Global scramble for critical minerals to shape markets in 2026: BMI

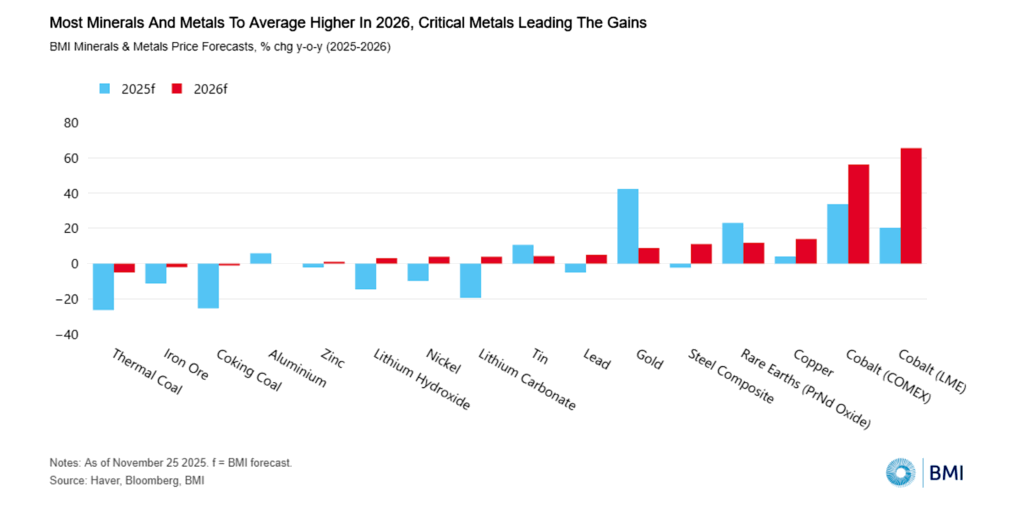

BMI, a unit of Fitch Solutions, expects most mineral and metal prices to edge higher in 2026 as net-zero demand, tighter supply and an intensifying global race for critical minerals offset persistent weakness in Mainland China’s property sector.

In its newly released outlook for mining and metals, BMI describes a “cautiously optimistic” price environment next year, with easing tariff uncertainties and robust demand from sectors tied to decarbonization underpinning the market.

The researchers add that China’s property slump will continue to weigh on base metals, limiting price gains even as supply remains tight.

For precious metals, BMI forecasts that gold will average higher in 2026 than in 2025, but says prices are likely to ease late in the year as global monetary easing slows and the US Federal Reserve ends its rate-cutting cycle.

Industrial policy will remain the main tool for securing critical minerals in 2026, BMI says, with most of the action centred in the EU and the US. Governments are pursuing a twin-track strategy of expanding domestic mining and processing capacity while locking in overseas supply through investment, strategic partnerships and offtake deals.

BMI says Mainland China will double down on its own strategy to reinforce its dominance across critical mineral value chains. Beijing is expected to accelerate exploration, expand targeted capacity in battery and rare earth minerals and promote greener manufacturing, while deepening ties with resource-rich economies under clearer outbound investment rules. Recent tariffs and rare earth export controls show protectionist leverage will stay central.

M&As remain strong

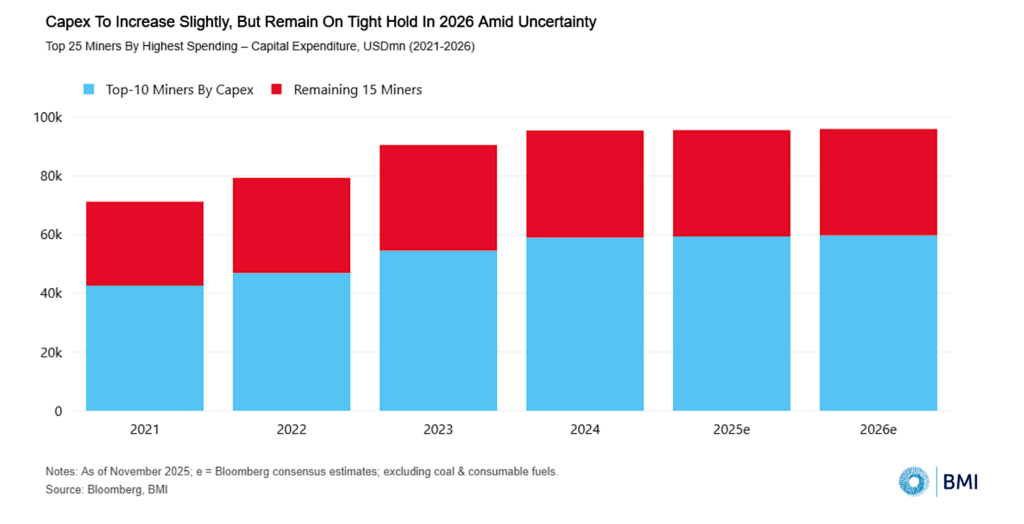

The competition for energy transition inputs will keep merger and acquisition activity robust into 2026, BMI forecasts. Miners and metals producers are set to prioritize deals that increase exposure to copper, lithium and rare earth elements. Large capex projects will remain on the agenda, though phased and brownfield developments are gaining favour as firms try to manage cost pressures and policy uncertainty.

BMI also sees continued investment flowing into frontier markets next year, despite persistent concerns over resource nationalism. Governments and local populations, particularly in Africa, now have greater awareness and bargaining power over their mineral endowments. Miners will have limited room to resist these policy shifts.

Partnerships between mining projects and technology, automotive and aerospace firms are expected to deepen next year. BMI notes that supply bottlenecks threaten growth in artificial intelligence, robotics and defence, giving downstream manufacturers strong incentives to secure materials at the mine site.

Taken together, BMI’s outlook suggests 2026 will be defined less by runaway price gains and more by strategic positioning, with industrial policy, critical minerals competition and shifting bargaining power in frontier markets shaping where capital flows next in the global mining industry.

{{ commodity.name }}

{{ post.title }}

{{ post.date }}

Comments

Rusty Atwood

Critical minerals, Rare Earths and precious metals are all needed for AI plus every New technology! Can a small mining company with road and port access surprise some of the large companies with remote locations and no road in Port access? Owner of Alaska Rare Earth LLC 😊