Fitch Solutions’ BMI upgrades industrial metals forecasts

Analysts at Fitch Solutions’ BMI have lifted their price forecasts for industrial metals to reflect the speculative momentum in this sector as well as strong market fundamentals and macroeconomic forces.

Metals like copper and aluminum have gone on a massive rally since late 2025, and that momentum carried into January as their prices hit records. This metals frenzy, according to BMI, was “driven largely by bullish speculative trades across the markets,” on top of bets on a weakening dollar and tighter supply.

While this rally was always unsustainable, as seen in last week’s historic metals crash, strong fundamentals — namely a tight physical market — “should help base metals find a floor above historical averages in the coming months,” its analysts wrote in a note published on Tuesday.

In the coming weeks, BMI sees prices of key industrial metals like copper consolidating above historical averages as they transition into a corrective phase, with the possibility of a fundamentals-driven resurgence.

Upgraded forecasts

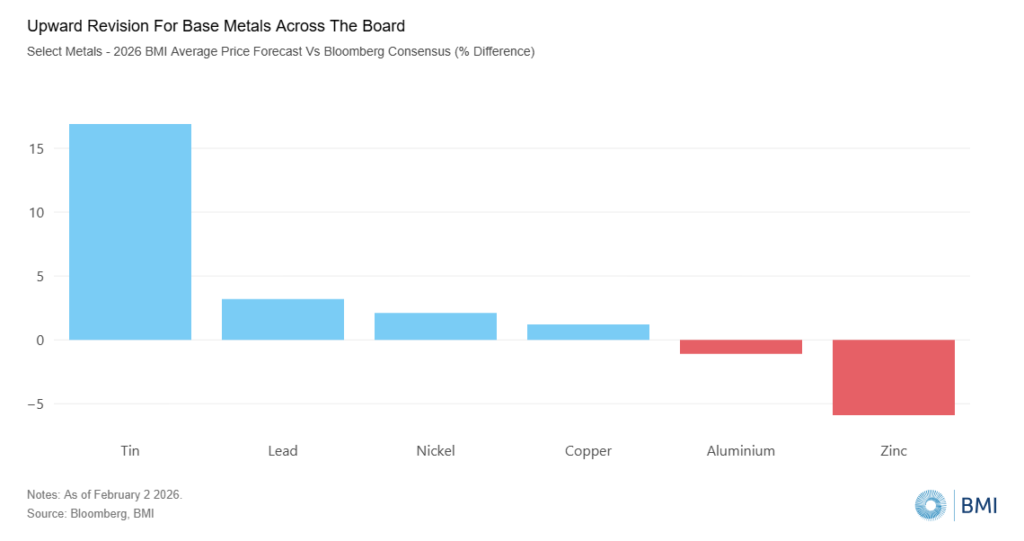

As such, BMI analysts have raised their annual forecasts for metals despite the LME index already hovering at record highs.

For copper, the Fitch Solutions unit sees prices staying elevated through at least mid-2026 and averaging $11,900/t for the year, with upside risks included. The red-colored metal set a record high of $14,500/t in London nearly a week ago before falling to the $13,000/t level.

As for aluminum, the firm also revised its annual average price forecast to $2,900/t, driven by supportive macro conditions and persisting expectations of structural tightness in the global market. The metal is currently trading at its highest level since Russia’s invasion of Ukraine in 2022.

Tin received a significant upward revision — from $35,000/t to $45,000/t — as analysts highlighted the sharp rise in speculative demand, with three-month futures on the LME now hovering around $47,100/t, alongside permitting issues in Indonesia and supply constraints in Myanmar.

Two battery metals — nickel and lithium — also received upgrades amid rising demand from the clean energy transition. BMI’s annual average price forecast for nickel is set at $15,800/t, while lithium prices, which have gained the most this year, are projected at $13,500/t and $13,000/t for carbonates and hydroxides, respectively.

“While prices are still likely to fluctuate and settle at a higher level than historical averages, another sustained rally remains elusive for now and base metals appear poised for a correction across the board,” BMI’s analysts wrote.

More News

{{ commodity.name }}

{{ post.title }}

{{ post.date }}

Comments