Anglo’s go-to banker drives Teck deal after seeing off BHP

Centerview Partners LLC banker James Hartop has his own badge to get into Anglo American Plc’s headquarters near London’s diamond district. Rival advisers wait to be called in. It’s a symbol of the dealmaker’s bond with the century-old miner, and his crucial role in protecting it – most recently just last year when BHP Group made a $49 billion bid for its smaller rival.

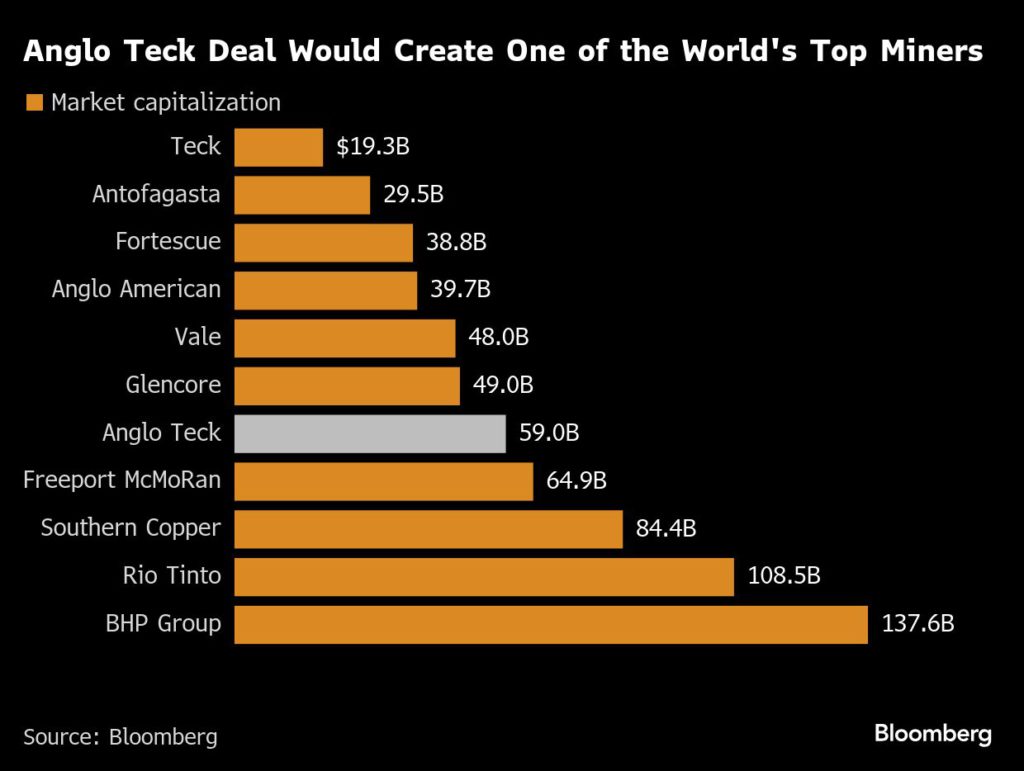

That relationship meant that Hartop took the lead for Anglo as it negotiated with the Canadian miner Teck Resources Ltd., according to people with knowledge of the negotiations. The deal, which would create a $50 billion copper giant, is one of the largest in the sector in years.

Over three decades, the 51-year-old has become Anglo’s go-to banker for advice in an industry with a constant backbeat of mergers, takeovers and restructurings. This kind of connection has become rare, as the business of advising on large M&A has become increasingly commoditized. But Hartop’s long-term association with the miner has given him, and Centerview, access to a mandate that several bankers with knowledge of the situation say is one of the most lucrative jobs in the mining industry.

This story is based on conversations with current and former employees of Anglo American, and other advisers and bankers who asked not to be identified in order to discuss sensitive information.

Centerview, Hartop and Anglo American declined to comment.

Hartop’s association with Anglo American started when he joined SG Warburg — which subsequently became part of UBS Group AG — as an M&A banker in 1995, following an internship at the firm. An Oxford theology graduate, he quickly moved up the ranks as a young banker who showed enthusiasm and a level of maturity beyond his age, according to one person who worked with him during that period.

Anglo American was one of UBS’s key clients at the time, and Hartop was brought into work on the firm’s sprawling global business, which spanned multiple geographies and had copper, gold, platinum and nickel assets, among others. In 1998, he lived in Johannesburg for six months as he worked to get a deal to consolidate eight gold mining companies into AngloGold over the line.

In 2009, Hartop helped ensure that a £41 billion ($66.7 billion) merger proposal from Xstrata Plc was left – according to the company — “dead and buried.”

He advised Anglo on the spinoff of packaging business Mondi Plc in 2007, the purchase of a controlling stake in De Beers Plc in 2012, and the sale of a minority stake in Anglo American Sur SA to a consortium led by Mitsui & Co Ltd. in the same year.

One mining banker at a rival firm said the ties between Hartop and Anglo were so strong that if he saw Anglo run a sell-side process without Hartop’s involvement, he thought the company wasn’t serious about a sale.

These deals propelled Hartop’s near two-decade career at UBS. He went on to become the co-head of European investment banking at the Swiss lender and was named the head of its coverage and advisory business for Europe, Middle East and Africa before leaving to join Centerview. The boutique advisory firm was cofounded by a former UBS colleague, Blair Effron, in 2006.

UBS’s advisory work with Anglo American dropped off after Hartop’s departure, according to data compiled by Bloomberg. In 2024, The bank worked as an adviser to BHP in its approach to Anglo, along with Barclays Plc.

When that bid was made, one of the first people Anglo called in was Hartop.

Anglo had suffered a series of major setbacks. Prices for some key products had plunged and operational difficulties had forced it to cut production targets, driving down its valuation and leaving the company vulnerable to potential bidders. BHP planned to break it up.

Along with counterparts at Goldman Sachs Group Inc. and Morgan Stanley, Hartop helped devise a turnaround at Anglo, which included exiting coal, diamonds and platinum and slowing down spending on a massive UK fertilizer mine. BHP eventually walked away last May after a five-week battle.

Since then, Hartop has been heavily involved in the simplification of Anglo, working on the demerger of its platinum business and an attempt to sell its steelmaking coal business to Peabody Energy, which was scrapped in August.

Discussions between Anglo and Teck started around a year ago, according to people familiar with the matter, and gained momentum a few months ago. On Anglo’s side of the table, Hartop was ever-present, the people said.

Outside of his mining work, Hartop has worked on some of the world’s largest M&A deals globally since joining Centerview — including Anheuser-Busch InBev’s purchase of SAB Miller for about $104 billion in 2016 and AstraZeneca Plc’s acquisition of Alexion Pharmaceuticals Inc. for $39 billion. Among his key clients is DSM-Firmenich.

Centerview ranks eighth among advisers on M&A deals announced this year with an 8% market share, ahead of rival boutiques, including Lazard Ltd. and Rothschild & Co., according to data compiled by Bloomberg. They have had a role on $226 billion of transactions, the data show. Centerview were the main adviser on the recent breakup of Kraft Heinz, and Sycamore Partners’ acquisition of Walgreen Boots Alliance in March.

People who have worked with Hartop describe him as unassuming, easy to deal with and straight to the point. He’s developed a strong rapport with the current Anglo CEO Duncan Wanblad, just as he did with previous leaders of the firm.

New CEOs often bring with them existing relationships with key advisers, but Hartop appears to have proved himself too valuable to Anglo. He’s been a constant even as five CEOs – Julien Ogilvie Thomson, Tony Trahar, Cynthia Carroll, Mark Cutifani and now Wanblad – have gone through the top office since he started working with Anglo.

The agreement with Teck doesn’t mean that Hartop’s job is done. There is still a chance that another bidder could attempt to derail the deal by coming in with an offer for Teck. And BHP, or another large miner, could still come back to make a bid for Anglo, meaning once again it will need someone to head up its defense.

(By Dinesh Nair and Thomas Biesheuvel)

{{ commodity.name }}

{{ post.title }}

{{ post.date }}

Comments