Big-spending SQM joins Chile’s hybrid bond boom

The giant lithium producer SQM has become the third Chilean company to sell hybrid notes in the local market in the past four months, as companies look to finance multi-billion investments without damaging their credit score.

SQM issued 10 million Unidades de Fomento ($432 million), an index-linked accounting unit, to yield 3.84% on Thursday. It followed similar sales by the forestry companies Celulosa Arauco y Constitucion and Inversiones CMPC earlier in the year.

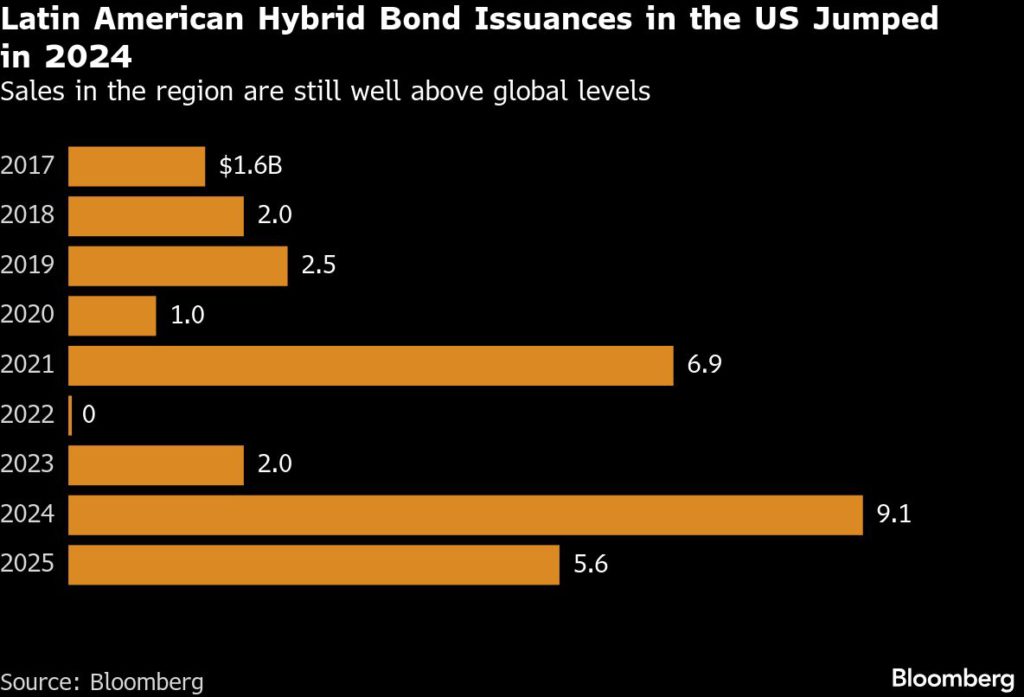

Hybrid bonds — which come with coupon step-ups if the company doesn’t call the securities when eligible — have shot up in popularity globally since 2024. Now as local companies step up investment plans, these notes are looking more attractive in Chile. Given that half of the money typically counts as equity, they limit the size of the debt burden, enabling companies to finance expansion without jeopardizing their credit rating. But they come at a cost — higher yields.

The debt comes “with an attractive trade off,” said Francisco Mohr, head of fixed income at the asset management division of BTG Pactual in Chile. “It pays more than traditional debt, but improves rating metrics, reducing the risk of a downgrade.”

SQM is rated at BBB+ by S&P, while CMPC is rated BBB and Arauco is BBB-, all at the lowest category — triple B — within investment grade.

Hybrid bonds “act like subordinate debt,” said Diego Pino, head of trading and equity at Scotia Corredores de Bolsa. But, “the companies that have carried out these transactions are sufficiently big and solid to be able to place them.”

Forestry industry

CMPC in August was the first company in Chile to sell hybrid bonds this year, with an issuance of 10 million UF. Arauco followed suit, selling 20 million UF of bonds two months later, the largest corporate issuance in Chilean history.

CMPC’s bond was placed at a rate of 4.19%, 230 basis points over the central bank’s bond in UF with an equivalent term and 110 basis above its senior debt. Meanwhile, Arauco’s yield was 3.97%, 168 basis points above the reference rate, and below the initial 4.5% at which the note was registered, showing strong demand. SQM’s notes also tightened from an initial yield of 4.4% to 3.84%.

“They offer investors a higher spread, around 80 to 100 basis points above what they would obtain with a traditional bond,” Pino said.

Inversiones CMPC issued a hybrid bond in the US just a week after the local sale.

Chile’s AES Andes was the first South American company to sell hybrid dollar bonds back in 2013. They returned to that same market market in 2019, while Banco Estado sold AT1s, which is a similar type of instrument used by banks, in 2024.

More recently, the trend has spread to other countries in the region. Mexican cement company Cemex made an issuance of $1 billion of hybrid bonds in September 2023, while development bank Corporacion Andina de Fomento sold $500 million in June of this year.

High capex

Hybrid notes are sold “with an explicit objective of defending a high international investment grade rating” and a robust balance sheet as companies step up investment, Mohr said. That typically happens in sectors such as pulp and paper, energy and utilities.

Arauco’s investment stood at $897 million in the first nine months of the year, on track for it’s highest annual level since 2022. CMPC’s investments total $653 million over the same period, on its way for a ten-year high. On the other hand SQM, has a three-year capital expenditure plan of $2.7 billion.

“The main aim of hybrid bonds is to support the credit classification of the issuer,” said Deneb Schiele, director of corporate finances and head of capital markets at Scotiabank. “That has been the object behind recent emissions, especially in the scenario of low commodity prices and heavy investment.”

The investment plans are so large, the companies may be tempted to return to the market. Arauco must continue financing its Sucuriu project — a large pulp mill in Brazil that entails an investment of $3 billion. CMPC is planning another mill worth more than $4.5 billion, which should take less than three years to build if the board approves the project in 2026.

The market should see more of these deals going forward, but from companies with a strong credit rating background so that the hybrid’s grade doesn’t fall into high-yield territory, Mohr added.

“It is reasonable to expect that other investment grade issuers with relevant investment plans will study similar structures, provided that the appetite for UF duration is maintained and the agencies continue to grant equity credit,” Mohr said.

(By Carolina Gonzalez)

{{ commodity.name }}

{{ post.title }}

{{ post.date }}

Comments