Orla Mining plunges as Fairfax trims stake

Shares of Orla Mining (TSX: OLA) plunged on Friday after it was announced that Fairfax Financial Holdings (TSX: FFH, FFH.U) sold nearly half of its shares in the company at a below-market price.

The Toronto-based investment firm sold a total of 25 million shares at a price of C$17.6435 per share for total proceeds of approximately C$441.1 million, Orla said in a press release.

Prior to the sale, Fairfax held, through its insurance company subsidiaries, about 56.8 million shares in the company, representing 16.7% of those outstanding on a non-diluted basis. The divestment of 25 million shares brings its shareholding down to 9.4%.

The news brought Orla’s shares down by as much as 9.5% to C$17.30 — its lowest in nearly two weeks. By midday, the stock traded at C$17.49 apiece, giving the Vancouver-based gold miner a market capitalization just under C$6 billion ($4.3 billion).

Year to date, Orla’s shares have more than doubled amid record gold prices.

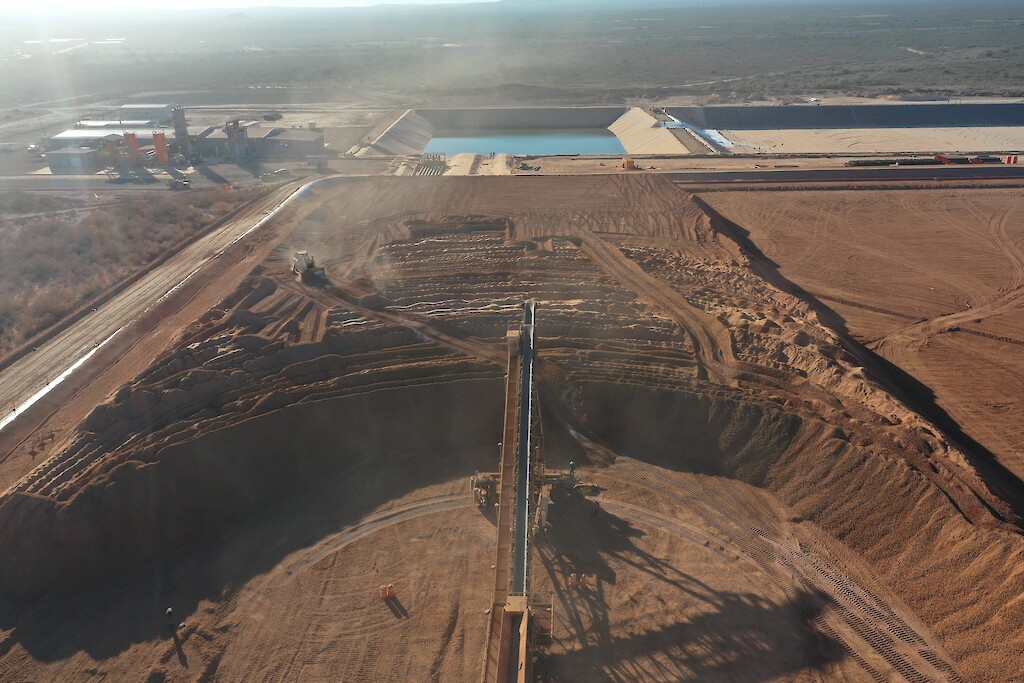

Orla currently has two producing mines based in North America: the flagship Camino Rojo in central Mexico, comprising an open pit deposit and a developing underground mine, and Musselwhite in Ontario, which it acquired from Newmont (NYSE: NEM; TSX: NGT) earlier this year. Together, they are forecast to produce 265,000-285,000 ounces of gold this year.

In September, Newmont also sold 43 million shares of Orla at C$10.14 per share, as part of its strategy to streamline its equity portfolio and raise more cash. With the sale, the Denver, Colorado-based miner is no longer a shareholder in Orla.

{{ commodity.name }}

{{ post.title }}

{{ post.date }}

Comments