China’s bumper silver exports belie market fears of curbs

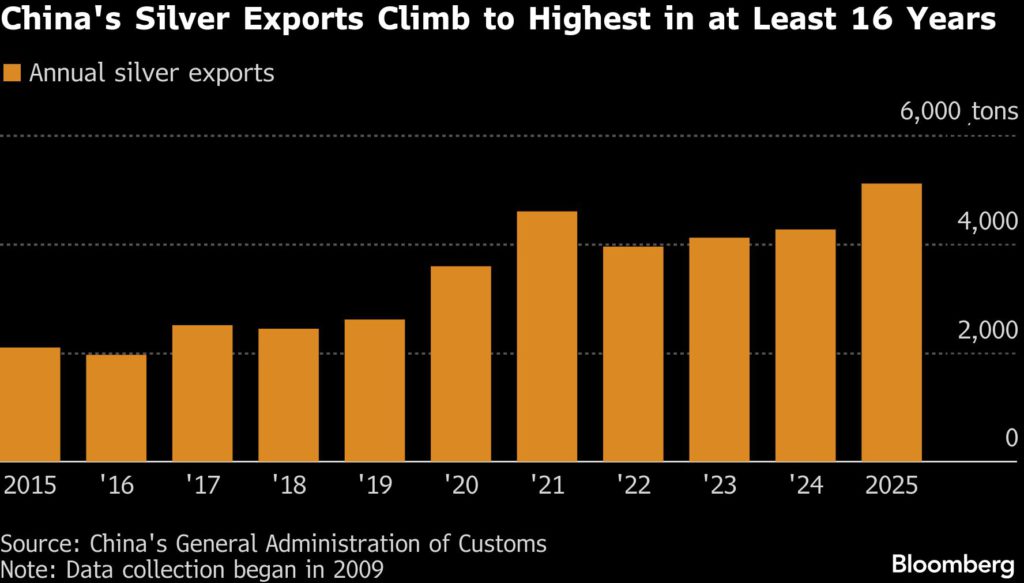

China shipped around 5,100 tons of silver overseas last year, according to customs data, the highest volume of exports in at least 16 years and a level that suggests market fears of tightening controls may be overblown for now.

China has had a licensing regime in place for silver since 2019. However, a document issued in October by the Ministry of Commerce to extend that policy into this year and 2027 rattled investors, with some seeing it as a sign of new or increased restrictions.

Versions of that interpretation, during a period of market tightness, have helped fuel a rally that has lifted the white metal alongside gold — pushing it to a record above $95 an ounce.

Major exporters in China say there has not been a significant change in shipments since the document was issued. They asked not to be named because they are not authorized to speak to the media.

“Most silver exports occur under the existing processing trade arrangements,” said Zijie Wu, an analyst at Jinrui Futures Co. The majority of the shipments are handled through re-export structures that exempt imports from value-added tax, Wu said, adding that any attempt to forcefully curb shipments would require revoking the tax relief on a large scale.

China shifted to license-only management from its quota-based system seven years ago. Since then, silver exports have risen in all but one year, largely reflecting the expansion of non-ferrous refining capacity, where the metal is produced as a by-product.

Under China’s export policy, domestic refiners must obtain export licenses that carry no explicit volume limits and are valid for two years. The requirements have remained largely unchanged since the system was introduced, including minimum production thresholds of at least 80 tons of silver a year or 40 tons for companies based in western regions.

Widespread frenzy

Online rumors tied to the misinterpreted export policy, among other misinformation, have created the impression that silver prices will surge higher, said Joshua Rotbart, managing partner at J. Rotbart & Co., a bullion broker serving high-net-worth clients. “Hence, investors are experiencing serious FOMO and looking to purchase even more silver,” he added, referring to investors eagerness not to miss out.

The misconception has been particularly widespread in India, where fund managers, bullion dealers, major media outlets and brokerages publicly interpreted the policy’s extension to mean a change and amplified the view through online commentary.

Back in October, Indians loaded up ahead of the Diwali festival. Along with tariff fears that kept supplies locked up in the US, that drained liquidity in London and pushed benchmark silver prices to the highest since the 1970s.

The frenzy even led to a December post on X by Elon Musk, linked back to China’s extensions of existing export rules.

Investor demand for silver is now even higher in India than it was in October, with smaller bars and coins particularly popular, according to Samit Guha, chief executive officer and managing director of MMTC-PAMP India Pvt., the country’s largest precious metals refiner.

Still, China’s use of export controls on critical materials, ranging from rare earths to antimony, has kept alive concerns that similar measures could eventually be applied to silver.

“There’s no indication that there’s tightening on export controls on silver, but we cannot rule out the possibility in the future,” said Jinrui Futures’ Wu.

(By Yihui Xie)

{{ commodity.name }}

{{ post.title }}

{{ post.date }}

Comments