J. Rotbart & Co. Marks 10-Year Anniversary Amid Historic Surge in Precious Metals

Hong Kong, Jan. 28, 2026 (GLOBE NEWSWIRE) -- J. Rotbart & Co., an international precious-metals consultancy, announced today its 10-year anniversary, coinciding with a historic rally in gold and silver markets that underscored growing investor demand for physical assets. The milestone year saw the company surpass US$3 billion in completed transactions, expand its vault network to 16 global locations, and open a fourth office in Tel Aviv, as high-net-worth clients increasingly turned to bullion amid global uncertainty.

Joshua Rotbart - Founder and Managing Partner at J. Rotbart & Co

Over the past ten years, geopolitical fragmentation, de-globalisation, and recurring inflation shocks have transformed physical bullion from a niche wealth-preservation tool into a core portfolio allocation. As J. Rotbart & Co., a specialist in precious metals trading and investment, marks its 10-year anniversary, the macro backdrop is striking - In 2025 alone, gold recorded more than 50 all-time highs, while silver, platinum, and palladium surged in tandem.

The firm’s anniversary theme, “Your Trust Is Our Legacy,” reflects a simple reality: in an unsettled world, investors increasingly value certainty, control, and tangible wealth.

Why Precious Metals Rallied in 2025

In the last decade gold has appreciated over 300%. It ended 2025 with gains exceeding 60%, driven by elevated geopolitical risk and sustained U.S. dollar weakness.

Gold has grabbed headlines throughout 2025. De-dollarisation trends and declining confidence in U.S. fiscal policy prompted central banks to add approximately 1,000 tonnes of gold to reserves, while investor demand rose by 10%. Together, these forces—amplified by trade uncertainty, tariffs, and widening fiscal deficits continued to push prices to record levels and draw high-net-worth investors toward physical bars and coins.

Silver outperformed all major metals, rising 149%. Its rally was underpinned by a severe liquidity squeeze and a sixth consecutive year of supply deficits, representing a cumulative shortfall of nearly 820 million ounces. Exchange-traded product holdings increased 18% as investors sought protection against stagflation and geopolitical stress. Strong industrial demand from renewable energy and semiconductors reinforces the metal’s upward trajectory.

Platinum staged a decisive comeback after years of underperformance. A reported 6% decline in mine supply in 2025 due to operational constraints, contributed to an estimated market deficit of 850,000 ounces. Platinum’s sustained discount to gold, coupled with strong jewellery and bar demand in China, lifted prices to a ten-year high of US$1,450 per ounce in July. Structural shortages suggest continued upside.

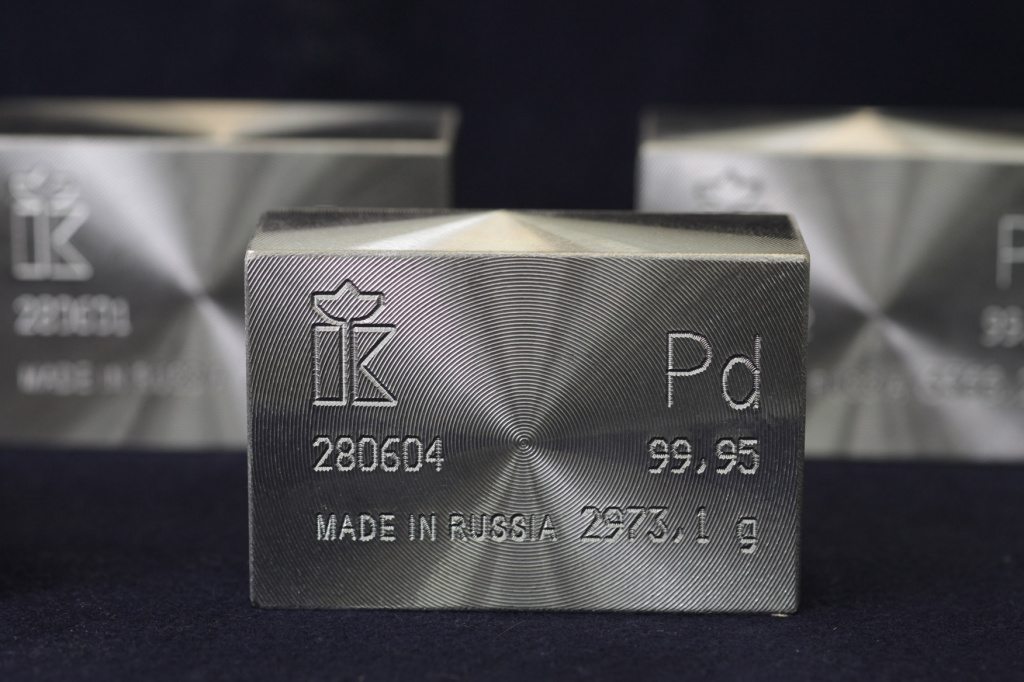

Palladium was the year’s most volatile metal, yet still posted gains of more than 80%, reaching US$1,675 per ounce in mid-December. The rally reflected slower-than-expected electric-vehicle adoption and renewed concerns over Russian supply disruptions. While palladium remains closely tied to the automotive sector, long-term demand is expected to moderate as EV penetration increases.

2026 Outlook: Demand Endures, Volatility Persists

Looking ahead, the outlook for precious metals in 2026 points to sustained demand amid elevated volatility. Ongoing safe-haven demand and policy uncertainty are likely to keep gold near record levels. Although central-bank purchases may slow modestly, they are expected to remain historically high. Should global growth weaken further, investors could still see moderate to strong upside.

Silver’s structural deficit, combined with expanding demand from photovoltaic and AI-driven technologies, continues to support higher prices. Platinum markets are also expected to remain in deficit, with firm demand from China offsetting potential short-term consolidation. Palladium may stabilize, with flat auto demand balanced against ongoing supply risks.

Trust as a Legacy

In 2025, J. Rotbart & Co.’s clients benefited from a historic surge in precious metals driven by inflation, sanctions, and geopolitical flashpoints. As the firm looks to 2026, it sees de-globalisation, fiscal excess, and supply bottlenecks continuing to steer investors toward physical assets.

Celebrating a decade in business, J. Rotbart & Co. believes its next chapter will remain rooted in the fact that during global uncertainty physical precious metals are not merely a hedge, but a foundation for enduring wealth. As founder and managing partner Joshua Rotbart puts it: “When the world feels unpredictable, people look for something that lasts, and gold has always been that anchor.”

About J. Rotbart & Co.

J. Rotbart & Co. is an international precious-metals consultancy specializing in the acquisition, secure storage, and structuring of physical bullion for high-net-worth and ultra-high-net-worth clients. Founded in 2016, the firm operates offices in Singapore, Hong Kong, Bangkok, Tel Aviv, and the Philippines, and works with a global network of independently operated vaults across key financial jurisdictions. J. Rotbart & Co. advises private investors, family offices, and institutions seeking long-term capital protection through allocated, fully segregated precious-metal ownership.

Press Inquiries

Natpawena Sangusa [email protected] +66 9 0950 4077 https://jrotbart.com Suite 1503, Champion Building, 287-291 Des Voeux Road Central, Sheung Wan, Hong Kong