The iron ore price fell on Wednesday as electricity rationing in parts of China has led to steel mill shutdowns.

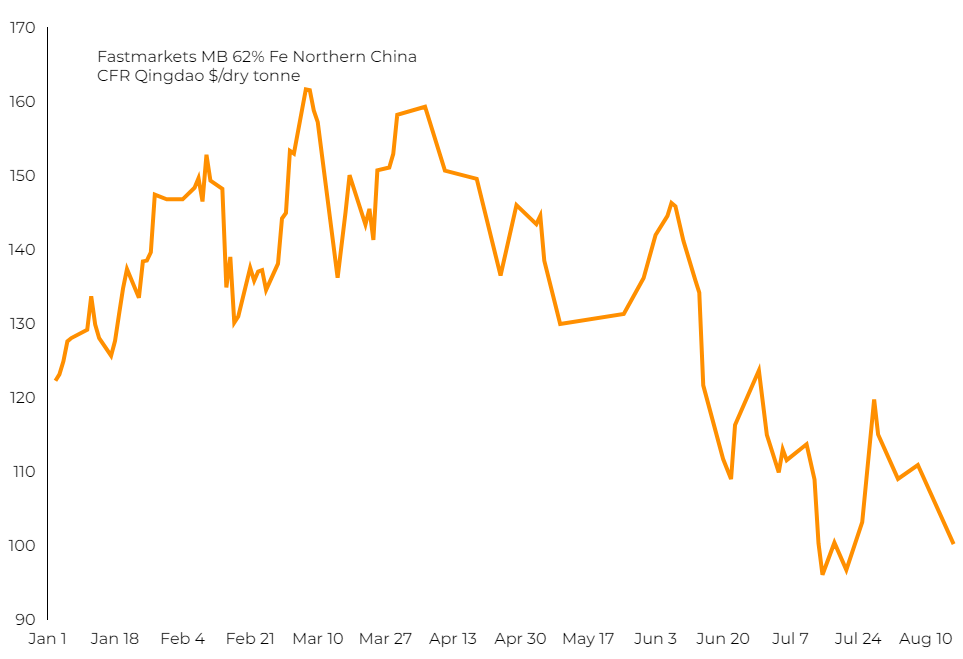

According to Fastmarkets MB, benchmark 62% Fe fines imported into Northern China were changing hands for $100.19 a tonne Wednesday morning, down 4.2%

Iron ore’s most-traded January 2023 contract on China’s Dalian Commodity Exchange tumbled as much as 4.4% to 683.50 yuan ($100.87) a tonne, its lowest since July 28.

A heatwave gripping several regions in China since mid-July has caused power shortages, forcing authorities to ration electricity.

Nearly 20 steel mills in China’s southwest regions had suspended operations as of Wednesday, according to steel industry data provider SMM.

The power rationing is expected to continue for a week, according to SMM.

“Our base case is that the power rationing this time around should be milder than that seen last year in terms of duration and scale,” J.P. Morgan analysts said in a note, adding that it will likely be confined to few provinces.

Rising iron ore supply in China also weighed on prices.

Stocks of imported iron ore at Chinese ports have steadily risen over the past seven weeks, hitting 138.6 million tonnes as of Aug. 12, the highest since mid-May, according to data from Mysteel consultancy.

(With files from Reuters)