Anglo’s swoop for Teck leaves bigger mining rivals on back foot

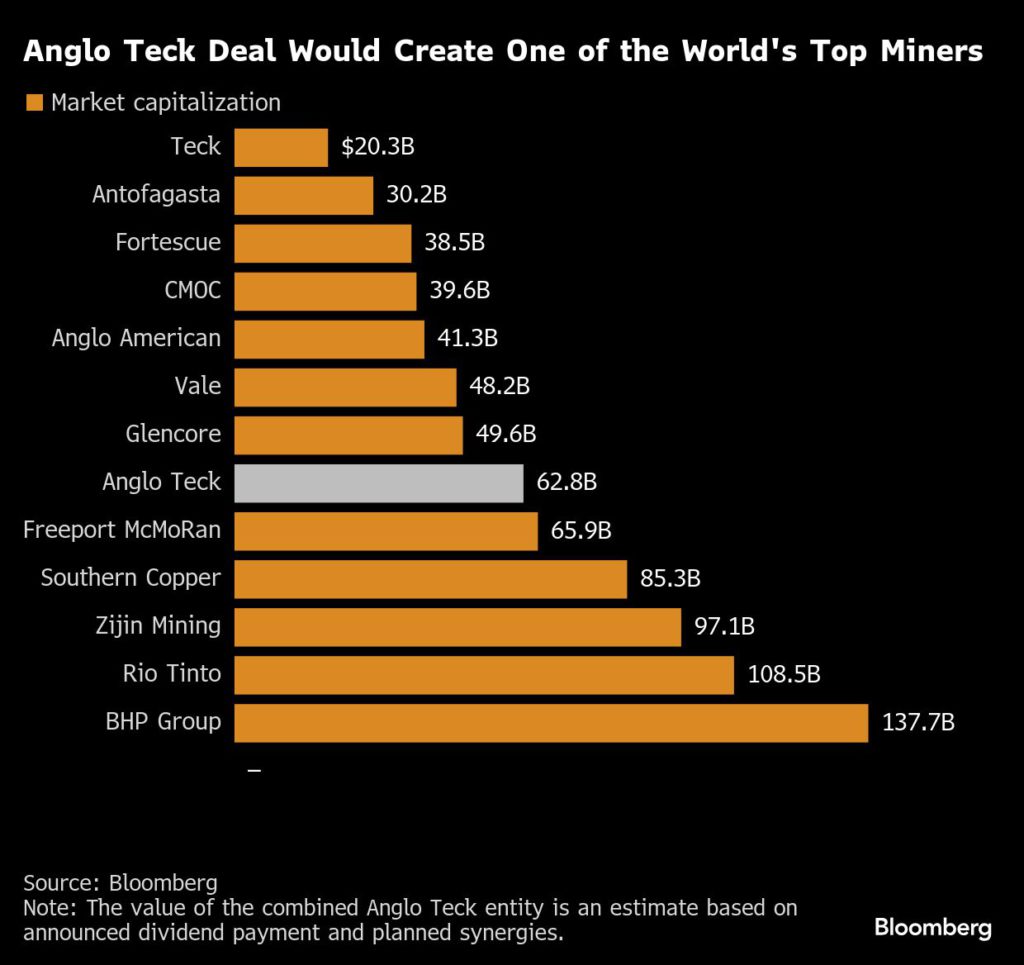

Anglo American Plc’s swoop for Teck Resources Ltd. swiftly found rival mining executives jumping on calls with bankers and advisers to find out more about the roughly $60 billion deal — realizing that two of mining’s best prizes had eluded them.

While a tie-up between the two had long been seen by many as an obvious one, they caught their peers flat footed this week when announcing a deal that was largely done. The companies already had unanimous board support, the backing of Teck’s founding family who own controlling shares, and had even briefed governments in Canada, South Africa and the UK.

That has left obvious interlopers such as BHP Group and Rio Tinto Group — the world’s top two miners — with limited room for maneuver as things stand, according to people familiar with the situation who asked not to be identified discussing private matters. That makes any counteroffers challenging, but not impossible, some of them said.

The mining world appears to be coming full circle again when it comes to big M&A. It spent much of the past decade in apology mode after reckless deals at the height of the China-fueled commodity boom resulted in billions of dollars in writedowns, forced out executives and left investors furious. But now after dishing out record dividends and simplifying their business, mining bosses have shareholders talking about acquisitions again.

Ever since Glencore Plc tried unsuccessfully to buy Teck in 2023, the sector has kicked into deal mode in earnest. Since then, BHP tried — and failed — to buy Anglo in a $49 billion deal, while Rio held talks to buy Glencore last year. Deal teams across the industry have looked at all possible transactions that they can do, from takeovers to combinations, and how to react to what rivals do.

But until this week, nobody had found a way to get a transformational deal done.

“The thing that shows out of these deals is you’ve just got to get friendly deals to really make them happen. It’s so hard to go hostile,” said Andy Forster, a Sydney-based senior investment officer at Argo Investments Ltd., which holds BHP and Rio stock. “Everyone’s talking about an interloper; I can’t really see that myself.”

However, people close to both Rio and BHP say there’s plenty of time to see how the deal plays out and that there’s no sense of urgency. Both firms for now are watching from the sidelines.

BHP and Rio declined to comment.

Teck has a portfolio of copper assets — which are much coveted and essential to the global energy transition. Its flagship asset is the giant Quebrada Blanca 2 copper mine in Chile, one that has been beset by problems and cost billions more to build than originally expected. It neighbors Collahuasi, one of the world’s best copper mines, which is owned by Anglo and Glencore.

Integrating the two operations is an attractive prospect for Anglo and Teck, but there wouldn’t be the same beneficial synergies on offer for either BHP or Rio.

Anglo also has the backing of Canada’s Keevil family, which controls Teck through “supervoting” Class A shares. They made having a Vancouver headquarters for the new proposed Anglo Teck company a red line for any deal, something Anglo agreed to, but which people familiar with the matter said would be more difficult for the bigger Rio or BHP.

And yet the door has been left ajar. Anglo and Teck said their agreement includes provisions that would allow either firm to consider unsolicited proposals and for the deal to be terminated in the event of a superior proposal.

A rival bid for Anglo is also possible, some of the people familiar with the matter said, though probably still a stretch.

BHP has largely moved on after being rebuffed by Anglo last year. The attempt wasn’t popular with many BHP shareholders, who instead favored the company focusing on internal growth. And while Rio has previously done extensive work on an Anglo bid, it preferred to talk with Glencore last year rather than going up against BHP.

Should a number of Teck’s investors oppose the deal, a counter bid for Teck would become more likely, the people said.

Some of Anglo and Teck’s biggest shareholders also see little chance of someone else swooping in, according to investors who spoke to Bloomberg under the condition of anonymity.

At the same time, there’s a view from within Rio and BHP that the new Anglo Teck — once finally combined — could be an attractive target, some of the people said.

For now, few see a bidding war on the cards. That’s partly because of lessons learned when the mining industry got too carried away with M&A more than a decade ago, when big companies paid too much for value-destructive deals.

“Where companies go wrong is where they feel they need to make an acquisition for scale, and value goes out the window,” Argonaut portfolio manager David Franklyn said.

(By Thomas Biesheuvel, Sybilla Gross and Dinesh Nair)

{{ commodity.name }}

{{ post.title }}

{{ post.date }}

Comments