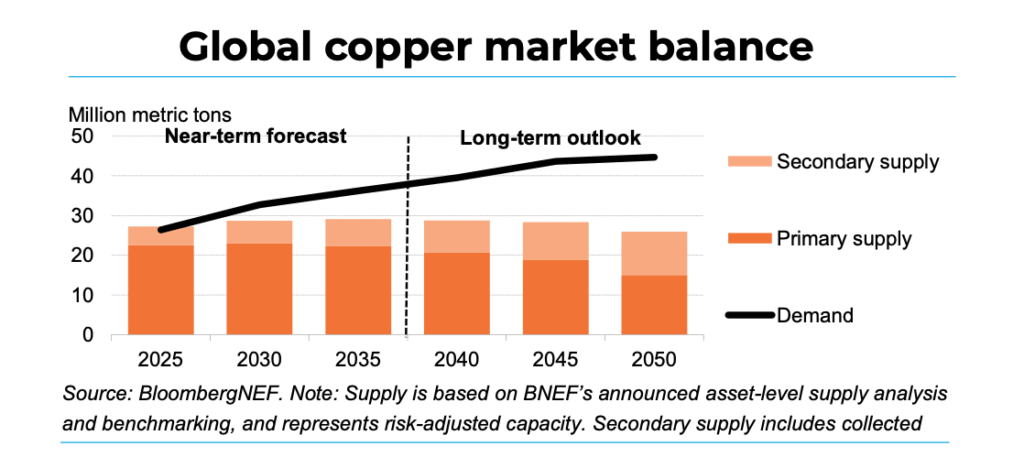

Longer term, analysts see deeper structural risks. BloombergNEF’s December Transition Metals Outlook 2025 warns copper demand for the energy transition could triple by 2045 and that the metal may enter structural deficit as early as 2026. Disruptions in Chile, Indonesia and Peru, along with slow permitting and a weak pipeline of new mines, compound the gap. Without major investment in new projects and recycling, the deficit could reach 19 million tonnes by 2050.

Kwasi Ampofo, head of metals and mining at BloombergNEF, told MINING.COM earlier this month the predicted copper market imbalance reflects rising demand colliding with slow project delivery.

“Copper, platinum and palladium have experienced very slow capacity addition at a time where demand is growing,” he said, calling them the commodities under the greatest near-term pressure.

Other critical minerals face their own constraints. Aluminum growth is limited by China’s production cap, graphite demand is expected to climb toward a technical deficit by 2032, and cobalt prices have rebounded after the DRC replaced its export ban with a quota cutting shipments by 50% for 2026–27.

Lithium supply continues to expand, but prices remain far below their 2022 peak. Across producers, including Anglo American (LON:AAL), BHP (ASX:BHP), Glencore (LON:GLEN), Rio Tinto (ASX:RIO), Vale (NYSE:VALE) and Zijin (HKEX:2899), capital spending is rising as companies chase future supply.

What to watch for in 2026

Taken together, 2025 revealed a copper market tighter than in previous cycles, but not yet in the structural shortage often advertised. Nearly one million tonnes of copper could be parked in US warehouses without obvious physical shortages elsewhere, even at record prices. At the same time, the long-term constraints on new supply and the growing copper intensity of the global economy are real.

For 2026, observers expect more of the same: a market pulled between a genuinely bullish long-term story and a more muddled near-term reality, with tariffs, trade policy and macro data driving sharp swings. In copper, the deficit may still be ahead, but the volatility is already here.

The key variables, they agree, are trade flows into the US, recovery at major mines and the global economic outlook.

If traders continue to divert hundreds of thousands of tonnes to CME-deliverable warehouses ahead of potential tariffs, tightness in the rest of the world will persist and premiums will remain elevated, analysts say.

A tariff surprise could send prices swinging in either direction, while fresh disruptions or aggressive Chinese stimulus could quickly reshape balances. Analysts expect high prices to persist but with deeper corrections if substitution and scrap accelerate.

“As long as Donald Trump remains in the White House, markets should brace for more sudden swings sparked by policy shifts or off-the-cuff remarks — effects that extend well beyond copper itself,” Mackenzie said.

{{ commodity.name }}

{{ post.title }}

{{ post.date }}

Comments