A Bonanza-grade Hit and Plenty of Results to Come

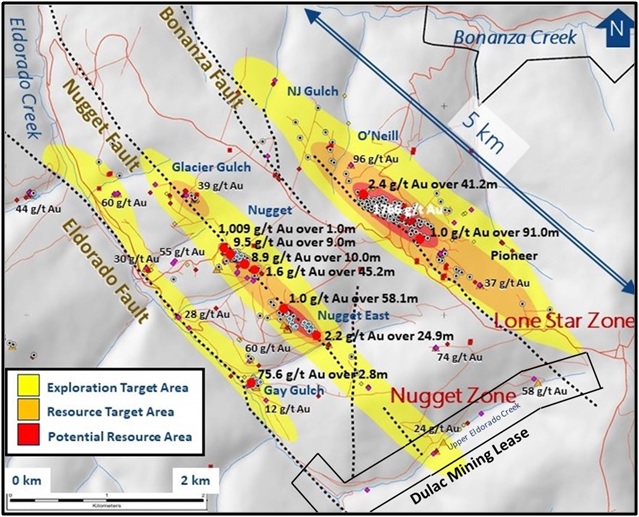

In 2019 Klondike Gold (TSX.V: KG; OTC: KDKGF) punched 94 holes into the hills above the Klondike’s most productive placer gold creeks, with most of those drill results still pending. The company’s initial assays turned some heads — including a 1-metre intercept of 1,009 g/t gold and 1,035 g/t silver in the Nugget Zone — and more recent results also returned good gold values. The bonanza hit in hole EC19-267 was one of the year’s best assays globally and formed part of a new parallel high-grade zone 25 metres below known mineralization.

The ultra-high-grade hit, as well as further Nugget intercepts including 8.9 g/t Au over 10 metres, prompted Klondike to raise a further $770,000 in a flow-through financing in September to fund an expanded program. “With these results, we felt it imperative to keep drilling without further delay,” said Klondike CEO Peter Tallman. Klondike drilled a further 12 holes and 913 metres at Nugget Zone following the money raise; now assays for a total fifteen holes from this Zone are pending.

More recently, Klondike released drill assays from Gay Gulch along the Eldorado Fault. Klondike drilled 7 holes at the confluence of two faults, following up from the 2015 drilling. Significant intercepts included 29.8 metres of 0.4 g/t gold, including 0.50m at 9.33 g/t of the yellow metal. Other intercepts included 1.55 metres of 2.29 g/t gold and 0.5 metres of 9.66 g/t gold in two separate holes.

Assays are also pending from the Lone Star zone, where Klondike drilled to test strike and see how far mineralization extends along major structures. The Company has been growing the size of this zone with systematic drilling in a grid pattern and producing long intercepts of disseminated gold the last two years.

NUGGETS OF POTENTIAL

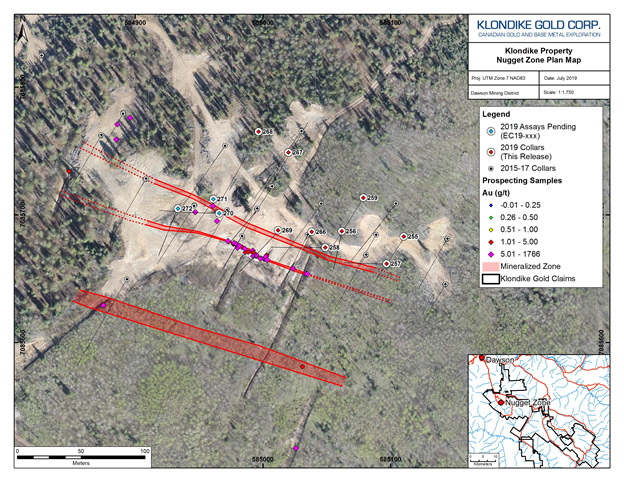

Drill testing along 200 metres of the Nugget Zone intersected interesting gold mineralization including the new parallel zone of high-grade gold. Klondike plans further drilling at Nugget in 2020.

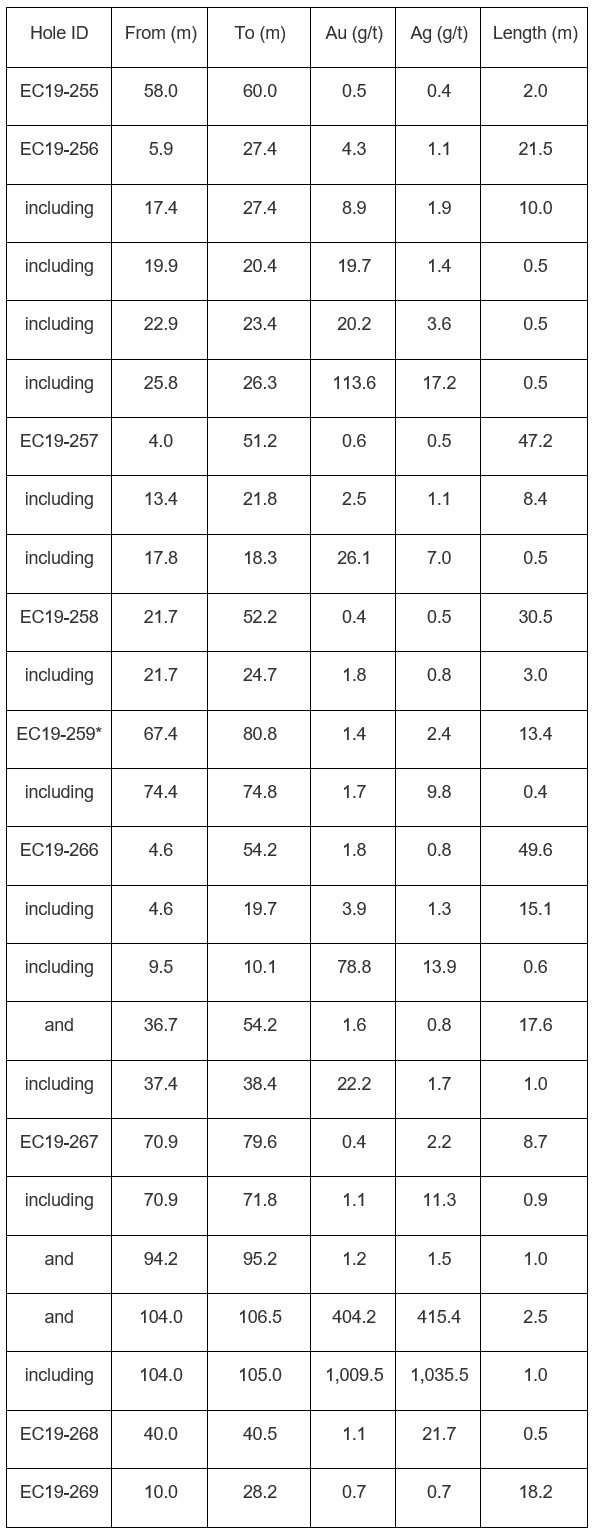

Highlights from the Nugget Zone program, including assays from nine drill holes, included:

(1) intersection of gold mineralization along 200 metres of drill testing, including the discovery of a new parallel zone of high-grade gold;

(2) drill hole EC19-267 intersected new mineralization grading 1,009 g/t Au with 1,035 g/t Ag over 1.0 meter. This new discovery is 25 meters below the known Nugget Zone mineralization and remains open;

(3) drill hole EC19-256, which hit mineralization grading 8.9 g/t Au over 10.0 meters; and

(4) drill hole EC19-266 intersected 1.8 g/t Au over 49.6 meters.

The bonanza-grade hit is just the latest in a string of impressive assays to come from quartz veins on Klondike’s property. Longer-term, the company will have to put together the higher-grade zones as well as the disseminated gold to determine the size of the eventual resource(s).

This year’s drilling at Nugget set out to target prospective areas of high-grade gold mineralization and improve structural understanding by capturing structural measurement data and quantifying gold-bearing quartz vein orientations. Larger diameter HTW-size drill core was used to improve core recovery and boost analytical precision. This decision seems to have paid off, based on the first batch of data from the assays.

Table 1: Results from drill holes EC19-255 to EC19-259, and EC19-266 to EC19-269

The true thickness of reported drill intervals cannot be determined with the information currently available.

*Hole EC19-259 ended in mineralization.

GOLDEN GAY GULCH

At Gay Gulch, mapping and drilling have identified gold-bearing quartz veining hosted within brittle felsic rocks developed adjacent to a significant northwest-trending fault (the ‘Eldorado Fault’) over a five-kilometer distance. These new results generated data to increase structural understanding and further drill testing is warranted in 2020. The program marked the first time drillers returned to this showing since 2015, a year that featured a highlight intersection of 75.6 g/t Au over 2.8 meters in hole EC15-10.

The structure at Gay Gulch is distinct from the Nugget Zone a kilometer away, and Nugget is different from Lone Star, the third area of interest.

MORE ON THE BONANZA HIT

From 104.0 to 105.0 metres downhole, EC19-267 intersected a mean grade of 1,009 g/t Au and 1,035 g/t Ag. This one-metre interval is a mafic schist containing coarse 2cm size cubic pyrite in a chocolate-coloured presumed ankerite alteration zone that includes a 0.4 metre rubble interval with pyrite. From 105.0 to 106.5 metres downhole, the coarse pyrite content decreases and typically gold bearing cross-cutting quartz veins occur.

The high-grade gold hit is comparable to other occurrences sampled from 2014 to 2018 in the Klondike District Property. In 2014, a chip sample from an outcrop yielded up to 1,766 g/t Au with 400 g/t Ag. In 2017, quartz veins were grab sampled that contained 24 g/t and 96 g/t Au with 110 g/t and 149 g/t silver. The EC19-267 hit should not be considered indicative of overall gold potential for the area. Nevertheless, the discovery is significant and more than just a lucky find. Klondike’s objective at the Nugget Zone was to systematically test for areas of high-grade gold, and the intersect proves there is potential for ultra-high-grade gold “pockets.” The technical information obtained can be used to potentially find more high-grade “pockets” so we view the discovery made at EC19-267 as a very positive development.

Figure 1: Nugget Zone 2019 Drill Plan Map.

UPPING THE GOLD ANTE

The USD price of gold is trading at six-year highs and gold is at or near all-time highs in several world currencies. The firm move above $US1,450 an ounce is driven by:

(1) geopolitical concerns;

(2) the Fed’s interest rate policy. Most recently, the Fed cut rates and investors have been rattled by an escalation in the U.S. trade war with China, which appears to be weaponizing the Yuan in retaliation. Hong Kong also remains a flashpoint of tensions. Meanwhile, Russia and China continue to bulk up their gold reserves by 50 tonnes per month. Given this backdrop we believe gold could be in the early stages of a new bull market.

POTENTIAL CATALYSTS

Assays have been reported for only 16 of 94 holes drilled, so pending drill results could be a major catalyst for Klondike Gold shares over the coming weeks and months.

Klondike has some key differentiators that make its shares worth a hard look:

- A dominant land position in a proven gold-rich belt

- Near-surface mineralization, which makes extraction simpler and more likely. Bulk-tonnage open-pit operations are typically lower-cost.

- Coarse free gold, which reduces metallurgical risk

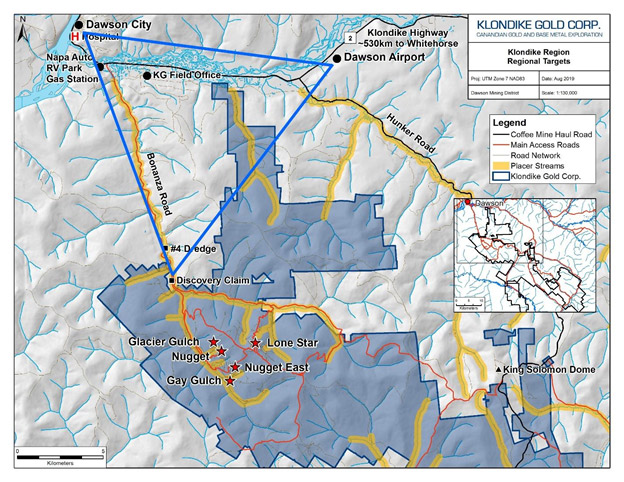

- Only 20 kilometres from Dawson City along paved roads. That reduces drilling costs, increases proximity to skilled labour and reduces environmental disturbance. During the Klondike Gold Rush, the only routes to Dawson City were via the steep incline of the Chilkoot Trail or the dangerous rapids of the Yukon River. Today it’s possible to fly from Vancouver and be on site in 6 hours.

Caption: Dawson-Klondike triangle – Klondike property, Dawson City, and the airport

BACKING

Klondike Gold is fortunate to be well-financed, which means it has continued to drill and build the gold endowment while funding dried up for most junior explorers. Roughly 46% of Klondike’s shares are held by management, with the top 10 shareholders including billionaire investors Frank Giustra (14%) and Eric Sprott (10.1%). With a strong shareholder base, CEO Peter Tallman has the rare opportunity to continue growing the project with minimal dilution next year, on the path to his goal of an economic gold deposit in the Klondike. The 2019 exploration budget is financed with $2.0 million allocated for exploration.

Important Disclaimer: I am not a certified financial analyst, licensed broker, fund dealer, exempt market dealer nor hold a professional license to offer investment advice. The work included in this article is based on current events, technical charts, company news releases, and the author’s opinions. All information is subject to change without notice, may become outdated, and will not be updated. It may contain errors, and you shouldn’t make any investment decision based solely on what you read here. This publication contains forward-looking statements, including but not limited to comments regarding predictions and projections. Forward-looking statements address future events and conditions and therefore involve inherent risks and uncertainties. Streetcents Investor Media Ltd. has been paid a fee by Klondike Gold Corp. for advertising and digital media from the company. This compensation constitutes a conflict of interest as to our ability to remain objective in our communication regarding the profiled company. Because of this conflict, individuals are strongly encouraged to not use this editorial as the basis for any investment decision. Actual results may differ materially from those currently anticipated in such statements. This publication is provided for informational and entertainment purposes only and is not a recommendation to buy or sell any security. Always thoroughly do your own due diligence and talk to a licensed investment adviser prior to making any investment decisions. Junior resource companies can easily lose 100% of their value so read company profiles on www.SEDAR.com for important risk disclosures.

{{ commodity.name }}

{{ post.title }}

{{ post.date }}

Comments