Chile predicts growth despite copper mine setbacks

Chile, which accounts for a quarter of the world’s mined copper, expects output to expand this year despite setbacks at two major mines, offering some respite to a tight global market.

A fatal accident at state-run Codelco’s top mine and tailings troubles at a Teck Resources Ltd. operation are obstacles to Chile meeting its annual target of around 5.6 million metric tons. But BHP Group’s giant Escondida mine churned out 11% more in the first half versus the same period last year and the Collahuasi operation is set to emerge from a period of low-quality ore. The overhauled El Salvador mine is starting to ramp up.

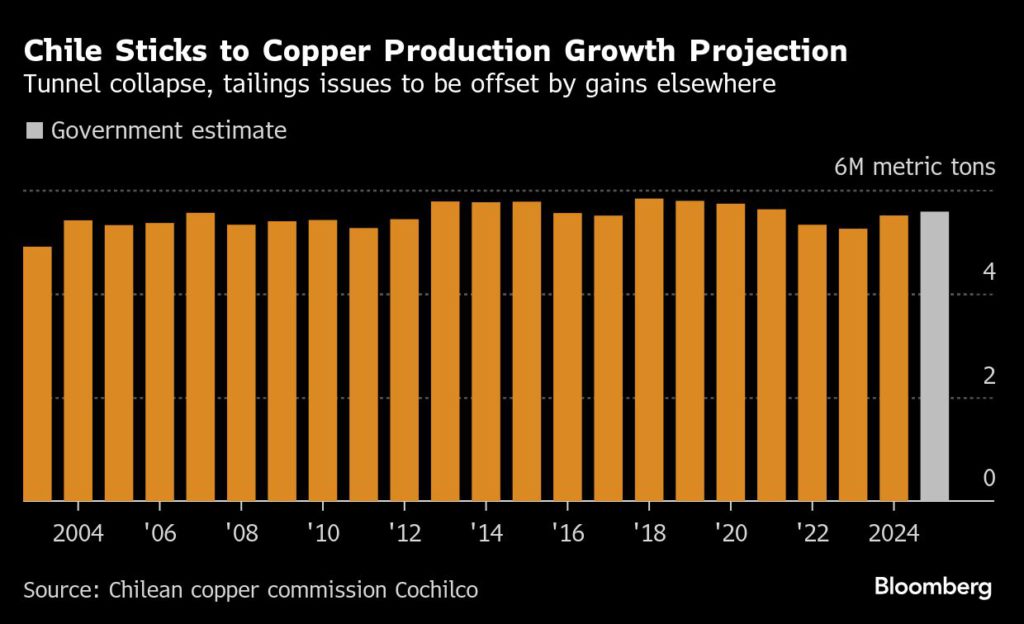

As a result, Mining Minister Aurora Williams still anticipates growth this year and next, en route to a record 6 million tons in 2027, she said in an interview. That would be a strong result for a country whose production hit a 20-year-low in 2023 as companies battle to revitalize aging operations and new deposits become tougher to find and develop. The longer-term outlook for the metal is also improving, she said.

“I believe production will increase and Chile will achieve a greater participation in the global market,” Williams said Friday from her downtown Santiago office. “Movements in the market point to more supply in the future.”

The prediction comes as global demand for the wiring metal is increasing due to the energy transition and building of more data centers to power AI.

To be sure, Chile has disappointed the copper market before. Several years ago, the government’s copper agency Cochilco was projecting production to be more than 7 million tons by now. Codelco has been a big part of that, as the state behemoth strives to play catch-up after decades of underinvestment.

But prospects have improved with two so-called adjacency deals that are set to add almost 300,000 tons to the country’s total, according to companies’ estimates. Codelco’s Andina mine and the neighboring Los Bronces operation run by Anglo American Plc are hammering out final details of an integration. Anglo and Teck, which this month announced a tie up, are working on a similar deal for the Collahuasi and Quebrada Blanca mines. Beyond that, BHP and Lundin Mining Corp. have a large project straddling the Argentine border and both BHP and Rio Tinto Group have promising exploration ventures with Codelco.

The merger agreement between Anglo and Teck is a “positive sign” for the dynamism of the industry in Chile and the global copper market, the minister said.

Regarding El Teniente’s recovery from a tunnel collapse that killed six workers, Williams said operator Codelco may have to use other methods — such as more automation — to tap deeper parts of the deposit, depending on the outcome of an investigation by authority Sernageomin.

“Chile has the challenge to actually be able to develop underground mining at an increasingly higher level,” the minister said. “If there are risks, in a country where safety comes first, well we’ll have to look for other mechanisms.”

“We’ll have to challenge ourselves to think how we are going to obtain the geological value that’s there given the results that Sernageomin’s report could potentially have.”

Meanwhile, a landmark lithium tie-up between SQM and Codelco is expected to be finalized before the government’s term ends in March, with China’s antitrust agency likely to sign off given the deal benefits the global lithium market, Williams said.

Besides planned expansions as a result of Codelco’s entry into SQM’s lithium business, Chilean authorities are opening up new production areas for the battery metal.

The goal is to have three or four new contracts signed by the end of the government’s term, although “naturally we aspire to having many more than that,” she said.

(By James Attwood)

{{ commodity.name }}

{{ post.title }}

{{ post.date }}

Comments