China’s output cap to underpin aluminum despite trade wars

Weakness in aluminum demand linked to trade tensions will likely weigh on prices this year, but a longstanding cap on Chinese output could limit losses, analysts said.

Prices of aluminum rose 7% last year, have fallen 2% on the London Metal Exchange (LME) so far this year after US President Trump imposed tariffs.

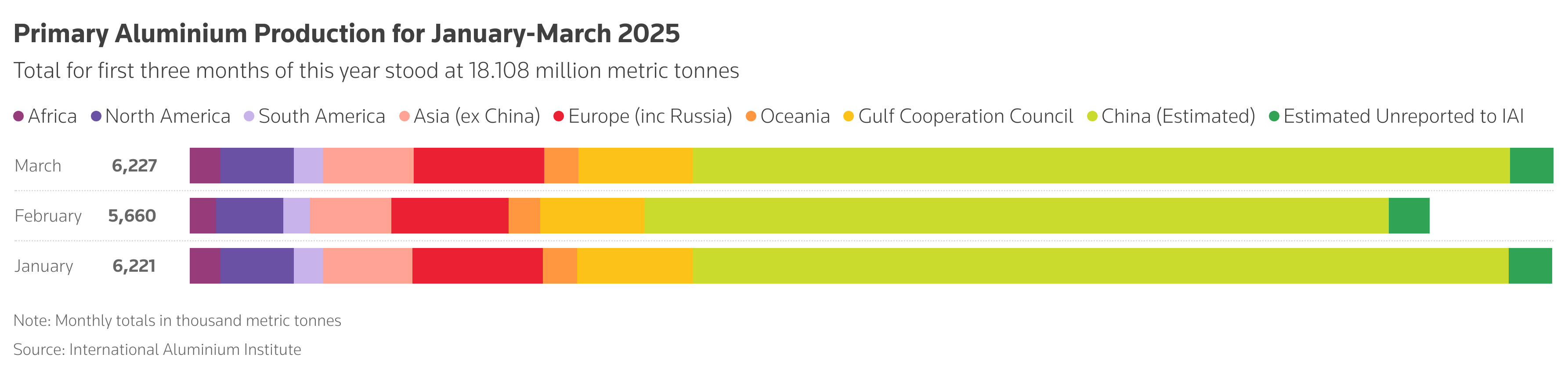

China accounts for about 60% of global production of aluminum, used in transport, green energy and construction. Its output is constrained by a government cap of 45 million tons per year, a limit introduced in 2017 to curb overcapacity.

“We are already running very close to that 45 million mark and globally, we don’t see much new capacity. It is a positive factor for prices (this year),” said HSBC analyst Howard Lau.

A Reuters poll in April showed an aluminum surplus of 280,000 tons this year, which analysts say is effectively a balanced market given global supplies at around 76 million tons.

Any disruptions such as loss of hydropower in China’s Yunnan province, where a significant proportion of the country’s aluminum smelting capacity is located, could turn that small surplus into a deficit.

Morgan Stanley said that in a tightening market with China’s capacity cap, it sees prices trading around $2,600, just above current levels, but recession risks could push it below $2,000 if demand declines. That would be its lowest since 2021.

“With growth in the US likely to slow thanks to tariffs and China already struggling to revive its economy, demand for aluminum … is likely to weaken,” said ING commodities analyst Ewa Manthey.

Trade relations between China and the US have thawed somewhat, with the two agreeing to temporarily slash reciprocal tariffs for 90 days. However, uncertainties persist after that, including over the risk of recession.

David Wilson, senior commodities strategist at BNP Paribas, said aluminum could outperform copper this year. “Copper has plenty of supply growth in the longer-term, there’s not enough supply growth for aluminum,” he said.

(By Ashitha Shivaprasad; Editing by Pratima Desai, Jan Harvey and David Evans)

Read More: As China nears peak aluminum production, what next?

More News

Contract worker dies at Rio Tinto mine in Guinea

Last August, a contract worker died in an incident at the same mine.

February 15, 2026 | 09:20 am

{{ commodity.name }}

{{ post.title }}

{{ post.date }}

Comments