Precious metals extend rally as silver price surpasses $90

Precious metals continued their hot start to the year, with gold setting another record on Wednesday and silver blasting past the $90-an-ounce level amid high demand for safe-haven assets.

Spot gold hit a peak of $4,641.29 per ounce, taking its year-to-date gains to 6%. Silver, meanwhile, continues to outpace gold, up more than 14% on the year after soaring to a record $92.23 per ounce.

“All roads are leading to gold and silver,” said Alex Ebkarian, COO at Allegiance Gold, citing demand from diverse buyers and noting the market is in a structural bull phase.

Tailwind for metals

Frenzied buying in China across multiple metals has stoked the recent rally, which extends into industrial metals such as copper and tin. At the same time, investors have been seeking safe-haven assets as geopolitical tensions rise around the world. Gold historically has served as a hedge against these risks and a store of value during economic turmoil.

Also underpinning bullion’s rise is a global pivot away from traditional assets like government bonds and currencies due to worries over ballooning debt levels leading to their depreciation, as is the case with the US. Those concerns resurfaced in recent days following the Trump administration’s renewed attacks on the US Federal Reserve and attempted interference with monetary policy.

“When gold moves first, it usually signals declining trust in fiat currencies,” said Hao Hong, chief investment officer at Lotus Asset Management. “Everything is measured against gold, then most assets look cheap right now, which is a strong tailwind for commodities, especially metals.”

A further boost could come in the form of lower interest rates, as this would elevate the appeal of non-yielding assets like gold. Latest US inflation data firmed market expectations that the Fed will cut rates twice this year.

Silver tightness

Silver has been riding the coattails of gold and even outperformed its sister metal last year.

Unlike gold, silver is facing the prospect of US import levies, especially after its inclusion on the critical minerals list. The tariff overhang has prevented some metal from leaving the US and entering the dominant spot trading hub in London, leading to severe market tightness.

Andrew Matthews, global head of precious metals distribution at UBS Group, said in a media call that the white metal is in a “perpetual state of backwardation.”

Tighter availability of metal generally results in higher prices, and speculators buy into that strength, he said, “so one creates the other, the chicken-and-the-egg effect, and that’s certainly what we’re seeing right now.”

Hot start

Prices of the two metals are now approaching or have exceeded forecasts given by major banks. Earlier this week, Citi set its three-month forecasts for gold and silver to $5,000 an ounce and $100 an ounce, respectively.

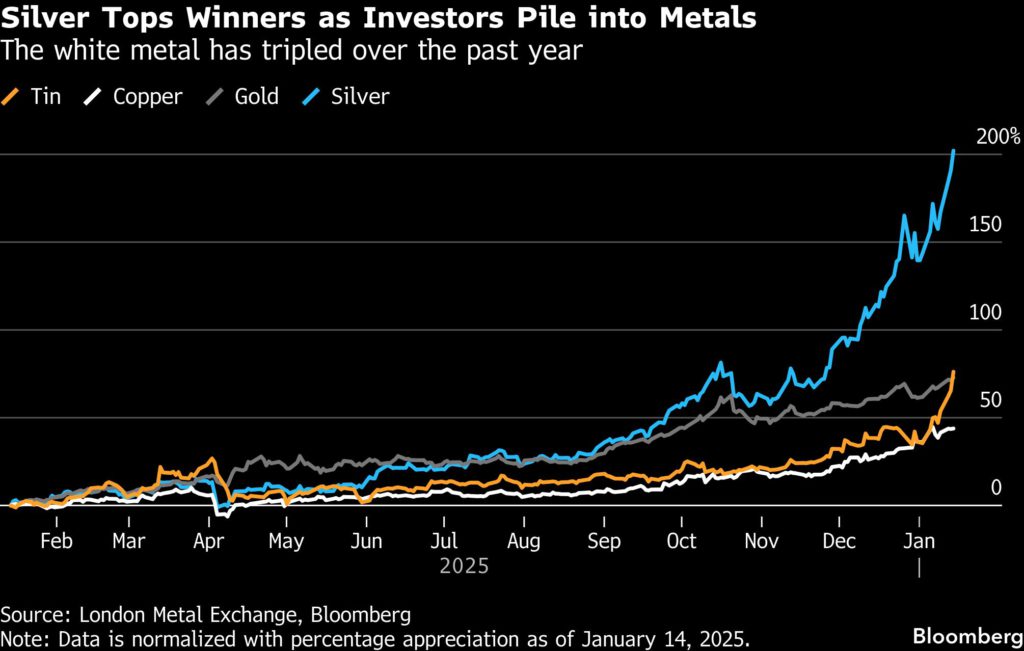

The rally follows respective gains of 65% and 150% last year — the best annual performance for both metals since 1979.

Still, despite their hot starts to 2026, some are warning that a pullback could be on the horizon, given how quickly the run-up has been.

Joni Teves, precious metals strategist at UBS, said “it would be healthy” for precious metals to see some consolidation before the next leg up.

(With files from Bloomberg and Reuters)

{{ commodity.name }}

{{ post.title }}

{{ post.date }}

Comments

Keith Mcmaugh

‘ declining trust in fiat currenciessss’, is well under stated. Last year every major currency appreciated against the USD which dropped over 9%. When Swift, USD, & Treasuries are used a weapons, other nations find solutions. It will be very interesting, extremely funny to see the reactions when Prez Trump sends in the military to seize Greenland, then Canada, then?? Who ever he wants,,,,? Gold will go to $8000