Arcelor’s South Africa assets get approach from steel processors

South African steel processors have approached the country’s biggest development-finance institution with a proposal to help take control of ArcelorMittal SA’s struggling local unit.

The industry group, which has six members including labor unions, made a proposal to the state-owned Industrial Development Corp. and includes local processor Allied Steelrode (Pty) Ltd., according to people familiar with the matter.

The IDC has been locked in talks with ArcelorMittal since November 2023, when the global steel giant said it planned to shut two steel mills at the unit that produces grades that are crucial to South Africa’s key automotive and mining industries.

The IDC — the second-biggest shareholder in ArcelorMittal South Africa Ltd., or AMSA — has loaned the company money and said it wants to boost its stake from a current interest of about 8% to preserve the nation’s industrial capacity. The group being considered as a strategic equity partner consists of South African companies and would bolster local ownership of manufacturing capacity, said the people who asked not to be identified because the talks are private.

AMSA referred queries to the IDC. The development institution said there are no updates regarding the steelmaker. Johannesburg-based Allied Steelrode referred queries to AMSA and the IDC.

Under the arrangement, the IDC would provide finance and take an increased stake, while ArcelorMittal could retain a shareholding for a limited period, the people said.

Talks between the IDC and ArcelorMittal fell apart late last year when the steel company rejected an informal proposal of about 8.5 billion rand ($531 million), which would have included the repayment of 7 billion rand in debt to the South African unit’s parent. The assets will also have to be revalued, said the people.

Nedbank Group Ltd. is running the process to select a strategic equity partner, or SEP, to part fund and mainly run the operations on behalf of the IDC, said the people. It’s compiling a shortlist, with Allied Steelrode a serious contender, they said.

“For the IDC, a key feature of complying with its internal policy entails running a public process to identify a SEP pursuant to a potential transaction in a manner that is administratively fair,” Nedbank said in an email to one prospective bidder late last year. “All interested parties are to be given an equal opportunity.”

Nedbank declined to comment.

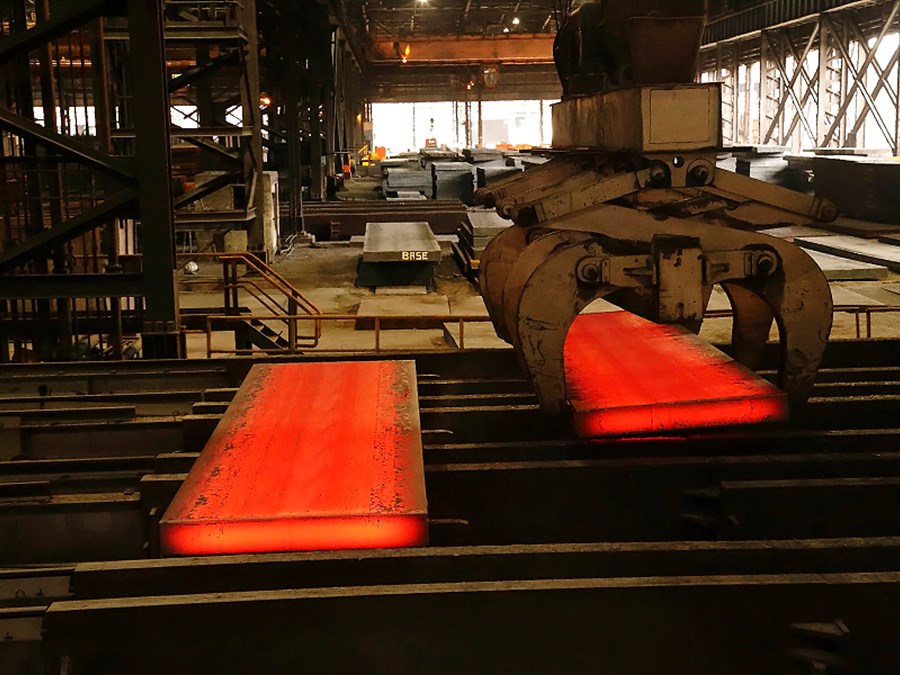

Allied Steelrode processes bulk steel into specialized components for the automotive, mining, construction and agricultural sectors, according to its website.

AMSA has now closed the two steel mills and an iron ore mine. It still operates a mill in Vanderbijlpark, south of Johannesburg, which produces steel sheets and other products and has idled facilities in the capital, Pretoria, and in the west coast town of Saldanha.

AMSA, formerly known as Iscor, was acquired by Indian billionaire Lakshmi Mittal in 2003. Mittal in 2006 combined with Arcelor to form ArcelorMittal.

(By Loni Prinsloo and Antony Sguazzin)

{{ commodity.name }}

{{ post.title }}

{{ post.date }}

Comments