The Future of Metal Investing – Strategic and Rare Minor Metals

Geopolitical instability has had a major impact on the financial markets over the past few years. The Russia–Ukraine war, Middle East conflicts, and mounting Taiwan Strait tensions propelled by ambiguous trade policies have led many experts to claim that the current valuation of major US indices is overly optimistic, pricing in hope instead of concern.

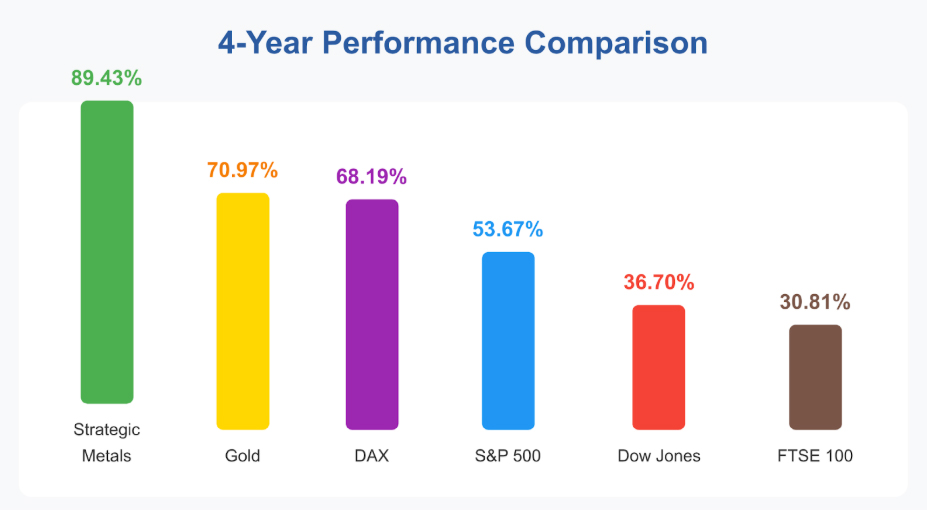

At the same time, one market that is benefiting from that volatile environment is metals. Precious metals, and specifically gold, have been enjoying a bull rally rarely seen before in history, with prices more than doubling from ~$1,800/oz to over $3,700/oz in just two years. Another, lesser known asset class that has appreciated to an even greater extent is strategic and rare industrial metals. Metals like gallium, germanium, indium, hafnium and rare earth elements have posted outsized gains on selected benchmarks, some up well over 100% since mid-2023 as supply tightened and buyers scrambled to secure material.

Gold has received tremendous coverage over the period and most portfolios, including central banks, have structural exposure to it. At the same time, there are very few investors in the rare and strategic metal market. By industry estimates, fewer than a thousand funds and private investors hold meaningful positions for speculative or strategic purposes. It’s a combination of less coverage by mainstream media, lower liquidity and the complexity of buying and storing industrial materials as opposed to gold, which is readily accessed via ETFs and futures.

Demand for these metals isn’t going anywhere soon. Gallium (GaN/GaAs) underpins high-efficiency power electronics and RF chips used in EV drivetrains, fast chargers, 5G networks and defense radar. Germanium is critical to fiber optic networks, infrared optics and solar cells (including space). Hafnium’s neutron absorption and high temperature properties keep it anchored to nuclear and aerospace. And rare earth elements, especially Nd, Pr, Dy and Tb sit at the very heart of permanent magnets for EV motors and wind turbines. These are not fad uses; they scale with electrification, datacenter power needs and rearmament cycles, and they face few true substitutes at performance parity. The “AI revolution” is very much reliant on these materials.

Export policy is moving the market as much as geology. In July 2023, China introduced export licensing for gallium and germanium, a shot across the bow that exposed how concentrated these supply chains had become. Controls tightened through 2024 and into 2025, including curbs that effectively cut direct US-bound shipments, driving price spikes and periods of scarcity outside China. In parallel, governments have begun to formalize diversification targets most visibly the EU’s Critical Raw Materials Act (10% extraction, 40% processing, 25% recycling in-bloc by 2030, and less than 65% dependency on any single third country). The direction of travel is clear: more screening, more licensing, and an incentive structure that favors non-Chinese supply, recycling and substitution where feasible.

What this means for investors. Gold is now widely owned; strategic metals are not. That asymmetry, plus policy driven supply risk and sticky end demand, explains why select “minor” metals can move far more than bullion. The flip side is liquidity and storage: these are niche markets with technical specifications, custody logistics and wider bid/ask spreads. For readers exploring the physical route, specialist brokerages like Earth Rarest publish primers on sourcing, storage, purity specs and exit processes. They allow private and institutional investors access to an untapped niche.

Bottom line. The same uncertainty that buoyed gold has pulled strategic metals out of obscurity. With demand tied to semiconductors, optics, clean energy and defense and with export regimes tightening the setup remains constructive.

You can contact [email protected] for more information on how to buy into the market with a minimum investment size of $10,000.

{{ commodity.name }}

{{ post.title }}

{{ post.date }}

Comments