Barclays warns mining earnings could fall 25% from nature-related risks

Mining companies could see earnings drop by as much as 25% over five years due to nature degradation, Barclays said in a new report.

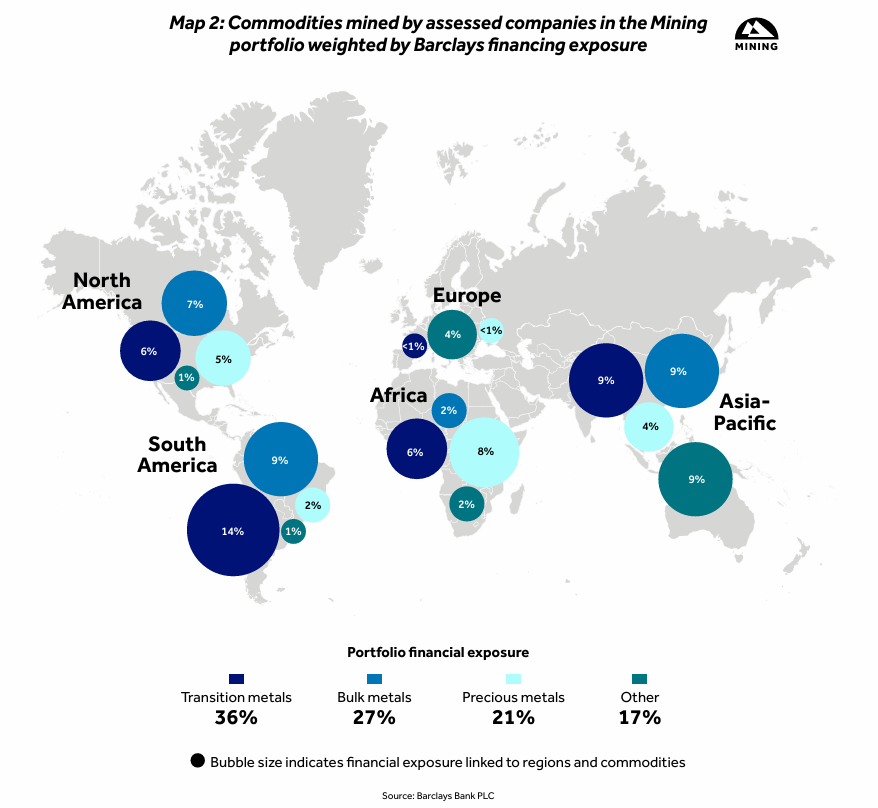

The bank’s stress test, published in Navigating Nature Risk: Applying the TNFD’s LEAP Framework, analysed 250 mines linked to 30 companies and about 9,000 European power facilities. It found that transition risks such as higher water prices, stricter pollution rules, expansion of protected areas and increased minerals recycling pose the greatest threat to miners.

Power companies faced smaller potential earnings declines of around 10%, mainly due to physical risks such as droughts and floods.

The World Economic Forum estimates that adopting nature-positive practices could unlock over $430 billion in cost savings and new revenue across the mining and metals value chain by 2030. Yet nearly three-quarters of mining assets overlap with sensitive locations, most commonly areas of high physical water risk. Copper mines, concentrated in water-stressed countries such as Australia, South Africa and Chile, were the most exposed.

Barclays said biodiversity loss and ecosystem degradation are emerging as systemic financial risks. “These risks are increasingly materialising across our clients’ operations,” head of sustainability Marie Freier said.

The bank said data gaps limit analysis but stressed enough information is available for action, with opportunities also arising from biodiversity financing, which faces a $700 billion annual shortfall.

Read More: From the ground to the rule book: Mining’s new regulatory era

More News

{{ commodity.name }}

{{ post.title }}

{{ post.date }}

Comments