What mining investors should watch for in 2026: Sprott

Critical minerals dominated headlines in 2025 as vulnerabilities across their supply chains became increasingly apparent amid rising global trade tensions. At the same time, precious metals—gold and silver—both raced to record highs as their safe-haven appeal intensified.

Those narratives have carried into the new year, with geopolitical tensions, resource nationalism and persistent supply bottlenecks all keeping the metals market firmly in the global spotlight.

With that in mind, analysts at Sprott have identified some of the biggest themes investors should watch for this year:

Deglobalization

In 2026, deglobalization is expected to deepen and broaden across economic, geopolitical and investment landscapes as the old global order dissolves under the weight of aggressive geopolitical maneuvering and rising tensions, Sprott said.

As such, nations are now prioritizing sovereignty and resilience over efficiency, driving structural inflationary pressures and reshaping global commodity flows. The focus, thus, will remain firmly on critical minerals and energy security, which governments are using as strategic levers in a multi-polar world.

Further division amongst the world powers would also accelerate the de-dollarization movement, reinforcing the status of gold as the globally accepted neutral reserve asset. Silver, as a cheaper alternative, would also benefit from gold’s rise.

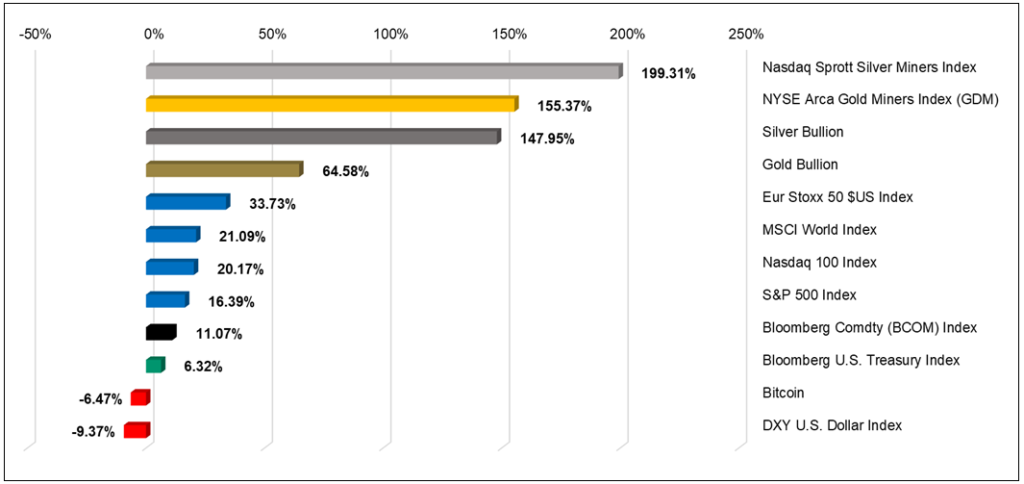

Both gold and silver are coming off a record-setting year and their best annual performances since 1979. Funds backed by these metals also saw significant gains, and analysts are expecting a repeat in 2026.

Debasement trade

The debasement trade, referring to a secular shift away from fiat currencies into hard assets, is expected to become a recurring theme amid concerns over the level of fiscal spending in developed countries dating back to the pandemic.

Sprott noted that chronic deficits have become a defining feature, especially in the US , with public debt surpassing $38 trillion in 2025, double the level of a decade ago. The outlook for 2026 suggests fiscal dominance appears set to deepen rather than recede, reinforcing the strategic case for hard assets like gold, it added.

Inventory system breakdown

Sprott also sees the fractured global metal inventory system, as seen during 2025, underpinning a commodities bull market again this year.

Amid the risks of tariffs and resource nationalism, countries are starting to stockpile minerals like rare earths, copper, platinum-group metals (PGMs) and aluminum to insulate themselves against supply shocks.

These developments have dismantled the global trade mechanisms that once ensured price convergence across the globe, leading to widening gaps between key markets. For example, copper prices in the US traded as much as 30% higher than in London last year as tariff fears caused localized shortages.

Gold & silver bull cycles

In its report, Sprott highlighted that certain minerals, in particular gold and silver, will remain on their respective bull cycles due to the metals’ strategic importance.

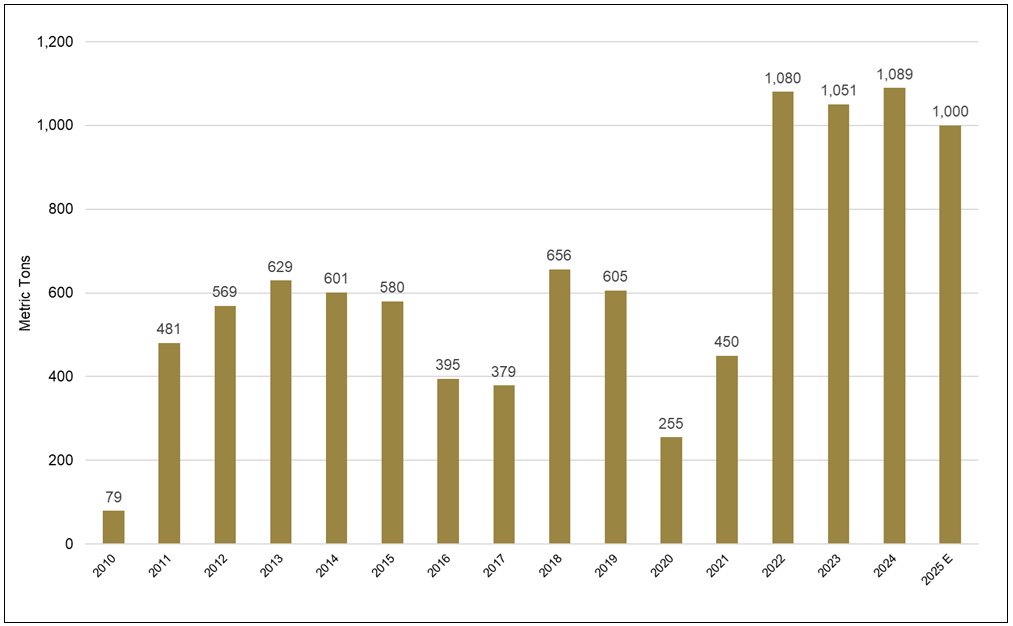

In gold’s case, the bull cycle started in 2022 when Western powers froze Russia’s foreign exchange reserves, which triggered a reassessment of what constitutes “safe” assets. Against that backdrop, global central banks have since been accumulating bullion at unprecedented levels, with China emerging as the dominant buyer. This year, central banks’ gold buying is expected to remain elevated as they further diversify away from the US dollar amid persistent geopolitical risks, Sprott said.

Silver’s cycle, which started around the same time, is also expected to continue, following up on a transformative year in which the metal surpassed most peers. Historically, it had followed the performance of gold as an alternative monetary hedge. Now, its newly attained status as a critical mineral for its role in clean energy and AI infrastructure has made its bull case even stronger, backstopped by persistent supply deficits.

“While consolidation after silver’s impressive 2025 rally is possible, we believe the longer-term risk skew remains to the upside,” Sprott analysts wrote, while also noting that the price ratio of gold to silver is near historical highs, meaning the latter is still undervalued.

Critical minerals to watch

Other critical minerals that Sprott believes are gaining momentum in 2026 are uranium, copper and rare earth elements.

Analysts are expecting uranium to build on its longer-term bull market amid tightening fundamentals and improving policy clarity. A main driver will be demand from AI, with Big Tech firms making multi-year, multi-billion-dollar commitments to secure nuclear power for the growth of data centers. Governments are also making their intentions clear, with the US recently announcing $80 billion in funding support to build new reactors.

After a breakout year in 2025, copper is poised to rise even higher as worries over supply and a transforming demand profile backstop its strong fundamentals. A major concern will be the growth of supply, as Sprott highlights that a new mine from discovery to production now averages about 17 years, which means deficits can persist even when prices are strong.

In rare earths, Sprott sees the minerals as a “distinct, highly strategic bottleneck where supply security can matter as much as price.”

As widely documented, the core vulnerability is the concentration of supply, which is dominated by China. Therefore, any further deterioration in the relationship between Washington and Beijing could accelerate global interest in rare earth mining outside of China.

{{ commodity.name }}

{{ post.title }}

{{ post.date }}

4 Comments

Keith Mcmaugh

There is a world Financial war happening right now. When you oppose the takeover of Greenland, you get 25% tariffs, the next is Iran then Canada. Where does it stop? At this point gold, silver is under priced considering the constant threats by Pres Trump.

Keith Mcmaugh

Some Wall Street financial experts call it the deplorable trade, some refer it as Sell America trade. It all ends up as fewer buyers of Treasuries thus the Fed absorbing it. In 2015 the Repurchase Agreements for Solid assets were only 1 T now over 14 Trillion. There is far too much liquidity in the world. It sure looks like stagflation of 1970s, except back then the govt was not lawless but normal

John Piekarski

In the global exploration and trading of rare earth metal stock , what is Canada’s short and long term plan to explore , mine and trade our own rare earth metals for our own development technology and security going forward?

Mutassim

Copper demand would require to open 7 times more Copper mines than what exist today if this is not the case after by 2035 there will be huge shortage in Copper which will cause big increase in price