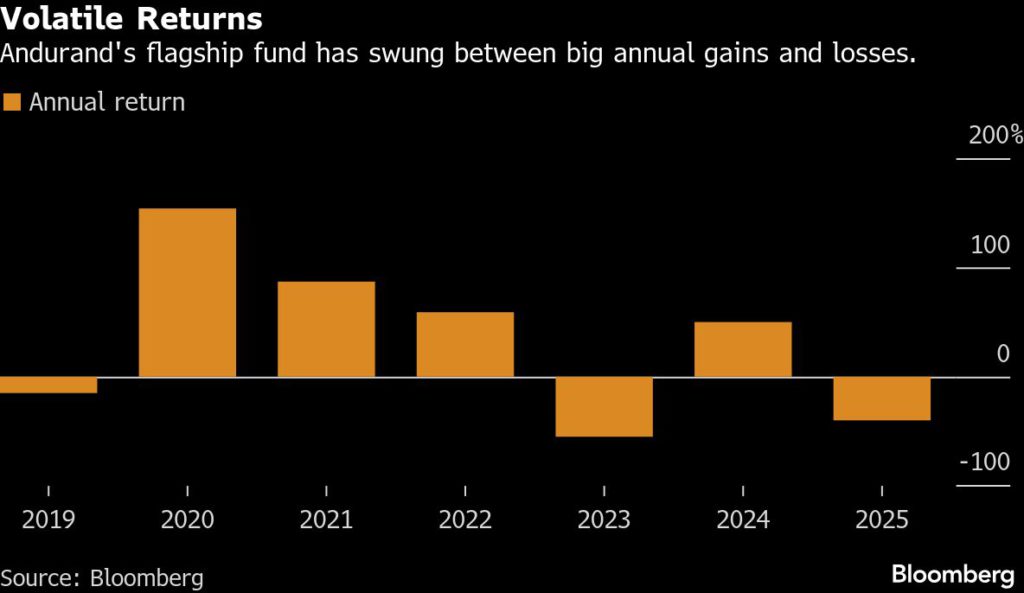

Andurand’s hedge fund pared 2025 loss to 40% on metals rally

Commodities trader Pierre Andurand’s flagship hedge fund ended 2025 down 40%, paring much deeper losses earlier in the year after bets on a range of metals.

The Andurand Commodities Discretionary Enhanced recovered from a mid-year loss of about 60% thanks in part to positions in copper, silver, gold, tin and carbon permits, according to a person with knowledge of the matter, who asked not to be identified because the details are private.

A representative for Andurand Capital Management declined to comment.

Copper rose 42% on the London Metal Exchange in 2025 — its best year since 2009 — due to mine disruptions and concerns around tariffs. The metal has extended its rally this year, touching $13,000 a ton for the first time on Monday.

Gold and silver posted their biggest annual gains in more than four decades, supported by strong demand for haven assets and interest-rate cuts by the US Federal Reserve.

With no set risk limits, Andurand’s Discretionary Enhanced fund often sees double-digit gains and losses. In 2024, its value rose by 50%.

The less volatile Andurand Commodities Fund ended the year down 21%, having earlier lost as much as 30%, the person said. The Andurand Climate and Energy Transition Fund erased most of its losses, ending down 6%, compared with a trough of minus 40%, they said.

(By Grant Smith and Nishant Kumar)

{{ commodity.name }}

{{ post.title }}

{{ post.date }}

Comments