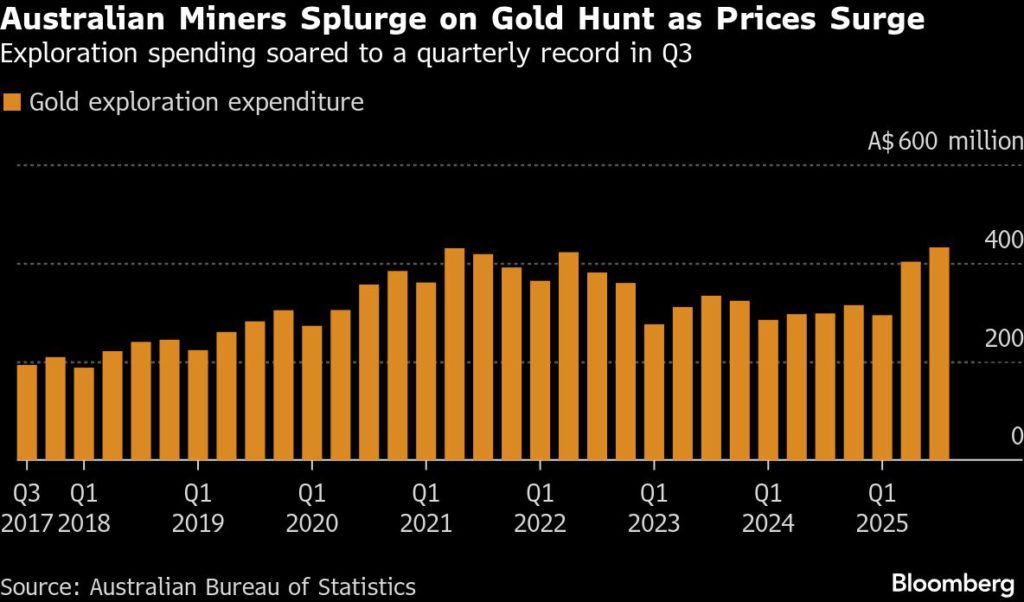

Australia gold exploration spending jumps to highest since 1994

Australian miners are ramping up gold exploration as prices that have surged to a record high this year spur a search for new deposits.

They spent a combined A$431.5 million ($238 million) on exploration in the three months through September, according to data from the Australian Bureau of Statistics. It was the highest quarterly spend in figures going back to 1994.

The rally in gold, which has more than doubled in price over the last couple of years, is being fueled by trade and geopolitical uncertainty under US President Donald Trump. Central banks and retail buyers have piled into bullion, which has also been aided by the so-called debasement trade, where investors avoid currencies and government bonds on fears that fiscal deficits will erode their value.

Newmont Corporation., Northern Star Resources Ltd., and Evolution Mining Ltd. are among the major Australian gold miners.

“Gold has proven itself to be a outstanding and resilient performer in maintaining explorer interest, buoyed obviously by recent gold price highs and the continuing uncertainties seen in global markets,” Warren Pearce, chief executive officer of Australia’s Association of Mining and Exploration Companies, said in a statement.

(By Paul-Alain Hunt)

{{ commodity.name }}

{{ post.title }}

{{ post.date }}

Comments

Mining Fan

Australia’s A$431.5m gold exploration spend in just one quarter really shows how powerful this price environment has become. When budgets hit the highest level since 1994, it’s clear miners are trying to lock in today’s margins and replace ounces after the metal has surged to record highs.

The big question is how much of this money is going into genuine new discoveries versus just extending the life of existing operations. If most of it stays around known camps, Australia may get a solid near-term production bump, but still face a structural supply issue down the road if this “super-cycle” cools off faster than expected.