Klondike Silver now owns 23,000ha at Sandon where $35 billion lead and silver were mined in 1890s

Klondike Silver has been acquiring over 80% of the Sandon, BC silver camp over the past 20 years and its land position is now at 23,000Ha. Historical output from Sandon area mines starting in 1890s is over $35 billion (at today's mineral value) of lead zinc and silver.

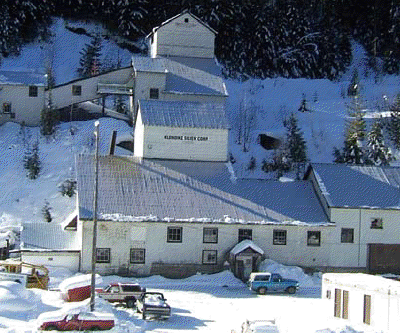

Klondike owns a 100 TPD fully operational flotation mill in Sandon which processes material from local mines. In its prime Sandon had 29 hotels, 28 saloons, 3 breweries, theatres, opera houses, cigar factory, soft drink plant, 3 sawmills, 3 churches, x2 newspapers, a schoolhouse, hospital, numerous lodges, clubs, organizations and a curling rink and bowling alley (in addition to one of the largest ‘red light’ districts in Western Canada). Klondike Silver is also reviving the Gowganda and Elk Lake silver camps in Ontario.