Met coal pipeline grows despite demand slide: report

A surge of proposed metallurgical coal projects could boost global capacity by 52% this decade even as demand is expected to decline, according to a new report from German non-profit Urgewald.

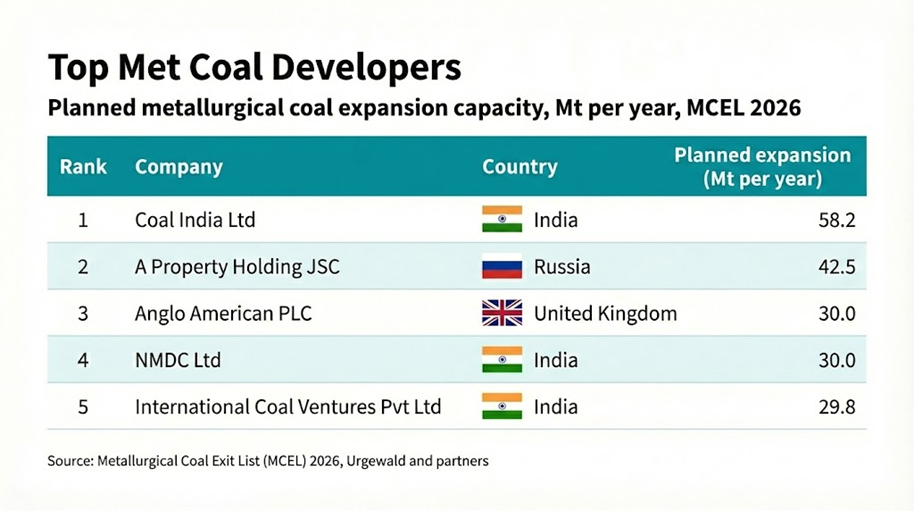

The Berlin-based group’s 2026 Metallurgical Coal Exit List, published Tuesday, tracks 145 parent companies and more than 200 subsidiaries developing new met coal mines or expansions. Urgewald identified 273 projects planned or under construction across more than 20 countries, representing about 580 million tonnes a year of potential new and expanded capacity.

The NGO argues the buildout clashes with an expected demand decline as steelmakers shift toward lower-carbon production routes. Metallurgical coal, used primarily in blast-furnace steelmaking, remains tied to one of the most emissions-intensive industrial processes, with coal-based steel production accounting for roughly 11% of global CO2 emissions, the group said.

“Green steel is no longer a future promise. It is here, it works, and is increasingly economically compelling,” Lia Wagner, Urgewald’s met coal expert, said in a statement. “That makes new metallurgical coal mines a dead end.”

Market strains

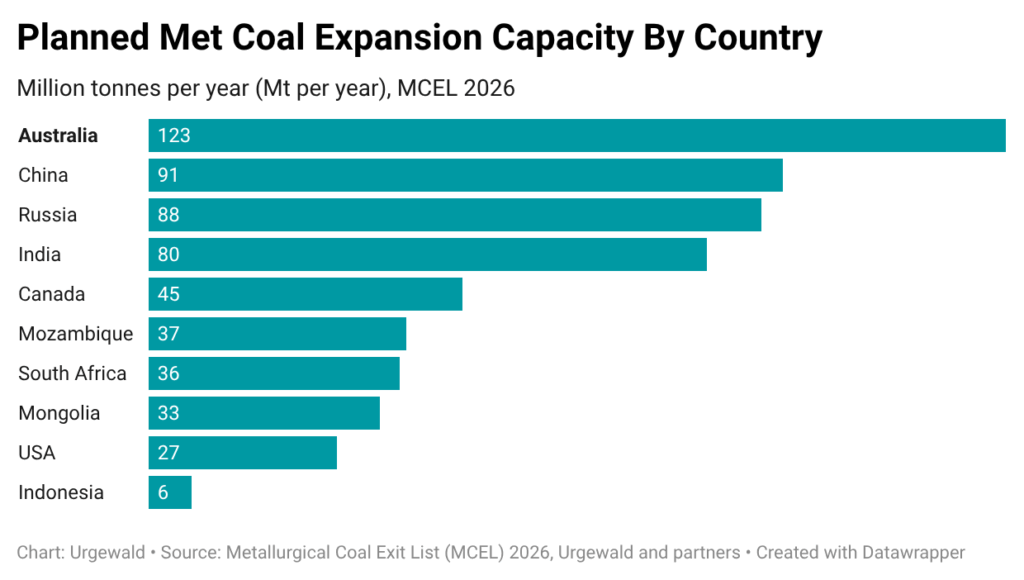

Urgewald cites International Energy Agency forecasts that it said show global met coal demand edging down from 1,114 million tonnes to 1,061 million tonnes by 2030, a drop of about 53 million tonnes a year. The NGO said the biggest planned supply increases remain concentrated in traditional coal regions, led by Australia, followed by China, Russia and India, with Canada also showing substantial planned growth.

In Australia, Urgewald said Queensland remains the centre of gravity for new open-cut proposals, including the Moranbah South project in the Bowen Basin, which it described as the largest proposed pure met coal mine at 18 million tonnes a year, backed by Anglo American (LON: AAL) and Exxaro Resources (JSE: EXX).

At the same time, the group pointed to early signs of stress among producers. BHP (ASX, LON, NYSE: BHP) has dropped plans for the Saraji East mine expansion in central Queensland after previously flagging job cuts in its met coal business, the report said, while Whitehaven has shelved the approved Blackwater North project but continues work on Blackwater South. Urgewald also cited pressure on smaller, met-coal-focused firms, including Coronado Global Resources and Bowen Coking Coal, as prices soften and costs and royalties rise.

Local fallout

Urgewald said the expansion debate is not only about macro demand forecasts, arguing the environmental impacts are already visible in major producing regions. It pointed to southeastern British Columbia’s Elk Valley, where selenium released by mining has been linked to fish with deformities, and warned of long-lived contamination risks for downstream communities.

The group highlighted Elk Valley Resources, a Glencore subsidiary, and said mountaintop removal mining and associated “valley fills” can permanently alter waterways and habitats. It also raised concerns about a proposed expansion at Castle Mountain, which it said could affect bighorn sheep habitat and wildlife corridors used by species such as grizzly bears.

At the policy level, Urgewald criticized the US administration’s move to designate metallurgical coal as a “critical raw material,” arguing it could prolong reliance on coal-based steelmaking even as investment grows in direct reduced iron and other lower-carbon technologies.

Urgewald also trained its focus on lenders, saying the Science Based Targets initiative’s latest Net-Zero Standard for Financial Institutions recommends excluding met coal developers and references the MCEL dataset.

The group said more than 150 financial institutions now use MCEL, and noted that Finnish pension investor Ilmarinen has announced plans to divest from met coal developers.

{{ commodity.name }}

{{ post.title }}

{{ post.date }}

Comments