Gold price returns to $5,000 as dip buyers step in

Gold bounced back above the $5,000-an-ounce level on Wednesday as investors looking to “buy the dip” snapped up more of the metal following its historic crash last week.

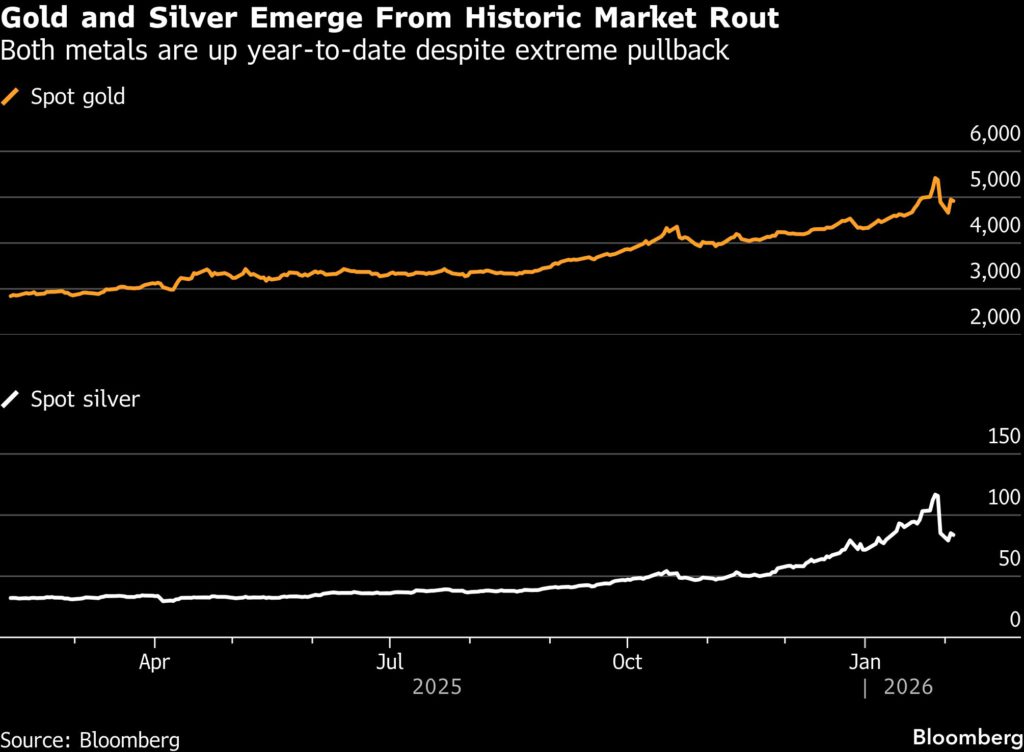

Spot gold traded as high as $5,091.89 per ounce during the early hours of trading, before erasing its gains. Silver also rose by as much as 9% to $92 an ounce but has since pulled back.

Bullion has now recovered nearly half of its losses from Friday’s sudden collapse, which saw prices plunge by as much as 12% for its worst decline since 1980. Before that, the metal had been soaring to all-time highs on nearly a daily basis, a scorching rally underpinned by speculative momentum.

Market watchers had been warning that gold’s advances were too large and too swift. Prices were up by about a quarter on the year before Friday’s crash, which continued into the early parts of this week.

“As prices fell, dealer hedging flipped from buying into strength to selling into weakness, investor stop‑outs were triggered, and losses cascaded through the system,” analysts at Goldman Sachs wrote earlier this week.

Fundamentals intact

Still, the major banks remain mostly bullish on gold, as they believe the underlying fundamentals that have driven its rally remain intact. Earlier this week, JPMorgan set a year-end price target of $6,300 per ounce, while Deutsche Bank reiterated its forecast to $6,000 an ounce.

While inflated prices and market turmoil may affect position sizing, it won’t dampen overall investor interest, Niklas Westermark, head of EMEA commodities trading at Bank of America, also said, though he warned that volatility in precious metals will remain elevated.

“Forced sales have likely run their course in precious metals,” Daniel Ghali, a senior commodity strategist at TD Securities, said in a note to Bloomberg. “The intense volatility over the last week could certainly keep retail participants on the sidelines, removing an increasingly important cohort of buyers.”

Meanwhile, gold has drawn increased safe-haven demand amid rising geopolitical tensions between the US and Iran, following the US Navy’s downing of an Iranian drone.

(With files from Bloomberg)

More News

Fitch Solutions’ BMI upgrades industrial metals forecasts

February 04, 2026 | 10:07 am

{{ commodity.name }}

{{ post.title }}

{{ post.date }}

Comments