Anti-Newmont protest shuts down regional capital

Reuters reports schools and businesses were closed and Peruvian police fired tear gas on Friday to break up a protest at Newmont Mining and Buenaventura's proposed $4.8 billion Conga gold mine as the government tried to mediate a bitter environmental dispute over the project.

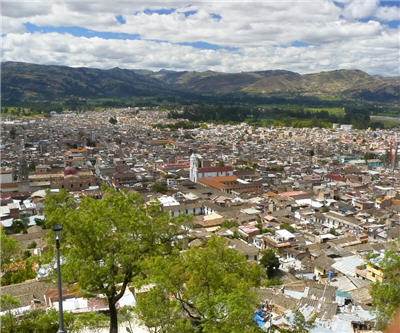

Residents in the northern city of Cajamarca which has more than 200,000 residents (pictured), led by the president of the region, say a new mine – adjacent to South America’s largest gold mine Yanacocha – will harm agriculture and livestock by relocating water supplies. Conga would be the biggest investment ever in Peru mining.