A years-long push to unite Glencore and Rio Tinto fell apart in a day

For more than a decade, it was the deal mining billionaire Ivan Glasenberg had sought more than any other: putting Glencore Plc — the sprawling commodity trader-cum-miner he built — together with industry titan Rio Tinto Group.

For much of the past month, it looked like Glasenberg was finally going to get his way. The two companies were locked in merger talks for at least the fourth time, and nearly everyone involved agreed that they had never been more serious. And then suddenly, with a deadline for Rio to make a firm bid looming, it all fell apart in less than 24 hours.

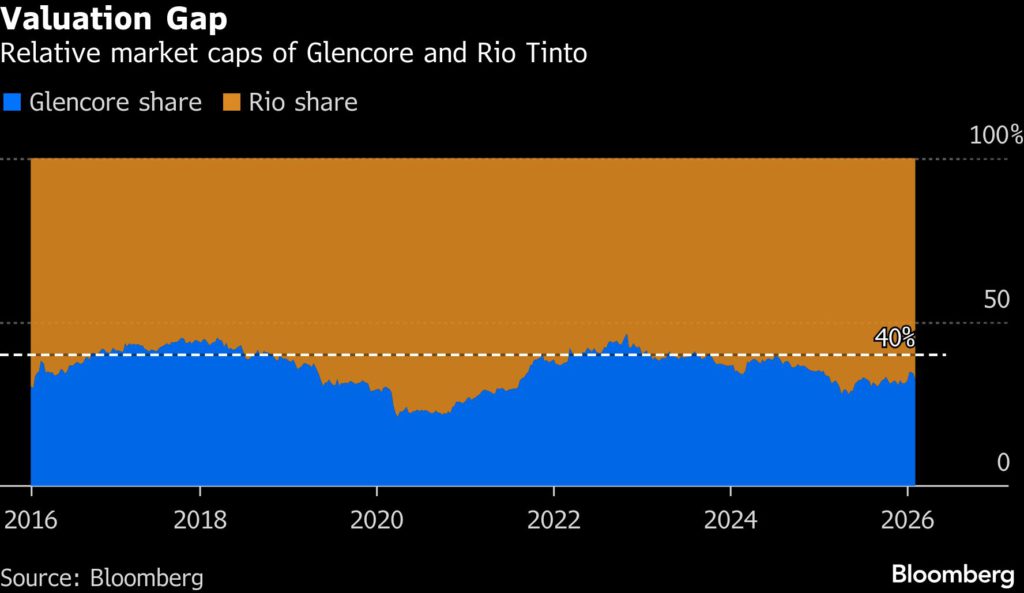

The two sides talked right up to the wire on Thursday, trying to find some common ground on price, before around 3 p.m. UK time Rio decided to pull the plug. Glencore was digging in on a demand for 40% of the combined company, and executives realized extending the talks would be a waste of time.

This account of how mining’s $240 billion mega-deal collapsed is based on conversations with more than half a dozen people familiar with the process, who asked not to be identified discussing confidential negotiations. Spokespeople for Rio and Glencore declined to comment.

The break-up is the latest in a string of attempted takeovers in the mining industry, and the stakes were high for executives on both sides as talks began in mid-December.

Glencore had seen its copper output drop more than 40% over a decade, and it was in the process of convincing investors that it had turned the business around as prices for the crucial industrial metal soared to all-time highs. Rio Tinto — which views itself as one of the industry’s sharpest operators — saw an opportunity to unlock the growth in Glencore’s copper portfolio. Without a deal, its earnings potential would remain hitched to the iron ore market, where prices were buckling under the weight of rising supply and waning demand.

A combination of the two companies would have allowed Rio to take BHP Group’s crown as the world’s biggest mining company, adding Glencore’s huge coal and copper operations, along with its commodity trading unit, to Rio’s giant iron ore business. Crucially for Rio, it would have doubled it copper output — potentially establishing it as the world’s top copper miner, and adding a million tons of future growth.

Prior efforts to fold Glencore’s cut-throat mining and trading business into the conservative corporate culture at Rio had broken down quickly, but with rivals also pursuing major copper acquisitions, the risks of inaction were growing and the opportunity was becoming too big to ignore.

Glencore Chief Executive Gary Nagle — who took over from Glasenberg in 2021 — had laid the groundwork over the summer last year when he informally reached out to Simon Trott, a Rio Tinto veteran who’d just taken over as CEO. After getting his feet under the desk, negotiations between the two sides formally kicked into gear in December, with Rio chairman Dom Barton also taking a leading role.

That period of quiet talks ended in early January, when the Financial Times first reported that negotiations were underway. That started the clock ticking: Under UK takeover rules, Rio had until 5 p.m. London time on Feb. 5th to make an offer, walk away or secure an extension.

In the early stages, the heads of the two companies largely took a back seat, while Rio dealmakers and advisers made multiple trips to Glencore’s headquarters in Switzerland to conduct due diligence. That was a herculean task given Glencore’s complicated business that comprises mines, smelters, refineries and huge trading and logistics operations.

As that process went on, both sides saw an extension as likely given the amount of work that was needed. There were no red flags in the due diligence, and the key sticking point was over the price that Rio would need to pay. Both sides had set the goal of getting a bid on the table before they reported earnings in mid-February.

Rio was working with Evercore Inc., led by veteran UK rainmaker Simon Robey, as well as JPMorgan Chase & Co. and Macquarie Group Ltd. Glencore spoke with banks including Citigroup and Barclays, but never officially appointed any advisers. However, the company did bring in veteran dealmaker Michael Klein, who had previously worked with Glencore on its failed bid to buy Teck Resources in 2023.

Klein’s core mandate was to convey the value of Glencore’s business to Rio executives, while Glasenberg — who remains the company’s biggest shareholder — also became more actively involved as the deadline drew nearer, partly to allay concerns at Rio that he wasn’t committed to doing a deal.

But with 24 hours before the deadline, things suddenly started to sour. There was a growing realization within Rio that Glencore — and Glasenberg — weren’t going to cede much ground on the demand that Glencore shareholders own about 40% of the combined company.

On the Glencore side, there was frustration that Rio had tied its bid to the the share prices on the day the deal became public. Glencore believed such an arbitrary ratio did not reflect the two companies’ past — and future — performance.

As talks rolled on over Thursday morning, there were still hopes within Rio that Glencore would show some willingness to lower its asking price, and Nagle and Trott spoke twice in a bid to break the impasse. Yet as the deadline neared, it became clear that an extension would be fruitless. The final time Nagle and Trott spoke, it was to discuss how they would announce to their investors that the deal was dead.

Bloomberg reported the news with less than two hours before the deadline, just minutes before Rio released a statement saying it was walking away. Under UK rules the two cannot talk again for at least six months, unless a rival bidder emerges or Glencore formally requests to reopen talks.

A 7% drop in Glencore’s shares underscored the stakes for its executives and investors, as analysts questioned whether the company will be able to develop its copper business itself. For Rio, an ongoing slide in the iron ore price offered a reminder of the risks in backing out of the industry’s biggest ever deal, and talk in the industry soon turned to the question of whether a competing bidder will arrive.

“We have always believed BHP to be the most likely interloper,” RBC Capital Markets analyst Ben Davis said in an emailed note. “There is a chance that BHP now steps in, but the challenge will be explaining to value conscious Australian investors how they see the value in Glencore when Rio Tinto didn’t.”

(By Thomas Biesheuvel, Aaron Kirchfeld, Jack Farchy and Dinesh Nair)

More News

Infographic: Global gold demand

Global gold demand is being reshaped by shifting sovereign reserve strategies.

February 05, 2026 | 01:05 pm

{{ commodity.name }}

{{ post.title }}

{{ post.date }}

Comments