Mining stocks dominate TSXV’s top performers list

Gold’s record rally and renewed interest in rare earths did more than lift producers in 2025, it propelled some of the industry’s riskier themes to the top of the TSX Venture Exchange, the world’s leading venue for early-stage mining finance.

Several of the top 10 performers on this year’s TSXV 50 list issued Wednesday remain years from commercial production, yet posted four-digit gains as investors chased leverage to precious metals and critical minerals.

The TSXV lists more junior exploration companies than any other market and serves as the primary pipeline of projects that later graduate to senior exchanges. Its top performers often signal where global risk capital is rotating in the resource sector.

The TSXV annual ranking of the 50 top-performing issuers is based on equal weightings of market capitalization growth, share price appreciation and Canadian consolidated trading value. Mining companies accounted for 48 of the 51 entries, including one tie.

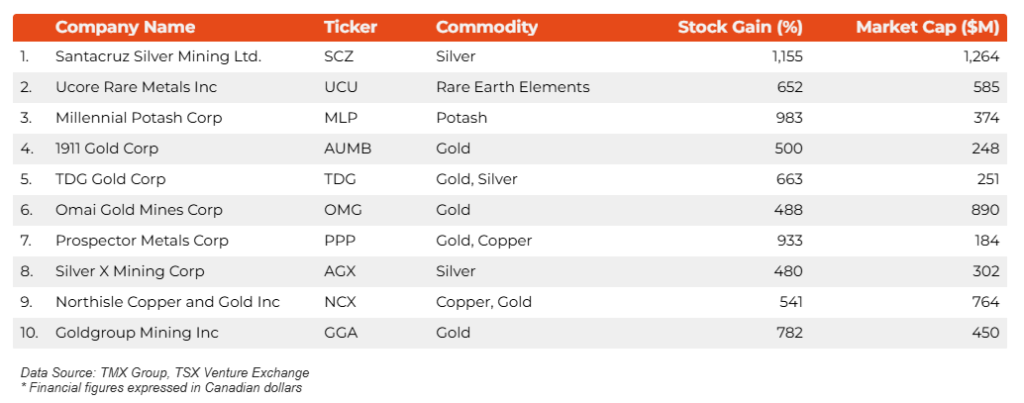

Below is a recap of the top 10 performers, along with their respective gains and market cap by the end of 2025:

British Columbia-based Santacruz Silver Mining (TSXV: SCZ) led the list with a 1,137% increase in market capitalization and a 1,103% gain in its share price by the end of 2025. The company, which operates silver and base metal mines in Latin America, benefited from rising silver prices and renewed investor appetite for precious metals exposure.

Ucore Rare Metals (TSXV: UCU), focused on light and heavy rare earth processing, ranked second with a 1,109% rise in market capitalization. The Nova Scotia-based company has positioned itself as part of North America’s push to build domestic rare earth supply chains amid geopolitical tensions and industrial policy shifts.

Together, the mining companies on the TSXV 50 represented a combined market capitalization of $19.9 billion and recorded an average share price gain of 443% in 2025. Including three technology firms on the list, the full TSXV 50 delivered an average 431% increase.

“The sector’s exceptional performance reflects a new global financing cycle driven by geopolitical uncertainties and industrial policy shifts that have increased investor demand for metals and minerals,” TMX Group said in a statement.

Americas focus

Nearly 80% of the ranked companies operate in what TMX describes as Tier-1 mining jurisdictions across the Americas. Sixteen hold properties in Canada, concentrated in Yukon and Ontario; 15 operate in the United States, primarily Nevada and Alaska; and 14 are active in Mexico.

Together, the TSX and TSXV list roughly 40% of the world’s publicly traded mining companies — more than any other exchange group — with the bulk of early-stage explorers concentrated on the venture market.

Trading activity reached record levels. The 2025 cohort saw volumes double year over year to more than 13.2 billion shares, the strongest liquidity metrics in the program’s history.

“Collectively, 43 of the TSX Venture 50 companies completed capital raises during 2025, totaling over $1.5 billion of equity capital raised,” said Robert Peterman, chief commercial officer, TSX & Global Capital Formation.

“This liquidity surge demonstrates that TSXV continues its position as the premier destination for early-stage public capital formation, particularly in the resource sector.”

For the full TSX Venture 50 list, click here.

More News

{{ commodity.name }}

{{ post.title }}

{{ post.date }}

Comments