As Gold Hits Record Highs, These Are the Miners With the Most Upside

Gold’s record-breaking rally has become one of the defining stories in global markets this year. Prices hovering near $4,200 an ounce are not merely the product of speculative froth; they reflect a broader structural realignment in global capital flows. The U.S. dollar, which has long served as the world’s ultimate store of value, is weakening. Central banks, wary of reserve concentration, are buying gold at a pace unseen in modern history. And investors are beginning to rotate out of crowded equity trades into tangible, hard-asset plays.

Gold mining equities outperform broader markets — VanEck Gold Miners ETF up 90% YTD vs S&P 500 (Source: Bloomberg, IMF)

The dollar’s decline has been one of the most striking elements of this market environment. The dollar index is down more than ten percent year to date, the weakest first-half performance since at least 1980. While still the dominant reserve currency, its role as the unquestioned anchor of global finance is eroding at the edges. Daniel Ghali, director of commodity strategy at TD Securities, described it bluntly: “This is what it looks like when the U.S. dollar is at least partially losing its store of value function.” He points to the unusual confluence of all-time equity highs, recovering bond markets, frothy credit, and surging commodities as the classic fingerprints of currency devaluation.

Gold’s rally supported by record central bank buying — global reserves climbing to new highs (Source: Bloomberg, IMF).

Supporting this view is the quiet but steady bid from central banks. Since 2022, global institutions have been accumulating over 1,000 tonnes of gold annually, the highest pace in decades. The motivations are structural. Diversification away from the dollar in a world where financial sanctions have become tools of geopolitics, inflation protection in the face of stubborn deficits, and a desire for tangible reserves as the world fragments into regional blocs. This steady accumulation explains why pullbacks in gold have been shallow and short-lived.Amid shifting market dynamics, central banks have become the dominant force sustaining gold demand worldwide.

Silver has joined the party as well. After years of underperformance, the metal is pressing 14-year highs, benefiting both from its monetary role and from surging industrial demand tied to solar, electric vehicles, and advanced electronics. Historically, silver tends to outperform late in gold bull markets, and its recent rally suggests the catch-up phase is now underway.

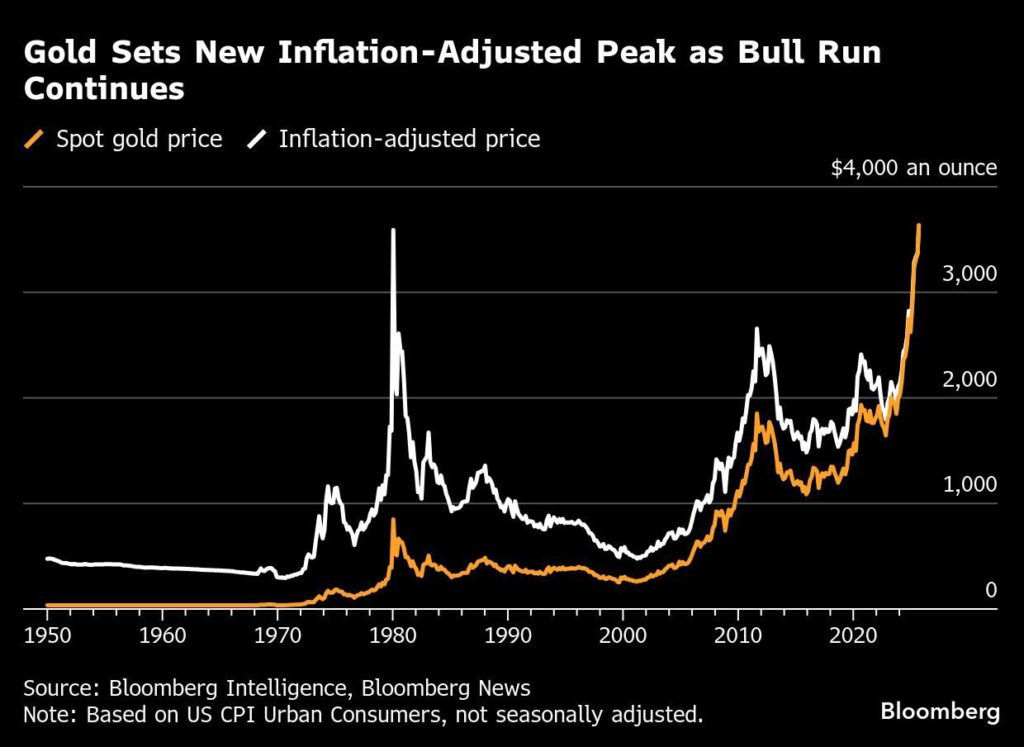

Viewed through an inflation-adjusted lens, the rally may have further to run. Gold’s 1980 peak, when measured in today’s dollars, would be worth more than $4,000 per ounce. Against the backdrop of unprecedented sovereign debt and monetary policies that remain accommodative, arguments that gold is overvalued lose credibility. If anything, the real-value comparison suggests the rally is still in early innings.

Gold sets new inflation-adjusted record above US$3,500/oz — entering historic bull territory (Source: Bloomberg, IMF).

For equity investors, the implications are equally important. Historically, once bullion makes new highs, capital begins to rotate down the value chain of miners. Senior producers move first, then mid-caps, and finally juniors and near-term developers. The reason is torque. Every additional dollar in the gold price drops disproportionately to the bottom line of producers, giving them two to three times the beta of bullion. This is why hedge fund manager John Paulson, who built a fortune in the last cycle, emphasized that the best way to invest in gold is through the equities, particularly those leveraged to rising prices. Goldman Sachs recently echoed this view, reaffirming a $4,000 target for gold and highlighting miners’ expanding margins.

But not all miners benefit equally. Exploration-stage juniors with no path to cash flow remain speculative and struggle for relevance, while large-cap producers are already well understood by the market. The real sweet spot in this phase of the cycle lies with near-term producers. Companies that are fully permitted, funded, and approaching production with relatively low capex requirements and high-margin profiles. These companies capture institutional flows because they are de-risked, yet still trade at steep discounts to their future cash flows. When gold is rewriting all-time highs, it is precisely this category that rerates the fastest.

One example of how this model looks in practice is ESGold Corp., a Canadian developer advancing the Montauban Gold-Silver Project in Quebec. ESGold has taken a markedly different approach than most juniors. Where the standard playbook is to raise money, drill, dilute, and hope for discovery, ESGold has flipped the model on its head. The company is moving into low-capex, high-margin tailings reprocessing first, generating near-term cash flow, and then using that revenue to fund exploration. This structure reduces risk, minimizes dilution, and compounds value for shareholders over time.

Montauban mill building moving steadily toward completion, targeted mid-Q4 2025 (Source: ESGold Corp.).

Montauban is fully permitted, fully funded, and under construction, with cash flow expected in 2026. The updated economic assessment shows an after-tax internal rate of return of more than sixty percent with a payback period of less than two years — metrics that underscore the kind of torque these projects offer in a high-gold-price environment. At the same time, ESGold is advancing systematic exploration using advanced technology, which has imaged continuous geological structures to depths of 1,200 meters. Academic studies suggest geological parallels with Broken Hill in Australia, one of the most significant silver-lead-zinc deposits ever discovered. For investors, this creates a dual-track profile: near-term cash flow with a built-in call option on a potentially district-scale discovery.

Importantly, ESGold sees Montauban as a blueprint rather than a one-off. The company has already signed a binding memorandum of understanding in Colombia, one of South America’s most prolific gold regions, with vast inventories of legacy tailings. The strategy is straightforward: replicate the Quebec model internationally by starting with tailings, moving to cash flow, and then advancing exploration, building a pipeline of projects that spreads risk while driving growth.

What makes this approach different is discipline. Too many juniors dilute shareholders into the ground; ESGold is building the opposite. By generating its own cash flow, the company aims for higher margins and sustainable growth, keeping more value in the hands of shareholders. With the heavy lifting on permitting and infrastructure already complete in Quebec, and Colombia positioned as the next leg of growth, ESGold has a clear runway to 2026 production and beyond.

For investors in today’s macro environment, the signals are clear: the dollar is weakening, central banks are buying record amounts of gold, silver is resurging, and capital is rotating into real assets. The companies best positioned to benefit are those with near-term production, low capex, and scalable models. ESGold provides a case study of how this can be done differently: cash flow today, discovery tomorrow, and a disciplined pathway to building one of Canada’s next premier gold and silver producers.

{{ commodity.name }}

{{ post.title }}

{{ post.date }}

Comments