China’s bar on BHP iron ore cargoes hammers capesize rates

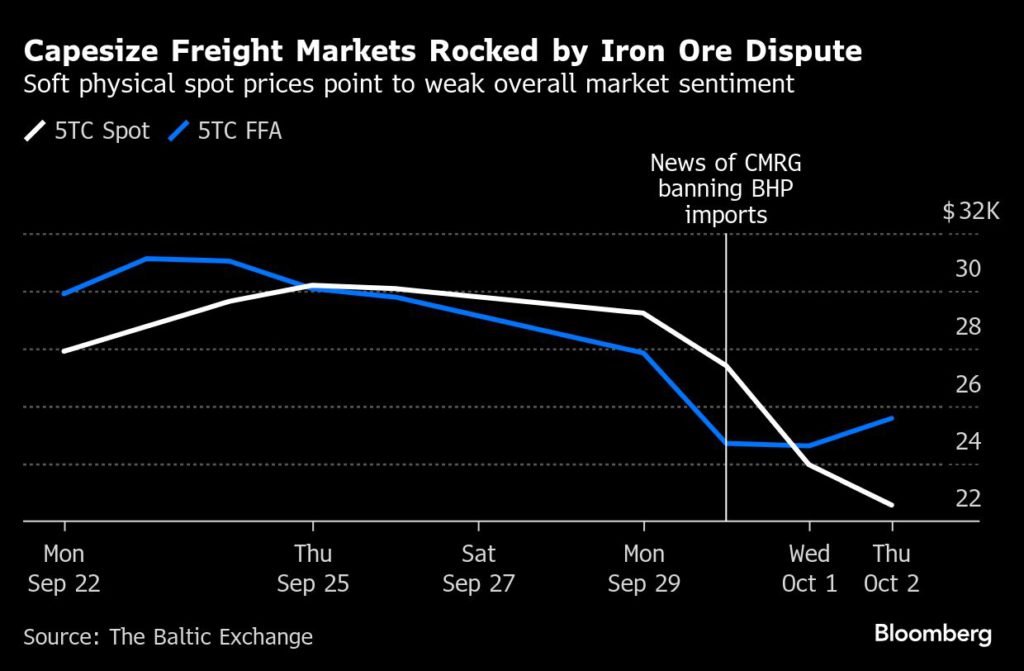

Dry-bulk shipping rates have tumbled around 25% this week, with a dispute over BHP Group’s iron ore shipments to China adding strain to a market already suffering a seasonal lull in demand.

Spot rates for Capesize bulk carriers sank 6% on Thursday, extending declines seen earlier in the week, according to data from the Baltic Exchange. The 5TC, as the index is known, is a key indicator for the global dry-bulk shipping market and last traded at this level in late August.

The downturn began after Bloomberg News reported Tuesday that China Mineral Resources Group Co., the country’s state-run iron ore buyer, had ordered a temporary halt to new purchases of dollar-denominated seaborne cargoes from BHP, the world’s biggest mining company.

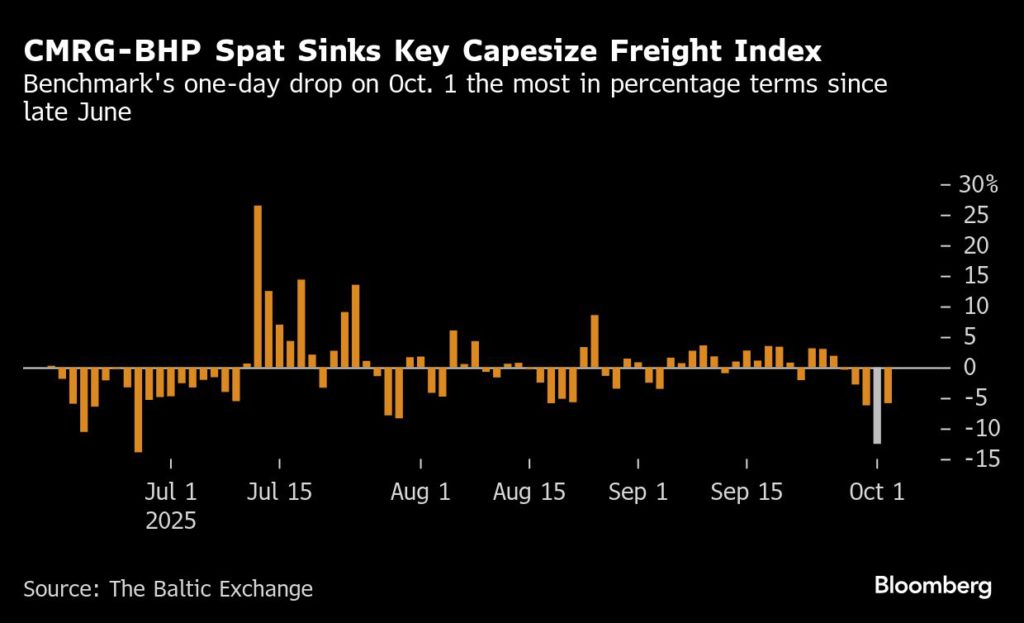

The move exacerbated weak market sentiment during a seasonal slowdown that is accompanying China’s Golden Week holiday. The freight rate dropped 12.5% the day after the news, the biggest single-day drop since June 26.

“There was carnage,” said Lennon Lim, a Singapore-based freight analyst with shipbroker Thurlestone Shipping, referring to the decline in rates. “With the Chinese market closed now, the BHP issue became a double whammy for all of us.”

Capesize markets are sensitive to movements in the iron ore market. Prices for the steelmaking raw material have held up this year in the face of bearish long-term sentiment, rallying almost 15% last month from their June lows as a result of China’s push to curb overcapacity.

Though the spot Capesize rate continued its downward trend this week, forward freight rates ended a six-day losing streak on Thursday after BHP appeared to have requested two Capesize bulk carriers for delivery of iron ore to China in two weeks’ time, according to a shipbroker and a research report, neither of which was clear whether these cargoes were purchased before or after the halt.

Both sides have an interest in ending the impasse quickly. In a report published Wednesday, shipbroker Fearnleys AS said China buys as much as 250 million tons of iron ore annually from BHP. This accounts for a large proportion of the total 1.2 billion tons purchased last year, according to China Customs data.

“There is a strong incentive for both parties to wrap up talks before public holidays in China end on 8 October,” said Alexis Ellender, an analyst at Kpler. “Once completed, we expect a return to regular trading over the medium term.”

While the dispute plays out, traders and shipowners have the option of rerouting shipments to alternative buyers, according to shipbrokers’ reports. The net effect would be a boost in ton-miles covered, a key freight metric that measures the volume of cargo shipped and how far it’s traveled.

“We have yet to confirm any instances of cargoes diverted to non-Chinese ports, but have observed at least one vessel that appears to have halted in the South China Sea while en route to Tianjin and others running slow,” said Ellender, adding that he could not say for sure that this was due to the BHP-CMRG dispute.

(By Weilun Soon and Katharine Gemmell)

More News

Contract worker dies at Rio Tinto mine in Guinea

Last August, a contract worker died in an incident at the same mine.

February 15, 2026 | 09:20 am

{{ commodity.name }}

{{ post.title }}

{{ post.date }}

Comments