Venezuela shock lifts gold, but mining revival remains elusive

The Trump administration’s military intervention in Venezuela has jolted global markets, fuelling safe-haven demand for gold while doing little to improve the long-term outlook for the country’s battered mining sector, according to new analysis from BMI, a unit of Fitch Solutions.

Gold prices jumped 2.2% to $4,430/oz on January 5, following the US military raid over the January 3–4 weekend that led to the capture of President Nicolás Maduro. The move extended a powerful rally seen throughout 2025, when gold repeatedly hit record highs, peaking at $4,547/oz on December 26.

Prices averaged $3,450/oz last year, up 44% year-on-year, driven by heightened geopolitical risks, a more dovish Federal Reserve outlook and a weaker US dollar.

BMI says the removal of Maduro is likely to prolong geopolitical uncertainty, reinforcing the bullish case for gold into 2026.

The consultancy has already revised its 2026 gold price forecast to an annual average of $3,700/oz and highlights upside risks that could warrant further upgrades if global tensions persist.

Unlikely improvement

While markets have reacted swiftly, BMI sees little reason to expect a meaningful turnaround in Venezuela’s metals and mining sector, even under a post-Maduro government.

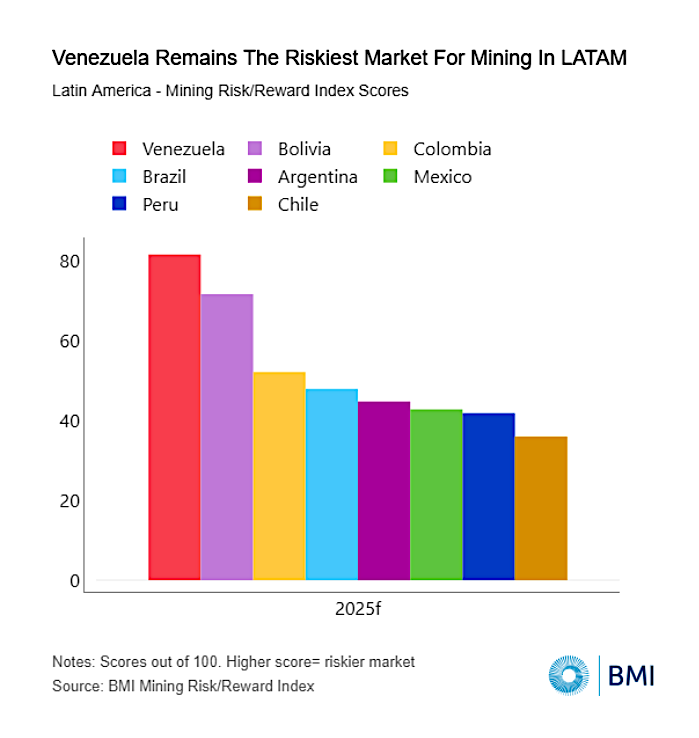

Over its 2026–2035 forecast period, BMI expects the industry to remain among the smallest and least attractive in Latin America.

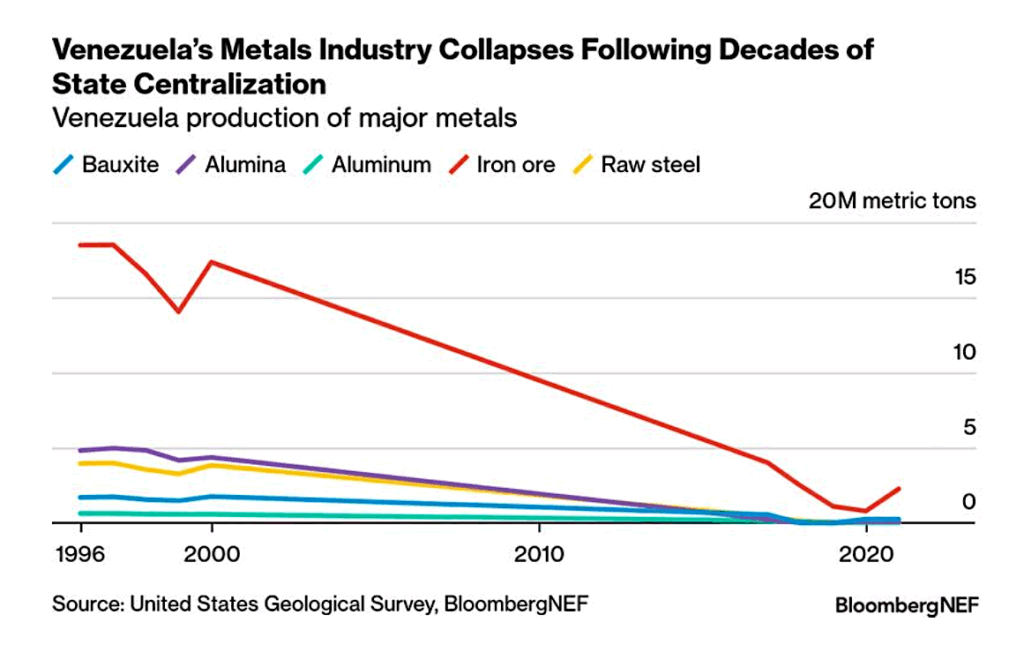

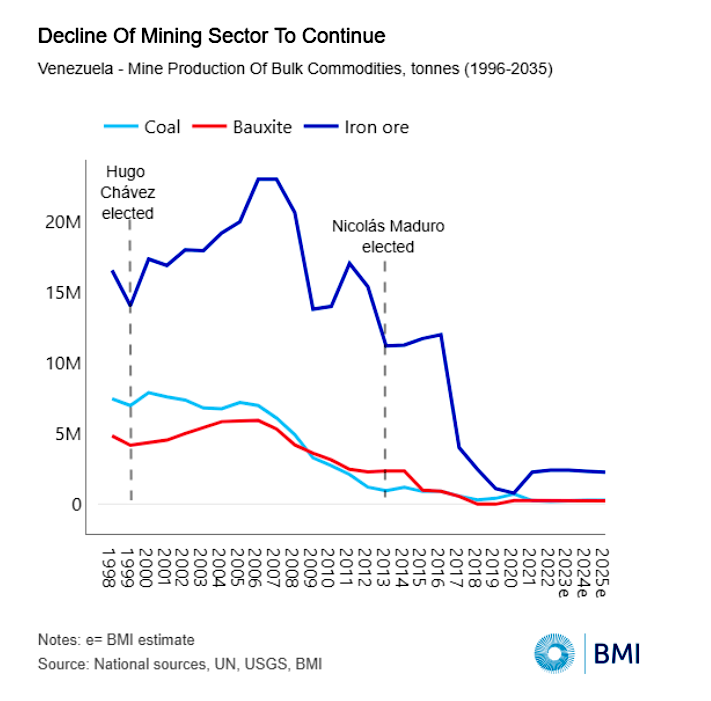

“Like its much larger oil and gas sector, Venezuela’s mining industry has suffered a steep decline over recent decades,” BMI said, pointing to widespread nationalization and chronic underinvestment.

Twenty years ago, the country ranked as the world’s 12th-largest iron ore producer and eighth-largest producer of bauxite. Since then, output has collapsed.

Between 2004 and 2024, BMI estimates iron ore production fell from 20 million tonnes to 2 million tonnes, bauxite from 5 million tonnes to 0.3 million tonnes, and coal from about 6 million tonnes to less than 0.5 million tonnes. The consultancy does not expect these trends to reverse, citing degraded infrastructure and years of missed capital spending.

Gold mining is also severely underdeveloped, with operations in Bolívar and Amazonas often controlled by guerrilla groups and criminal gangs, deterring legitimate investment.

Long odds

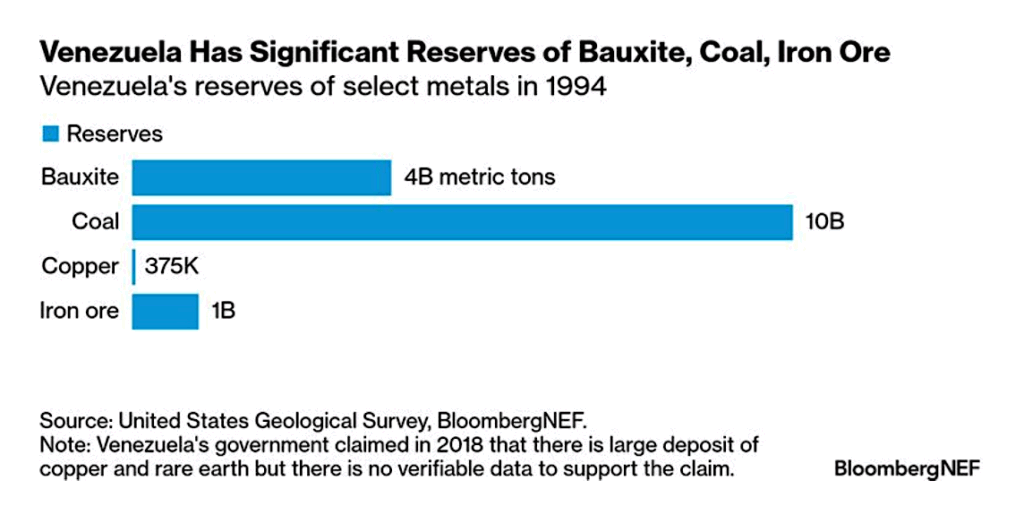

BMI argues that strategic and critical minerals represent the only plausible long-term opportunity for Venezuela’s mining sector. Government data suggests the Arco Minero del Orinoco hosts copper, nickel, coltan, titanium and tungsten — all minerals deemed critical to US national security.

A Washington-friendly government could pursue a Ukraine-style minerals agreement with the US, but BMI cautions that reliable geological data are virtually non-existent. Extensive exploration would be required before miners could commit capital, and Venezuela’s high-risk profile means only exceptional deposits would attract investment.

“Given the opaque nature of Venezuela’s official and black-market economy, we cannot say for sure what the real prospects are for critical mineral development,” Michael Cembalest, chairman of market and investment strategy for J.P. Morgan Asset & Wealth Management, said in a note this week. “But it’s notable that China, which controls the vast majority of critical mineral mining and processing activities around the world, is active in Venezuela.”

BloombergNEF echoes this scepticism, noting that metal production has declined by more than 90% over the past two decades. According to BNEF, reviving the sector would require a new transparent mining code, improved security and rule of law, major investment in infrastructure and at least a decade of sustained reform.

“The US government’s intervention has put Venezuela’s resources in the spotlight,” said Sung Choi, BNEF’s specialist in metals and mining. “But the country is crippled by poor geological data, low-skilled labour, organized crime, lack of investment and a volatile policy environment.”

Constraints for Venezuela’s mining sector “today are not geological,” Natixis analysts led by Benito Berber, said in a separate research note this week. “They are political risk, sanctions exposure, insecurity in mining regions, weak rule of law, and the absence of enforceable contracts. Until those fundamentals change, serious Western capital will likely remain on the sidelines.”

Ironically, Venezuela’s vast oil reserves may be the biggest barrier to mining investment. Oil projects are faster and cheaper to develop than mines, making them a higher priority for both companies and governments. As a result, experts say Venezuela is unlikely to become a meaningful player in global critical minerals markets anytime soon.

RELATED:

{{ commodity.name }}

{{ post.title }}

{{ post.date }}

Comments