Asian rare earth stocks surge on new China-Japan export curbs

Rare earth-related shares gained across the Asia-Pacific region after China imposed a ban on exports of military-use items to Japan, a move with the potential to squeeze supply chains.

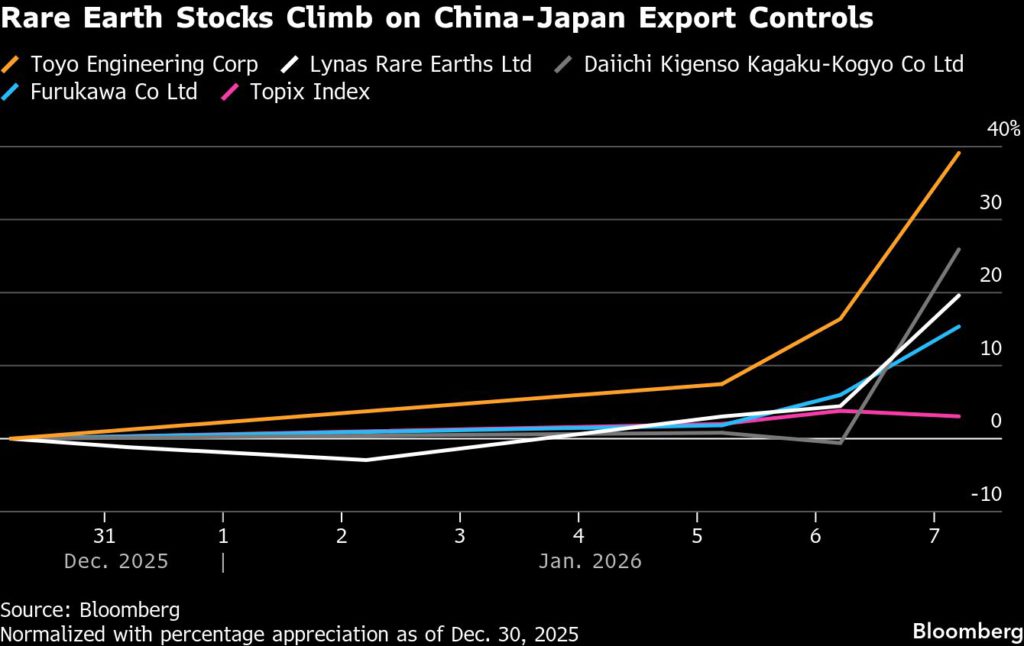

In Tokyo, Toyo Engineering Corp., which makes technology to recover rare earths from the sea bed, jumped 20%. Cerium manufacturer Daiichi Kigenso Kagaku-Kogyo Co. soared as much as 27%. Australian miner Lynas Rare Earths Ltd. was also up as much as 16%, the most since July, with metal producer Australian Strategic Materials Ltd. climbing almost 10%.

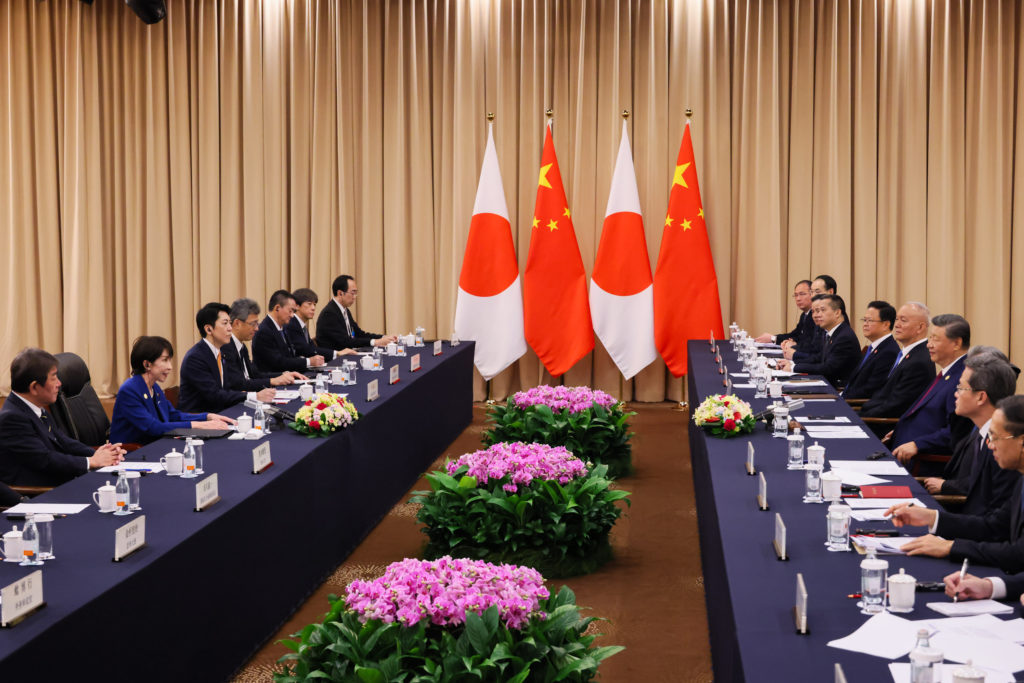

The gains came after Beijing said all dual-use items are banned from being exported to Japan for military use, the latest escalation in an ongoing bilateral spat spurred by Japanese Prime Minister Sanae Takaichi’s comments on Taiwan. The new measures will include rare earth-related items, according to a China Daily report.

“There are fears the restrictions could lead to bottlenecks for critical materials, and that means higher prices,” said Hiroshi Namioka, chief strategist at T&D Asset Management Co. “That’s a tailwind for companies that manufacture rare earths,” especially since Japanese auto and defense makers will be looking to diversify their supply chains further away from China, he said.

Rare earths are essential for making magnets and the elements are used in electric vehicles, robots, and some defense-related technology. China leads the world in rare earth reserves and production, controlling more than 90% of global refining capacity, according to the Japan Organization for Metals and Energy Security.

Tighter restrictions on Chinese exports would “favor upstream players” in other markets, like Australia’s Lynas and Japan’s Sojitz Corp., said Jeremy Yeo, an analyst at SMBC Nikko Securities Inc.

Shares of Chinese rare earth producers like China Rare Earth Resources and Technology Co. and JL Mag Rare-Earth Co. also climbed Wednesday. “As Europe and other Asian markets constitute the bulk of export demand, the potential loss of Japanese market share is manageable” for China’s exporters, wrote Citi Research analysts including Anna Wang in a note.

However, the prospect of costlier supply chains hurt sentiment around Japanese auto, machinery and defense stocks Wednesday. China’s latest export controls extend beyond rare earths to cover more than 800 items from chemicals to sensors.

Toyota Motor Corp. shares dropped 3%, the most since early November, and weighed on Japan’s Topix index, which fell as much as 1%. Mitsubishi Heavy Industries Ltd. and Kawasaki Heavy Industries Ltd. lost over 2%.

“There’s a heightened sense of caution around autos, as well as other firms with a high exposure to China,” said T&D’s Namioka. “It looks like Japan-China tensions are set to continue, and I see that suppressing Japanese stocks’ upside for a while.”

(By Alice French)

{{ commodity.name }}

{{ post.title }}

{{ post.date }}

Comments