Chile copper supply gains seen years away, mining council warns

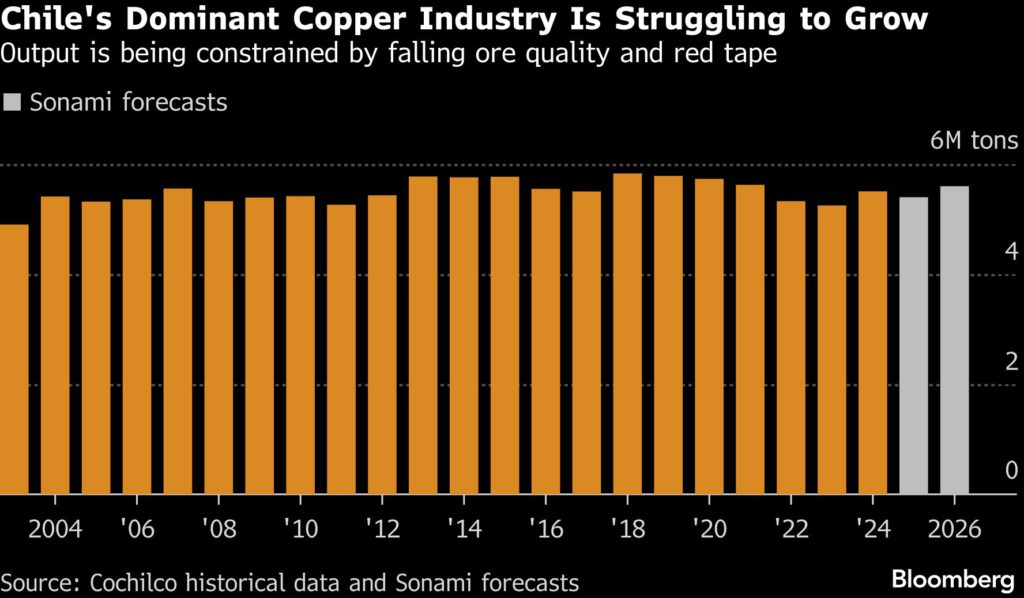

The pro-growth agenda of Chile’s incoming government could bring forward new copper supply, but any meaningful production increase will still take years to materialize, Chile’s Mining Council warned.

The association representing local units of global mining heavyweights such as BHP Group and Anglo American Plc is very much aligned with President-elect José Antonio Kast’s pledges to accelerate investments by making permitting easier to navigate. Kast’s team has said mining output could rise as much as 20% over the next year or two, giving a much needed boost to a tight market.

But Mining Council executive chairman Joaquin Villarino said growth expectations need to be realistic given the structural difficulties behind any meaningful increase in supply.

“The Council doesn’t have any kind of background or estimate that would allow it to say that growth of that magnitude could be achieved within that timeframe,” Villarino said in an interview Thursday. “You can’t change production levels overnight.”

To be sure, Chile has the project pipeline to lift annual production to 7 million metric tons, Villarino said, from about 5.4 million tons now. With efficient permitting and execution that could happen in a decade, he said.

Large producers are already operating at or near capacity, limiting the scope for short-term gains, although small and medium producers could increase output more quickly, Villarino said. The challenge, he added, is to show that accelerating approvals doesn’t mean weakening standards.

“Efficient permitting could bring production forward, but this must be done without lowering environmental or social standards,” Villarino said. “The goal is to eliminate bureaucracy, not safeguards.”

Some of the delays that have contributed to Chilean production staying at similar levels for two decades come from applying environmental rules “without proportionality,” at the same time that regulators don’t have enough trained staff to evaluate increasingly complex projects, he said.

“A clear example of misapplication is chinchilla protection, which has halted many projects despite evidence that the species is not endangered and can be responsibly managed,” he said.

The broader metals backdrop remains supportive. Demand for copper is being driven by urbanization, data centers and artificial intelligence, electro-mobility and clean energy, while supply is not growing at the same pace, Villarino said.

(By James Attwood)

{{ commodity.name }}

{{ post.title }}

{{ post.date }}

Comments