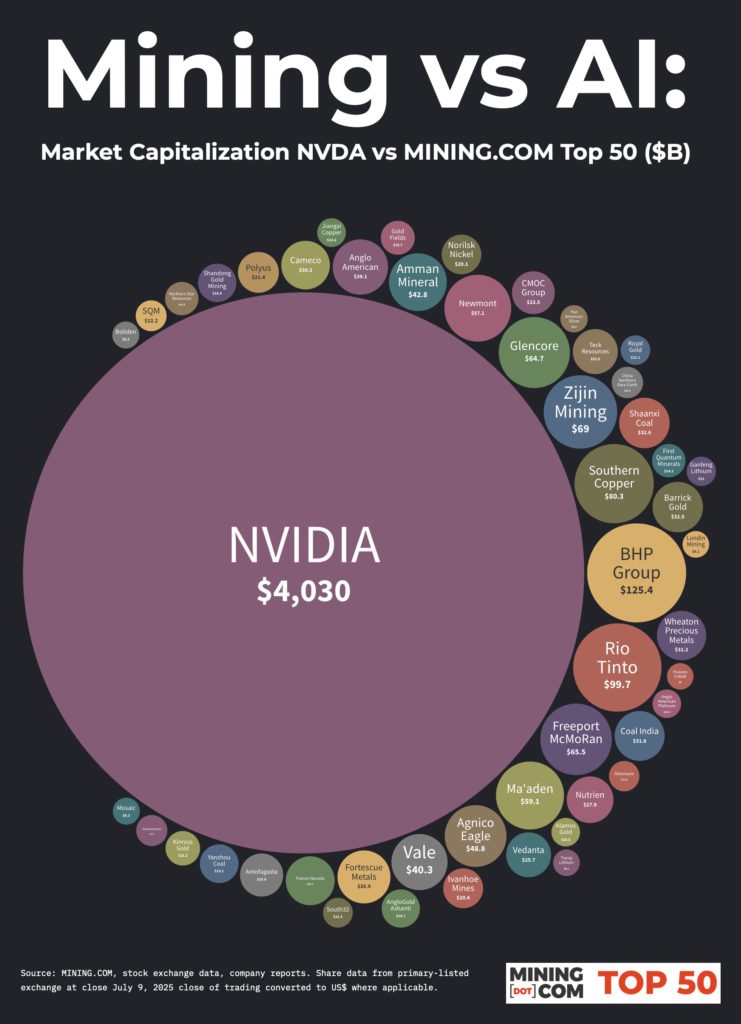

CHART: Nvidia hits $4 trillion – how do mining stocks stack up?

At the end of the second quarter, the MINING.COM TOP 50 ranking of the world’s most valuable miners reached a combined market capitalization of $1.49 trillion, up just over $100 billion, or almost 10% since early April.

Nvidia has surged by more than 40% since then, becoming the first publicly traded company to hit a $4 trillion evaluation.

Comparing the AI chipmaker’s stock valuation to progress in the mining industry’s collective worth, which has still not reached the peak hit in the second quarter of 2022 despite record and multi-year price highs for a number of metals, remains a head scratcher.

Should Nvidia (or Microsoft or Apple for that matter) be worth more than twice the top 50 miners? Outside the top 50 the average market cap quickly shrinks to low single digits, so Nvidia is in fact worth more than the entire globally listed mining industry.

Even when extending the top 50 into metals and energy – steel, aluminum and power generating companies often operate their own mines – Nvidia still throws shade over most of the industrial economy.

The only mining stocks to crack the $100 billion mark, BHP and Rio Tinto, sit at number 138 and 206 in global rankings. The Anglo-Australian giants are worth far less than Booking.com, and Temu and Zara’s owners, none of which can exactly be called the building blocks of the modern world like copper, aluminum and steel (and lithium and graphite for that matter).

More News

{{ commodity.name }}

{{ post.title }}

{{ post.date }}

Comments