Almonty buys US tungsten project in bid to resume local supply

Almonty Industries Inc. agreed to buy a tungsten project in Montana, with plans to quickly turn it into the first US mine in a decade to produce a metal used in weapons and semiconductors.

The Toronto-based company is acquiring the Gentung-Browns Lake project, which was formerly operated by Union Carbide Corp., paying with stock and cash, it said Monday, without identifying the seller. Almonty shares pared declines on the news.

Subject to obtaining an extraction permit, Almonty could restart mining there as soon as late-2026 using reconditioned equipment from its facilities in Spain. Water rights and pipes are already in place.

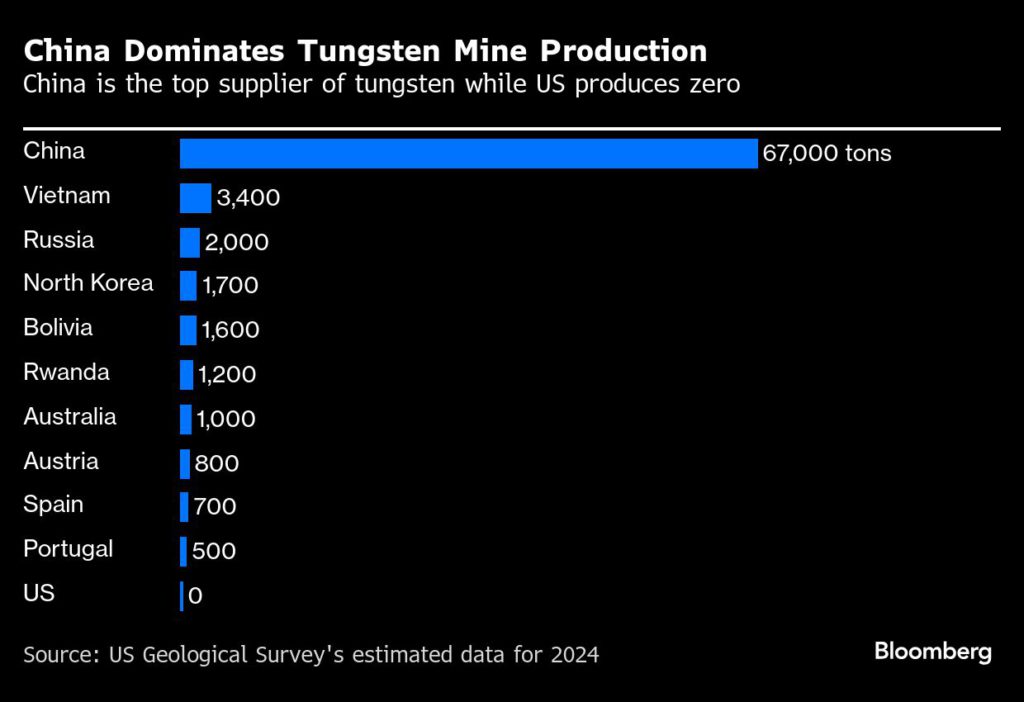

Almonty is joining the US push to reduce its reliance on China for the super-dense niche metal used in armor-piercing munitions as part of a broader push for critical-mineral independence. President Donald Trump has exempted tungsten from his country-based tariffs given the US ceased commercial production a decade ago amid falling prices. Since then, it’s relied on imports and recycling.

The acquisition is Almonty’s latest effort to boost its US presence after listing shares on the Nasdaq in July and announcing plans to redomicile to Delaware. It’s also holding supply talks with the Department of Defense, chief executive officer Lewis Black said.

Almonty sees the purchase of an existing asset in the US as a good complement to its large-scale project in South Korea, which is about to start producing, and a smaller mine in Portugal.

Tungsten concentrate produced in the US could be sold to companies such as Global Tungsten & Powders Corp., Kennametal Inc. or Buffalo Tungsten Inc., where it would be processed into a powder and then into a carbide and other tungsten-bearing alloys.

Besides the asset purchase, Almonty has also been in discussions for the past several months with US agencies, including the Defense Advanced Research Projects Agency, or Darpa, Black said.

Rather than seeking funding or bringing in the Pentagon as a shareholder, Almonty is proposing state purchases of tungsten using transparent, market-based prices.

The firm’s shares are up more than 600% in the past year as trade tensions stoke tungsten supply concerns. The stock was down 3% at 3:26 a.m. in New York on Monday after falling as much as 11%.

(By James Attwood)

{{ commodity.name }}

{{ post.title }}

{{ post.date }}

Comments