Argentina’s cradle of Malbec wine is warming up to copper mining

A Swiss-backed venture seeking to build the first large copper mine in an Argentine province better known for winemaking is considering financing offers in a key test case for the fledgling industry.

The San Jorge copper-gold project, controlled by Zug-based Zonda Metals, is evaluating multiple proposals, including Asian capital, conventional debt, equity partnerships and offtake or streaming arrangements, said Fabian Gregorio, who heads the venture.

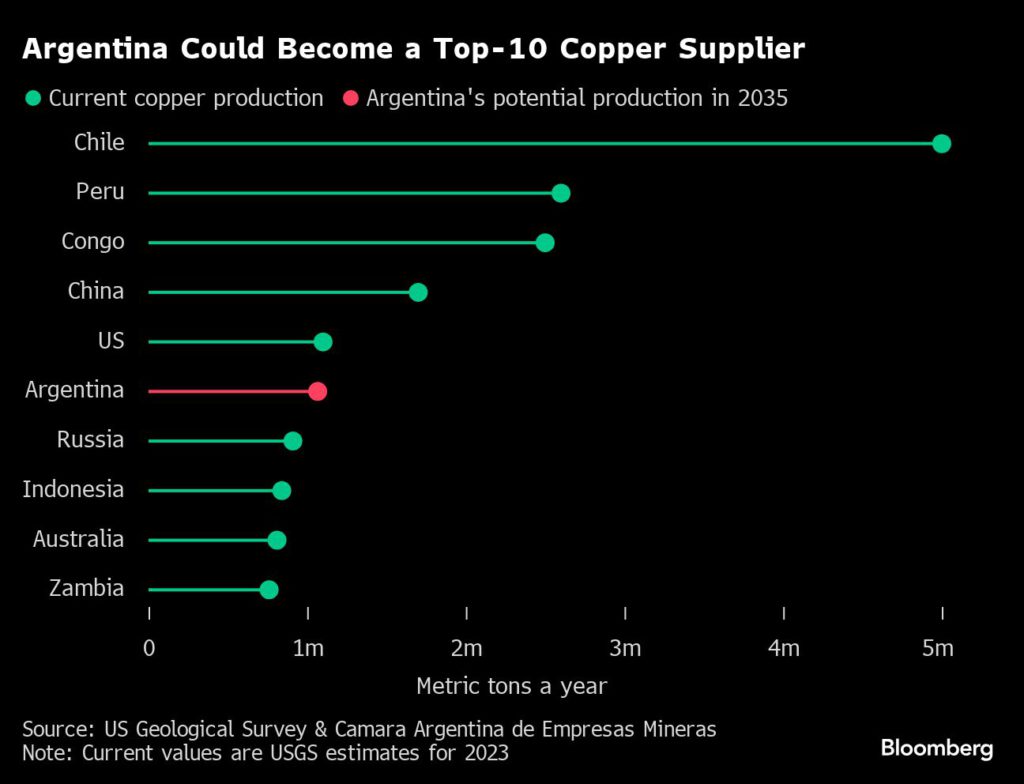

San Jorge would be a first for Mendoza, a province in the Andes foothills renowned for its Malbec vineyards. If the revived venture — rejected 14 years ago — manages to raise more than $600 million, navigate permitting and keep communities on its side, it could pave the way for other projects to tap vast mineral potential in an area long seen as off limits to mining. It would also strengthen Argentina’s bid to become a new copper hub.

Strong interest from investors and lenders partly reflects record-high metal prices and President Javier Milei’s deregulation drive, Gregorio said in an interview Wednesday. The project also secured political ratification in Mendoza, where mining ventures must be approved by both legislative chambers after a technical environmental review.

The project has failed once before, albeit under different ownership. In 2011, the provincial senate rejected it after sizable protests and political pushback tied to water concerns, turning San Jorge into a symbol of Mendoza’s unfulfilled mining ambitions. In 2019, the then-governor sided with environmentalists by vetoing a law that would have allowed miners to use chemicals such as cyanide and sulfuric acid.

“We feel a great sense of responsibility,” Gregorio said. “As the first copper project in the province, it must set a clear example of modern mining. Many eyes — in the province and nationwide — will be watching.”

Waiting in the wings are a series of much earlier-stage projects in the Malargüe area of southern Mendoza, which have long promised to help the province ease its dependence on wine exports and tourism.

A total of 39 exploration permits have been awarded and another 69 are under evaluation, said Emilio Guiñazú, head of provincial mining promotion agency Impulsa Mendoza. The district will likely see about 200 exploration projects come to fruition over the next few years, he said. Most are small mining companies known as juniors, but majors including BHP Group, Fortescue Ltd. and Lundin Mining Corp. have filed claims or hold property, he said.

San Jorge is modest compared with the vast mines next door in Chile, as well as a handful of large projects in the neighboring province of San Juan, where global companies are weighing investments totaling tens of billions of dollars. Chile’s President-elect Jose Antonio Kast said this week he hoped Argentine projects will opt to export minerals through Chilean ports.

The San Jorge project is designed to produce 40,000 metric tons of copper in concentrate form and 40,000 ounces of gold a year. If financing closes as planned, construction could begin in November, positioning the mine to start producing in 2028. Local family-owned conglomerate Alberdi is a minority owner.

Opponents of mining development in Mendoza are once again protesting, with opposition centered around concerns over water use and contamination. José Luis Ramón, a provincial lawmaker who voted against the project and has joined recent anti-San Jorge rallies, posted on X that mining still lacks a “social license” in Mendoza and that activists would challenge the congressional approval in courts.

Besides producing world-class wines, Mendoza’s Mediterranean climate and snowmelt irrigation supports agriculture.

San Jorge says demonstrations reflect a “small but noisy” minority and haven’t affected timelines. Public participation in the environmental review exceeded 10,000 people, which the venture says boosts its chances of securing social acceptance this time around.

(By James Attwood and Jonathan Gilbert)

More News

Contract worker dies at Rio Tinto mine in Guinea

Last August, a contract worker died in an incident at the same mine.

February 15, 2026 | 09:20 am

{{ commodity.name }}

{{ post.title }}

{{ post.date }}

Comments