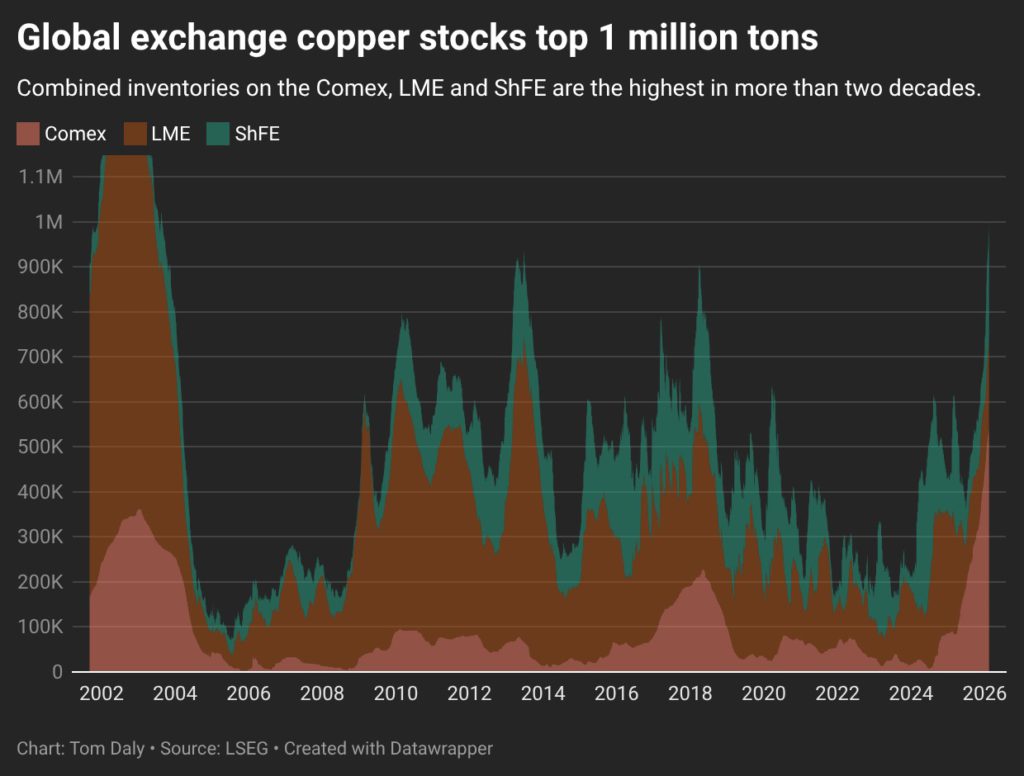

Copper price: Global exchange stocks top 1 million tonnes first time in 21 years

Copper rallied through 2025 and despite some sharp pullbacks along the way ended the year more than 40% higher than at the start. This year the price is being pulled into different directions.

In holiday thin trade, copper for March delivery fell nearly 1% in New York to $5.76 a pound or $12,700 a tonne on Monday and is now trading 12% below highs hit just at the end of January.

Copper stocks on the world’s biggest metal exchanges have exceeded 1 million tons for the first time since 2004. Tariff induced stockpiling in the US has been a feature of the market for more than a year and now soft demand in top consumer China is adding to burgeoning global inventories.

Combined copper stocks on the US Comex exchange, London Metal Exchange and the Shanghai Futures Exchange are at 1.012 million tonnes, after the LME and ShFE recorded further inflows on Friday, Reuters reports.

The news comes on the heels of satellite data showing January copper smelter activity was the lowest on record since tracking began nearly a decade ago in a report released last week.

{{ commodity.name }}

{{ post.title }}

{{ post.date }}

Comments