New York copper price surges again, Shanghai sets record

New York and Shanghai were playing catchup on Friday after copper trading on the London Metal Exchange surged to a record high of $12,282 a tonne before the 148-year old market closed for the Christmas break.

Prices for the orange metal gained as much as 4.7% to trade near 100,000 yuan or $14,270 a tonne on the Shanghai Futures Exchange for the first time, opening up a huge premium to US markets.

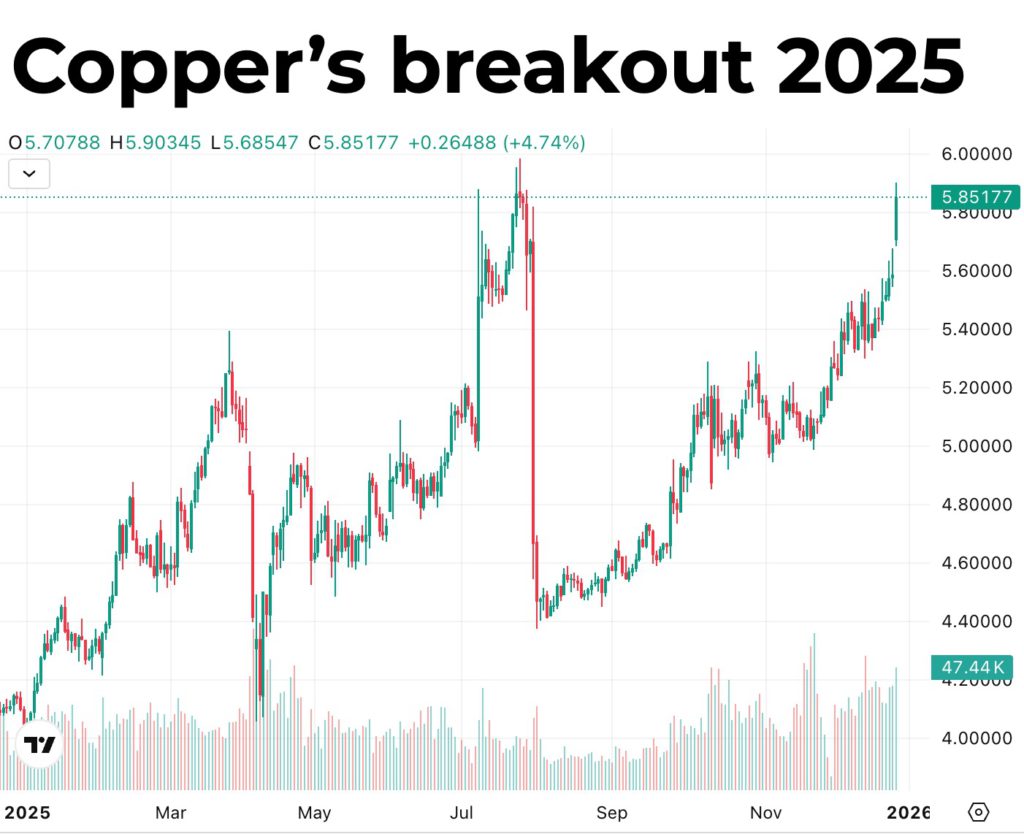

Copper for delivery in March, the most active contract on the Comex in New York, climbed more than 5% to hit an intraday high of $5.90345 a pound or just over $13,000 per tonne in late morning trade.

It was the highest level since the short squeeze in July when copper briefly topped $6.00 per pound before falling by 20% after the US limited 50% tariffs to semi-finished products and excluded cathodes after some intense industry lobbying.

While most copper price predictions factor in supply disruptions of as much as 6%, 2025 was in many ways an exceptional year with high profile mines and top producers undershooting output targets.

A deadly accident at the world’s second-largest copper mine – Grasberg in Indonesia – saw owner Freeport McMoRan declare force majeure on deliveries and slash its 2026 output guidance. Freeport updated on progress at Grasberg in November saying full production is expected to be restored in 2027.

In May, an underground flood in the Democratic Republic of Congo at another high profile copper complex – Ivanhoe’s Kamoa-Kakula mine – and a fatal rock blast at Codelco’s El Teniente mine in July all crimped global production. Before the incident Kamoa-Kakula was set to become the world’s third largest copper operation.

In a recent note BMO Capital Markets said despite the commodity’s impressive gains already, copper still offers upside, with ongoing US stockpiling dominating price formation. The investment bank forecasts an average of $12,500 by the second quarter of 2026, before mine supply catch-up offers some relief.

Year in review

Copper articles were some of our most read posts of 2025 and in all, copper headlined stories were read more than 2.5 million times this year with the following articles leading the charge. We also added a brand new page on MINING.COM to track live prices this year. Check it out here.

1. RANKED: World’s biggest copper mines

Fittingly, our most popular article on copper in 2025 is the ranking of the world’s top 10 copper mines of 2024 by production. No surprises that Escondida in Chile came in at number one with 1.28 million tonnes, but the massive BHP-Rio Tinto mine also managed to up output by more on a percentage basis than any of its competitors. We did a follow up in October ranked by H1 2025 output and expanded the list to 20.

2. An American mine still has millions of tons of copper, if companies can get to it

The Morenci mine in Arizona retains ~10M tonnes of copper in waste piles after 154 years of operation. Freeport-McMoRan is advancing sulfide leaching to extract it, targeting 400kt by 2030. A number of copper majors are looking into the technology including BHP and Rio Tinto which are developing similar processes for chalcopyrite ores.

3. A mile underground, America’s largest untapped copper mine inches toward reality

It’s called Resolution Copper, and it holds enough of the critical metal to supply a quarter of US demand for years. Yet two decades and over $2 billion later, not a single ounce of copper has been mined. While engineers have thoroughly mapped the ore body and workers have built one of the deepest shafts in the US, the deposit owned by Rio Tinto Group and BHP Group has been stalled by permitting hurdles as well as tribal and environmental opposition. Resolution was in the news a few times in 2025 – in May a federal judge temporarily blocked the land transfer after opposition from Arizona’s San Carlos Apache tribe.

4. Glencore said to consider shutting Canada’s largest copper plant

Glencore is weighing closure of its Horne Smelter and Canadian Copper Refinery in Quebec due to $200M+ environmental upgrade costs, impacting >1,000 jobs and 300kt annual output. A spokesperson denied the plans and added that a possible closure is not related to a class-action lawsuit recently authorized by Quebec’s Supreme Court related to the smelter’s arsenic emissions dating back to 2020.

5. USGS officially adds copper, silver to critical minerals list

The US Geological Survey, doing the lord’s work since 1879, added copper and silver to its critical minerals list (now 60 total, with 10 new entries like uranium and potash), based on disruption modeling across 84 commodities and 402 industries. The designation supports capital investments and permitting reforms – on paper at least.

6. Copper price won’t stay above $11,000 for long, says Goldman

Amid all the bullish predictions Goldman Sachs injected some sobriety into the conversation on future copper prices. The investment bank forecasts copper prices will be constrained to $10,000 – $11,000 a tonne in 2026 due to a 160kt surplus and no shortage until 2029, despite current supply drains and US tariff concerns. The forecast was published early December and the most recent jumps in the price are unlikely to sway Goldman’s analysts.

7. Bank of America projects copper price to surge past $11,000 in 2026

Back in September, Bank of America analysts raised forecasts to $11,313/t average in 2026 (up 11% compared to 2025) and $13,501/t in 2027 (up 12.5%), with spikes to $15,000/t, due to mine disruptions at Grasberg, El Teniente, Kamoa-Kakula, Quebrada Blanca II, and Cobre Panamá, plus low LME stocks and strong Chinese demand.

8. Chinese trader who made $1.5B on gold builds giant bet on copper price

A reclusive Chinese billionaire whose prescient gold trades turned into an eye-catching windfall has now become the country’s biggest copper bull, amassing a bet worth nearly $1 billion in a market jolted by escalating competition between the US and China. In May, Bian Ximing held a ~90 killotonne net long position on Shanghai Futures and the bet had already yielded ~$200M at the time despite trade volatility.

9. Copper’s next shortage is structural, not hype: analyst

BloombergNEF forecasts structural deficit from 2026 on electrification demand outpacing supply, with a 19M tonnes shortfall by 2050 absent new mines and an increase in scrap coming to the market. Disruptions in Chile, Indonesia, Peru and delayed permitting will lend support.

10. One of the strangest chapters in copper mining is drawing to a close

In April, MINING.COM visited the Cobre Panama mine, sitting idle in the South American jungle since protests and blockades forced its closure at the end of 2023: “When copper prices are swinging this wildly it’s easy to lose sight of the giant hole that exists in the industry where dynamite meets bedrock.” Later in the year we sat down for a wide-ranging hour-long interview with First Quantum CEO Tristan Pascall to discuss the future of the company.

{{ commodity.name }}

{{ post.title }}

{{ post.date }}

Comments

George A Doolittle

Copper? Long $aa alcoa strong buy