Australia’s VHM scraps offtake deal with Shenghe Resources

Australian rare earths miner VHM said on Monday it had terminated its offtake agreement with China’s Shenghe Resources for its Goschen rare earth project after conditions precedent to the deal were not met.

Shares of VHM rose as much as 12.1% to A$0.465 in early trading, set for their best day since November 10, if current moves hold.

VHM said the decision underscored its plan to pursue a wider pool of potential buyers as global demand for critical minerals from buyers outside China grows.

The company said it hired Macquarie Capital to lead its discussions with offtake and potential project partners for its Goschen project in Australia’s Victoria state.

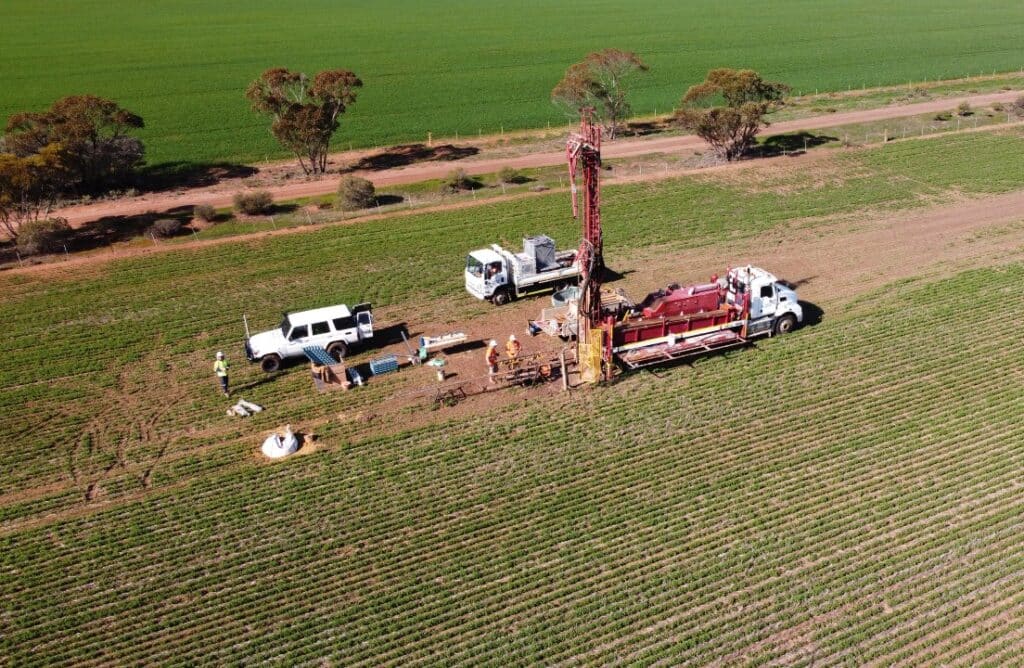

The Goschen project is VHM’s flagship development, focused on extracting critical minerals such as rare earth elements and titanium that power clean energy systems, electric mobility, advanced defence applications and modern digital technologies.

The agreement with Shenghe, announced in 2024, set terms for the supply of 6,400 metric tons per year of a valuable rare earth mineral concentrate, among others, from VHM’s Goschen project, for an initial three-year term.

The company said the project aimed to start producing rare earths and mineral sands concentrates by late 2027 and the end of the offtake deal with Shenghe meant 100% of the products would be available for purchase.

In 2025, the Melbourne-headquartered firm secured up to $200 million in funding from the US Export-Import Bank (EXIM) to support development of the Goschen project.

Shenghe has been expanding in Australia’s rare earth sector, buying nearly 20% of Peak Rare Earths in 2022 and signing a deal that year to purchase products from Peak’s Ngualla project in Tanzania.

Last September, partly state-owned Shenghe took full control of Peak after the firm had greenlit the Chinese rare earth producer’s $130 million buyout offer.

The deal came as Australia considered a price floor to support critical minerals projects and position itself as an alternative to China, the dominant supplier.

(By Rajasik Mukherjee; Editing by Deepa Babington and Jamie Freed)

More News

Contract worker dies at Rio Tinto mine in Guinea

Last August, a contract worker died in an incident at the same mine.

February 15, 2026 | 09:20 am

{{ commodity.name }}

{{ post.title }}

{{ post.date }}

Comments