Australian rare earth firm to select US plant site by year-end

Australian Strategic Materials Ltd. aims to choose a location for its planned US rare earths plant by the end of this year, capitalizing on President Donald Trump’s backing for the sector amid growing rivalry with China.

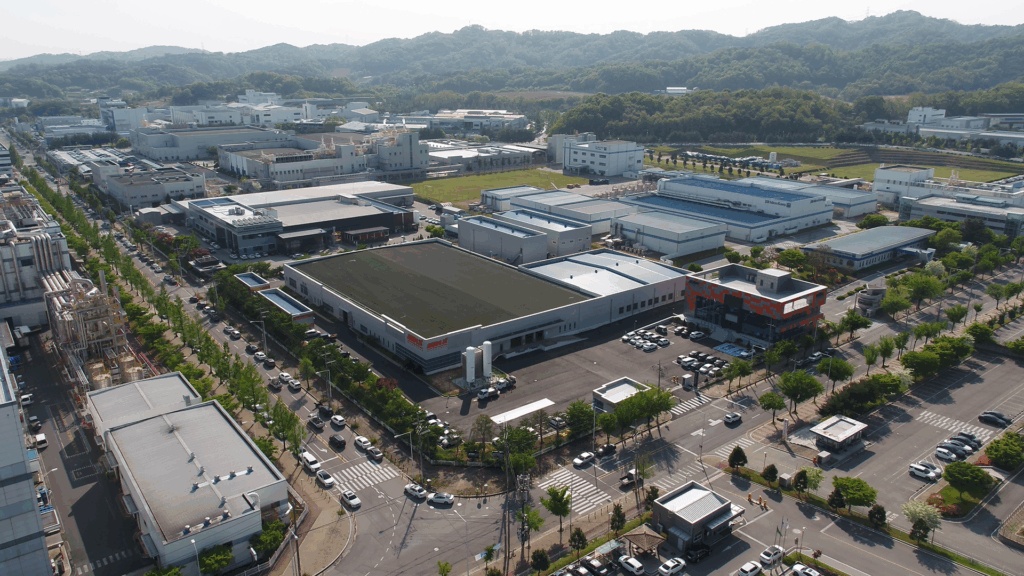

The firm has been in discussions with the Pentagon about funding to support a plant in America producing metal for rare earth magnets, chief executive officer Rowena Smith said in a Bloomberg TV interview on Friday. It already operates one metal plant in South Korea, and also wants to build a mine at its deposit in Australia.

“We initially, 12 months ago, shortlisted six states” for the new facility, Smith said. “We will identify our preferred state later this year.”

The Trump administration is ramping up efforts to back critical minerals projects outside China, as Beijing prepares to unleash even tighter controls on rare earths exports. Earlier this week, Washington and Canberra reached a broad agreement on joint funding for projects in Australia and the US to protect supply chains for industries from cars to the military.

ASM was not one of the initial beneficiaries, and its shares fell by about a third this week after months of volatile trading for rare earth firms worldwide. Its stock is still up by nearly 100% this year.

US states are offering “significant incentives” to build a metal plant, Smith said. The company recently raised A$80 million ($52 million) to fund company expansions, she added.

Magnets have been a focus of geopolitical tensions this year after China’s supplies slumped in the wake of a first wave of export controls. A flurry of new US magnet plants — mostly predating the recent crisis — are in the pipeline that will need supplies of refined metal and alloys to make their product.

ASM wants to build a supply chain starting from a potential mine at its Dubbo resource in Australia. That project has potential debt funding of up to $600 million from the Export-Import Bank of the United States, plus A$200 million in a letter of support from the Australian government.

(By Paul-Alain Hunt)

{{ commodity.name }}

{{ post.title }}

{{ post.date }}

Comments