Rio Tinto open to owning coal to secure Glencore deal: reports

Rio Tinto (ASX, LON: RIO) is said to be open to temporarily owning Glencore’s (LON: GLEN) coal business to clear a key hurdle in merger talks that could create the world’s largest mining company, with a market value of nearly $207 billion.

The shift, according to media reports including Bloomberg‘s, would mark a sharp reversal for Rio, which exited coal in 2018 under investor pressure. Retaining the assets could be key to removing one of the biggest obstacles to a deal with Glencore, one of the world’s largest coal producers, after doubling down on the fuel with its 2023 acquisition of Teck Resources’ coal business.

People familiar with the talks told Bloomberg News that one scenario under discussion involves Rio acquiring all of Glencore, including coal, with the option to divest the business later. No final decisions have been made.

Beyond coal, Rio is also keen to keep Glencore’s powerful trading division and expand it into a more formidable platform for selling commodities, according to sources cited by Reuters. The interest goes beyond copper, with Rio looking to draw on Glencore’s marketing and trading expertise as part of any transaction.

Goldman Sachs estimates Glencore’s marketing business could be worth about $4 billion by 2030. The unit generated $1.4 billion in adjusted earnings before interest and tax in the first half of last year, highlighting its contribution to Glencore’s valuation.

Rio and Glencore confirmed late Thursday they were in early-stage buyout talks that could value the combined group at nearly $207 billion. Rio, the larger company with an enterprise value of about A$200 billion ($134 billion), would likely be the acquirer under the structure currently envisaged, the people said. Negotiators are also weighing valuation, deal structure and who would run a combined company.

Under UK takeover rules, Rio has until Feb. 5 to make a formal offer for Glencore or walk away.

Analysts weigh in

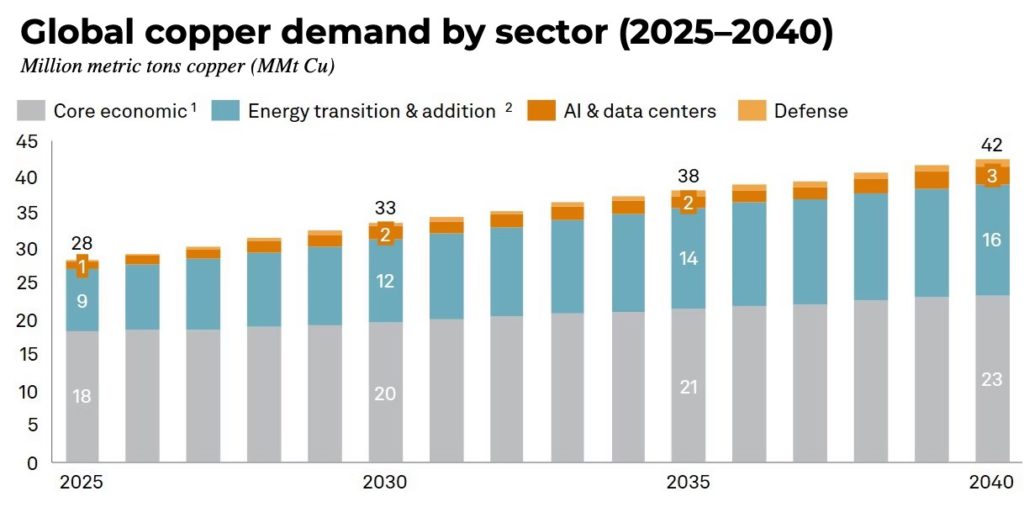

The talks underscore a renewed wave of consolidation sweeping the mining industry as companies scramble to secure copper growth amid soaring prices and constrained supply. Last year, Anglo American (LON: AAL) and Canada’s Teck Resources (TSX: TECK.A TECK.B)(NYSE: TECK) agreed to merge, raising the pressure on rivals to scale up.

Market observers say a potential Rio-Glencore combination would also sharpen the spotlight on BHP, which made two failed bids for Anglo American in recent years and now risks being sidelined as competitors pursue a transformative deal. Glencore’s copper assets are widely viewed as attractive, while its coal business has long been seen as a stumbling block for potential buyers.

BMO analysts said the companies have limited overlap beyond a shared appetite for copper growth, with few obvious synergies outside marketing and corporate functions.

“If they were to merge as-is, it would create the largest listed mining company by a long way, but realistically we’d expect significant reshuffling of the portfolio, including spin or divestiture of coal,” analyst Alexander Pearce wrote. He added the talks could also lead to asset-level combinations focused on copper.

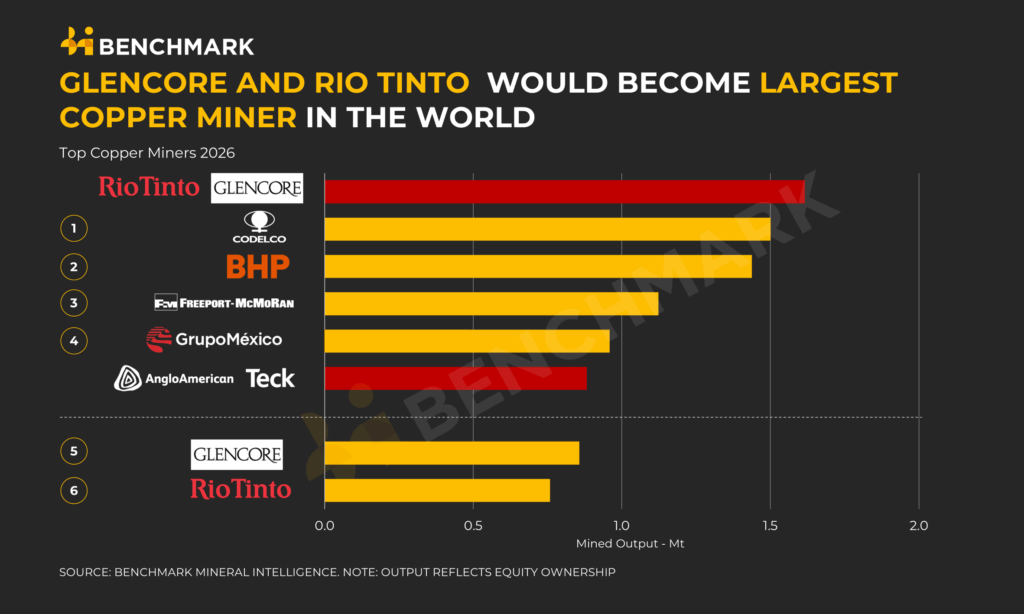

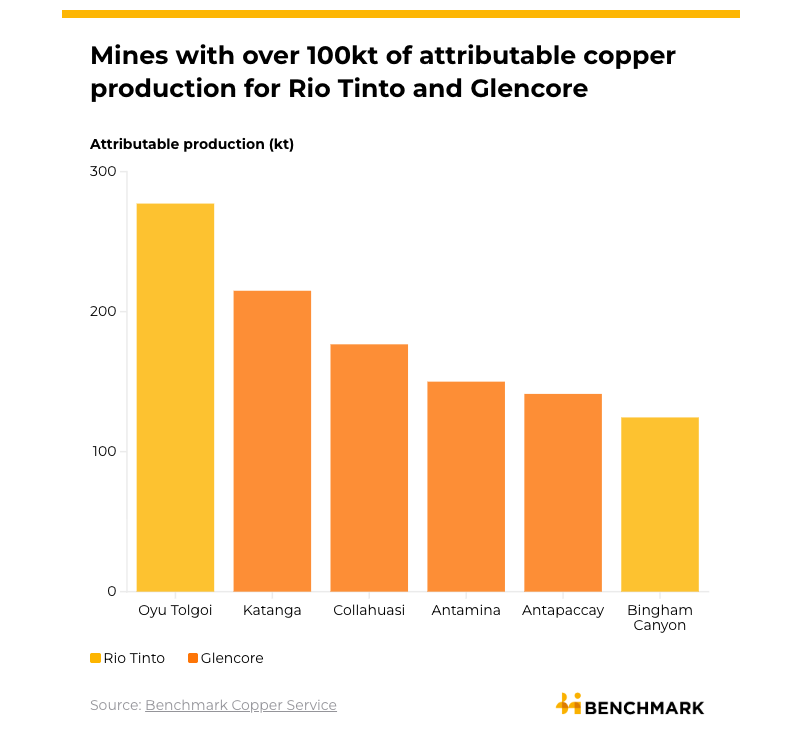

For Benchmark Minerals experts, the merger would be beneficial for both companies but wouldn’t necessarily alleviate supply concerns, as it would be consolidating production rather than creating new production. The consultancy says their combined 2026 output would be over 1.6 million tonnes of production, higher than any other company globally.

Richard Hatch, an analyst at Berenberg, said the rationale echoed recent successful mergers driven by access to copper. Rio needs more of the metal as investors increasingly view iron ore as facing long-term price pressure, he said, adding that buying producing assets is preferable to waiting years to build new mines.

George Cheveley, natural resources portfolio manager at Ninety One, and a Glencore shareholder, also pointed to copper as the key driver. He said Rio’s investor day last month “struggled to articulate copper growth beyond 2030,” while Glencore has a deeper project pipeline. One uncertainty, he added, is whether BHP might feel compelled to get involved.

A decade in the making

The renewed talks mark a striking change from 2014, when Rio swiftly rejected Glencore’s proposal for what would have been the largest mining deal on record, triggering a public feud that exposed deep cultural differences. Glencore’s then-chief Ivan Glasenberg accused Rio of misunderstanding iron ore markets, while Rio criticized Glencore’s traders as short-term focused.

Negotiations resumed quietly in the second half of 2024 but collapsed over valuation, according to people familiar with the matter. Since then, copper prices have surged and Glencore has repositioned itself as a company with significant copper growth potential, while Rio continues to derive most of its earnings from iron ore.

Leadership dynamics have also shifted. Glencore previously pushed for chief executive Gary Nagle to lead a combined group. Rio has since replaced former CEO Jakob Stausholm with company veteran Simon Trott, who took over in August and is seen as more closely aligned with chair Dominic Barton, a change analysts say could smooth negotiations.

Rio’s openness to coal reflects a broader change in the political and business climate, including a backlash against green policies championed by US President Donald Trump. Even so, the move could deter some investors.

“It could be difficult for some shareholders, given how many have mandates against holding thermal coal,” said Iain Pyle, senior investment director at Aberdeen Group Plc, which holds about 0.5% of Rio but bars Glencore from its future minerals fund because of coal exposure. Access to Glencore’s copper growth assets, he added, remains the appeal.

Glencore has disappointed investors in recent years by missing production targets, particularly in copper, but sought to reset expectations at an investor day last month by outlining plans to nearly double copper output over the next decade. That coincided with a rally that pushed copper above $13,000 a tonne this week amid mine outages and US stockpiling ahead of possible tariffs.

For Rio, which has limited near-term copper growth after completing a major expansion at its Mongolian mine, the rally adds time pressure as iron ore prices remain subdued by China’s prolonged property slump. Glencore’s coal unit remains a major profit contributor despite weaker prices over the past year.

After acquiring Teck’s coal assets, Glencore scrapped plans to spin them out following shareholder pushback, with Nagle saying the ESG pendulum had swung back in coal’s favour.

(With files from Bloomberg, Reuters)

More News

Contract worker dies at Rio Tinto mine in Guinea

Last August, a contract worker died in an incident at the same mine.

February 15, 2026 | 09:20 am

{{ commodity.name }}

{{ post.title }}

{{ post.date }}

Comments