China’s central bank adds gold in nine-month buying streak

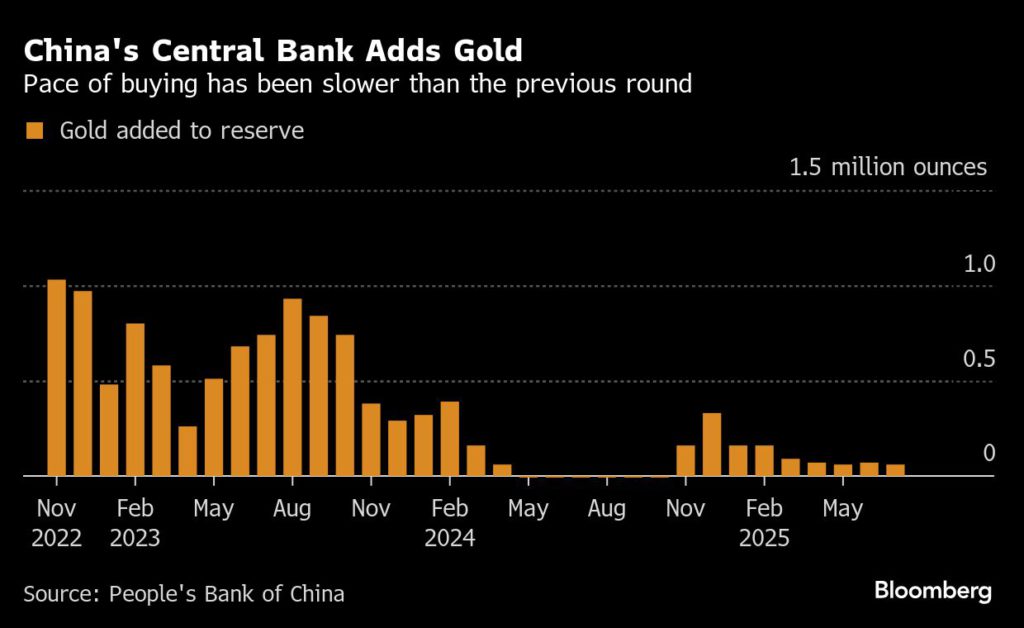

People’s Bank of China increased its gold reserve in July, marking nine straight months of purchases that are helping it diversify its holdings away from US dollars.

Gold held by the central bank increased by 60,000 troy ounces to 73.96 million troy ounces last month, according to data released on Thursday. This brings the total tally of purchases since November — when the current wave of buying started — to around 36 tons.

This round of buying is much slower than the previous one that started in late 2022, when gold prices were around half of their current level. “We take it as a sign that the central bank wishes to minimize the impact of its activities on the gold market,” said Michael Hsueh, an analyst with Deutsche Bank AG.

Bullion has been range-bound since April, when it surged past the record of about $3,500 an ounce. Buying by central banks, including China’s, is among the key drivers of the 30% rally that bullion has enjoyed this year. While the buying spree is expected to continue, the pace has slowed amid elevated prices.

Gold traded 0.3% higher at $3,378.15 an ounce in London at 10.44am on Thursday.

(By Yihui Xie)

{{ commodity.name }}

{{ post.title }}

{{ post.date }}

Comments